Conquer the World of Options with Robinhood: Embark on a Journey of Smart Investments

Introduction

In the dynamic world of finance, options trading emerges as a tantalizing path toward financial growth. However, for the uninitiated, the complexities of this realm can seem daunting. Fear not, for this guide will illuminate the enigmatic world of options trading, with Robinhood as your trusty guide.

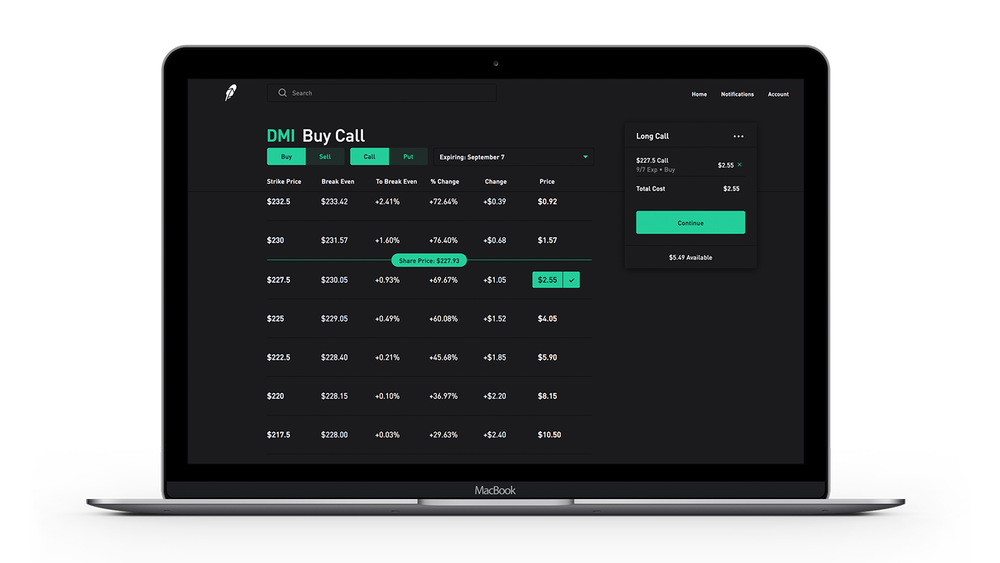

Image: joshgallagher.com

Options trading is an intricate but potentially rewarding endeavor that involves speculating on the future value of assets without actually owning them. With Robinhood, the accessibility of options trading has soared, making it possible for everyday investors to delve into this captivating realm.

Unveiling the Basics: What is Options Trading?

An option contract grants the holder the right but not the obligation to buy (in the case of “call” options) or sell (for “put” options) the underlying asset at a specific price (known as the strike price) on or before a set date (the expiration date). Imagine having the power to predict the future direction of an asset without needing to commit substantial capital.

Options Jargon 101: Mastering the Vocabulary

Navigating the world of options trading requires familiarity with essential terms:

- Premium: The price paid to acquire an option contract, providing the right to exercise it.

- Exercise: The act of utilizing an option to buy or sell an asset.

- Expiration Date: The deadline by which an option must be exercised.

- Volatility: A measure of how rapidly the price of an asset fluctuates.

Embarking on Options Strategies: A Compass for Navigating Market Conditions

Options trading offers a menu of strategies, each tailored to specific market scenarios:

- Covered Call: Generate income by selling call options on stocks you already own.

- Cash-Secured Put: Collect premiums while simultaneously agreeing to buy an asset at a specific price if it falls below the strike price.

- Bull Call Spread: Profit from a modest increase in the underlying asset’s price by buying a call option at a lower strike price and selling a call option at a higher strike price.

- Bear Put Spread: Benefit from a moderate decline in the asset’s value by selling a put option at a higher strike price and buying a put option at a lower strike price.

Image: amabroad.com

Making Informed Decisions: Factors Influencing Option Prices

Understanding the factors that influence option prices is crucial for making sound investment decisions:

- Underlying Asset Price: Changes in the underlying asset’s price directly impact option premiums.

- Time to Expiration: As the expiration date approaches, the value of an option decays, a phenomenon known as time decay.

- Volatility: Increased volatility means higher option premiums as the asset’s price is likely to fluctuate more.

- Interest Rates: Higher interest rates tend to lead to lower option premiums.

Managing Risk with Prudence: Strategies for Mitigation

Options trading, while alluring, is not without its risks. Prudent risk management is paramount:

- Understanding Greek Letters: Greek letters, such as Delta, Gamma, Theta, Vega, and Rho, measure the sensitivity of an option’s price to various factors.

- Position Sizing: Allocate only a portion of your investment portfolio to options trading.

- Avoiding Naked Options: Selling options without owning the underlying asset can be highly risky.

Robinhood Options Trading Explained

Conclusion: Unveiling the Path to Profitability

Options trading with Robinhood presents a captivating opportunity for investors to amplify their returns and diversify their portfolios. By embracing the concepts outlined in this guide, you are one step closer to unlocking the potential of options trading. Remember, knowledge is the key to prudent investment decisions, and Robinhood is your ever-reliable companion on this exciting journey.