Introduction

The vibrant financial hub of Singapore has emerged as a prominent destination for options trading, attracting investors from both domestic and international markets. As a derivative instrument that provides exposure to fluctuations in the underlying asset, options offer a powerful tool for risk management, speculation, and income generation. In this comprehensive guide, we delve into the world of options trading in Singapore, exploring its multifaceted nature, latest trends, expert advice, and practical FAQs to empower aspiring and experienced traders alike.

Image: foyasuromada.web.fc2.com

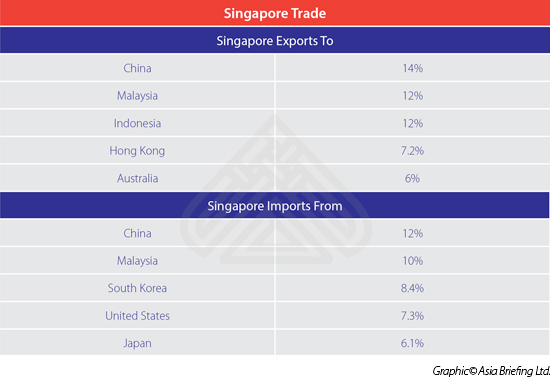

With Singapore’s robust regulatory framework, world-class infrastructure, and favorable tax policies, options traders enjoy a conducive environment for their pursuits. The presence of the Singapore Exchange (SGX), a leading global exchange, further enhances the accessibility and efficiency of options trading in the city-state.

Understanding Options Trading in Singapore

Definition and History

An option is a financial contract that grants the buyer the right but not the obligation to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). This flexibility enables traders to tailor their strategies to suit their investment objectives and risk tolerance. The history of options trading dates back centuries, with its origins in the agricultural sector where farmers sought to hedge against crop price fluctuations.

Key Features

Options trading involves two primary parties: the option buyer who acquires the right to exercise the option and the option seller who is obligated to fulfill the contract should the buyer choose to exercise it. The price of an option is known as the premium, which is influenced by various factors such as the underlying asset price, time to expiration, strike price, and market volatility. Understanding these factors is crucial for successful options trading.

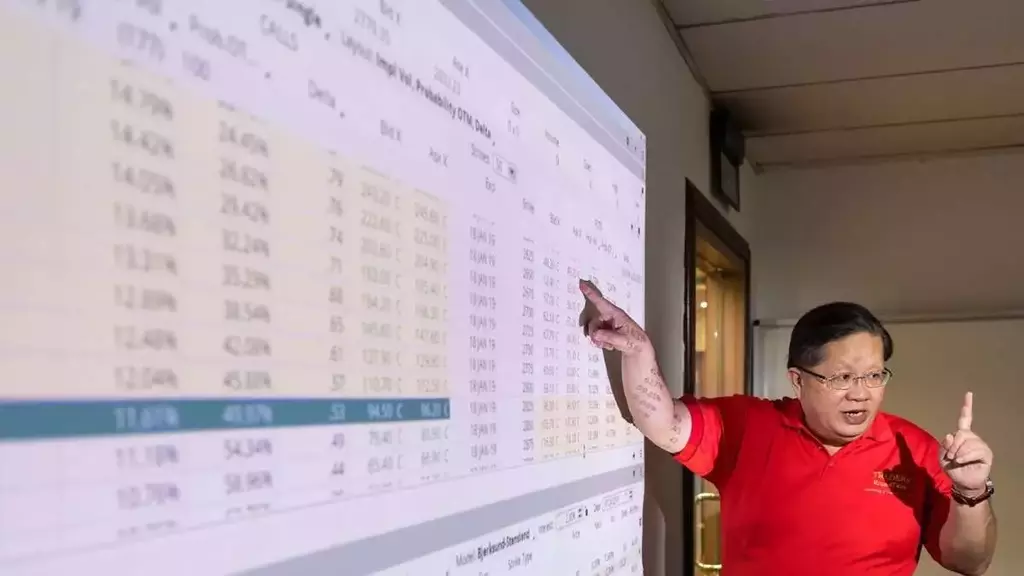

Image: www.traders.sg

Recent Trends and Developments

The options market in Singapore has witnessed several notable trends and developments in recent years. The proliferation of online trading platforms has democratized access to options trading, empowering retail investors to participate in this sophisticated market. Additionally, the introduction of new products and strategies, such as index options and covered calls, has expanded the opportunities available to traders. Keeping abreast of these developments is essential to stay ahead in the ever-evolving options landscape.

Tips and Expert Advice

Embarking on options trading requires a well-defined strategy and risk management practices. Experienced traders recommend a comprehensive approach that encompasses the following tips:

- Define your objectives: Clearly outline your investment goals before venturing into options trading.

- Understand the risks: Options trading involves inherent risks that traders must fully comprehend and mitigate.

- Learn and practice: Continuous learning and simulated trading through demo accounts are essential for honing your skills.

- Monitor market conditions: Stay abreast of real-time market developments that can affect options prices.

- Manage your emotions: Discipline and emotional control are paramount in the fast-paced world of options trading.

FAQs on Options Trading in Singapore

To address common queries, here are answers to some frequently asked questions about options trading in Singapore:

- What is the minimum capital required for options trading in Singapore?

There are no specific minimum capital requirements for options trading in Singapore. - Who can trade options in Singapore?

Individuals, corporations, and entities with a trading account can participate in options trading in Singapore. - What are the tax implications of options trading in Singapore?

Options trading profits in Singapore are subject to a capital gains tax of 30%.

Options Trading Singapore

Conclusion

Options trading in Singapore presents a compelling opportunity for investors seeking to enhance their portfolios and manage risk. With its robust regulatory framework, advanced infrastructure, and a wealth of resources, Singapore has established itself as a thriving hub for this exciting trading arena. By embracing a disciplined approach and leveraging the insights provided in this guide, traders can navigate the complexities of options trading and harness its potential to achieve their financial aspirations.

Are you intrigued by the world of options trading in Singapore? Share your thoughts and questions in the comments section below. Embark on a journey of financial empowerment and unlock the opportunities that options trading offers!