In the exhilarating world of financial markets, options trading offers traders the potential for substantial profits. Among the myriad strategies available, credit spreads stand out as a versatile tool that can help traders navigate market volatility while managing risk. This article will delve into the intricacies of YouTube options trading credit spreads, providing a comprehensive guide for beginners eager to explore this lucrative strategy.

Image: www.youtube.com

Understanding Credit Spreads

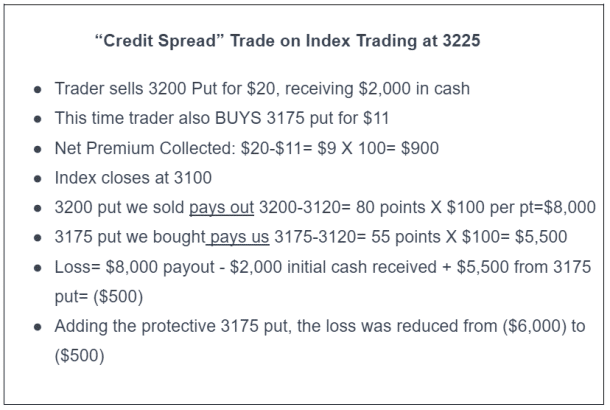

Credit spreads are formed by selling one option while simultaneously buying a further out-of-the-money option of the same type (call or put) and expiration date. This strategy results in a net credit to the trader’s account upon the trade’s execution. Unlike a debit spread, where the trader pays a premium upfront, a credit spread allows the trader to collect a premium from the sale of the first option.

Why Use YouTube Options Trading Credit Spreads?

YouTube options trading credit spreads offer several compelling benefits, making them a popular choice among experienced traders.

-

Limited Risk: By selling the at-the-money option, the trader defines the maximum potential loss. The profit potential, on the other hand, is theoretically unlimited.

-

Leverage: Credit spreads effectively increase the leverage compared to buying individual options outright, making them a capital-efficient strategy.

-

Directional Flexibility: Credit spreads can be used for both bullish and bearish market views, providing traders with versatility in various market conditions.

Types of YouTube Options Trading Credit Spreads

There are two primary types of YouTube options trading credit spreads: bull call credit spreads and bear put credit spreads.

-

Bull Call Credit Spread: This spread is constructed by selling an at-the-money call option and buying a further out-of-the-money call option. It profits when the underlying asset price significantly rises above the strike price of the short call option.

-

Bear Put Credit Spread: This spread involves selling an at-the-money put option and buying a further out-of-the-money put option. It benefits when the underlying asset price falls significantly below the strike price of the short put option.

Image: www.youtube.com

How to Trade Credit Spreads on YouTube

YouTube offers a wealth of educational content on options trading, including detailed tutorials on how to trade credit spreads. By watching these videos and supplementing your learning with reputable online resources, you can gain the necessary knowledge and confidence to execute credit spreads successfully.

Expert Insights and Actionable Tips

-

“Credit spreads are suitable for traders with a moderate risk tolerance and a good understanding of options pricing,” advises expert trader Mark Douglas.

-

“Always conduct thorough due diligence before entering any trade, and ensure you have a solid trading plan in place,” emphasizes financial analyst Susan Li.

Youtube Options Trading Credit Spreads

Image: www.smbtraining.com

Conclusion

YouTube options trading credit spreads present an intriguing opportunity for traders seeking to enhance their risk-management strategies. By carefully selecting the strike prices and understanding the mechanics of the trade, traders can harness the potential of credit spreads to generate significant profits. However, it’s crucial to approach this strategy with caution and adequate knowledge. By leveraging the insights and trading tips shared in this article, you can embark on your YouTube options trading journey with confidence and a deep understanding of credit spreads.