Embark on an enlightening journey into the world of options trading, where meticulous strategies meet the thrill of market uncertainty. In this comprehensive guide, we unveil the secrets behind options trading results, empowering you with knowledge and insights to navigate this dynamic financial landscape.

Image: www.twoinvesting.com

Demystifying Options Trading: Where Risk and Reward Dance

Options trading, an alluring yet often intimidating realm of finance, grants traders the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). This contractual flexibility allows investors to hedge against risk, speculate on price movements, or generate income. However, it’s crucial to recognize that options trading carries inherent risks that can lead to substantial losses.

Unveiling Options Trading Strategies: A Trader’s Arsenal

Like a seasoned general preparing for battle, options traders employ a diverse arsenal of strategies to maximize their chances of success. These strategies, ranging from simple to complex, cater to various risk appetites and investment objectives.

-

Covered Call Writing: Sell call options against an existing stock position, generating income while limiting upside potential.

-

Uncovered Selling: Sell options without owning the underlying asset, earning premiums but exposing yourself to potentially unlimited losses.

-

Buying Call Options: Acquire the right to buy an underlying asset at a specific price, benefiting from potential price appreciation.

-

Buying Put Options: Secure the right to sell an underlying asset at a specific price, hedging against market downturns.

The Psychology of Options Trading: Embracing Emotional Discipline

The world of options trading is a psychological battlefield where emotions can cloud judgment and sabotage strategies. Master traders cultivate emotional discipline, resisting the temptation to fear or greed and adhering to rational decision-making principles. Understanding and controlling emotions enhances the trader’s ability to maintain a level-headed approach in the face of market volatility.

Image: www.youtube.com

Decoding Options Trading Risk Management: The Path to Preservation

Navigating the treacherous waters of options trading demands a robust risk management framework. Traders meticulously calculate potential gains and losses, implement stop-loss orders to limit downside risk, and diversify their portfolios to mitigate exposure to any single asset or strategy. By employing sound risk management practices, traders safeguard their capital and position themselves for long-term success.

Seeking Expert Guidance: Embracing Wisdom from the Masters

In the realm of options trading, knowledge is power. Seasoned traders seek out experts who have successfully navigated market fluctuations and garnered in-depth knowledge through hands-on experience. By tapping into their insights, aspiring traders gain invaluable perspectives and refine their own trading strategies.

Harnessing Technology for Trading Success: Tools to Empower

Technology has revolutionized options trading, empowering traders with powerful tools that enhance decision-making. Specialized software platforms provide real-time market data, technical analysis capabilities, and automated trading features. By leveraging these technological advancements, traders streamline their operations, optimize their strategies, and gain a competitive edge in the dynamic trading arena.

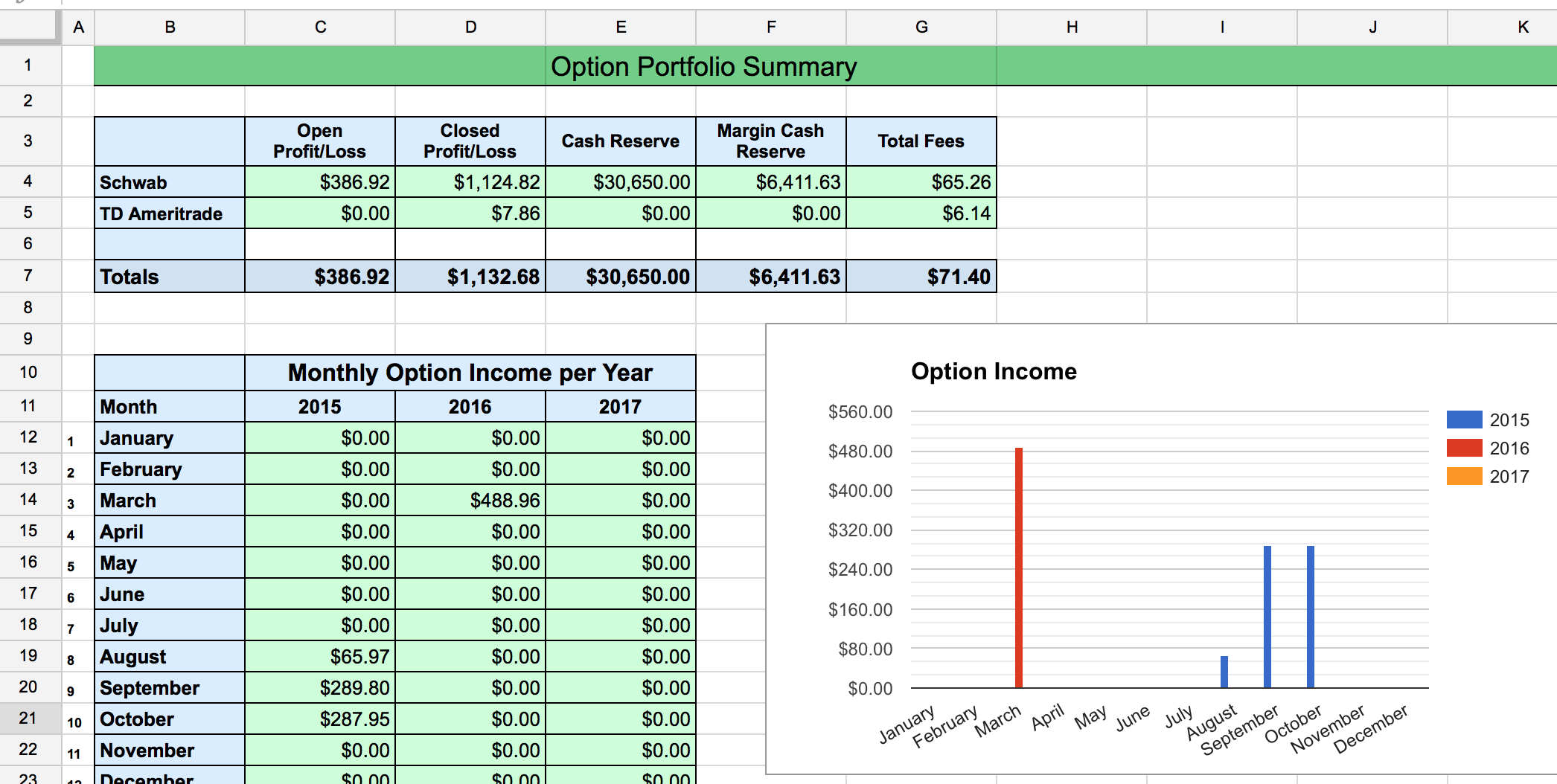

Options Trading Results

Conclusion: A Journey of Knowledge and Empowered Decision-Making

Options trading, with its inherent risks and rewards, presents a challenging yet potentially lucrative opportunity for investors. Through thorough research, strategic planning, and unwavering emotional discipline, traders can maximize their chances of success. This guide has unveiled the secrets behind options trading results, providing you with a solid foundation to embark on your own trading journey. Remember, knowledge is your greatest ally in the pursuit of informed decision-making, and the market awaits those who are prepared to confront its uncertainties with courage and strategy.