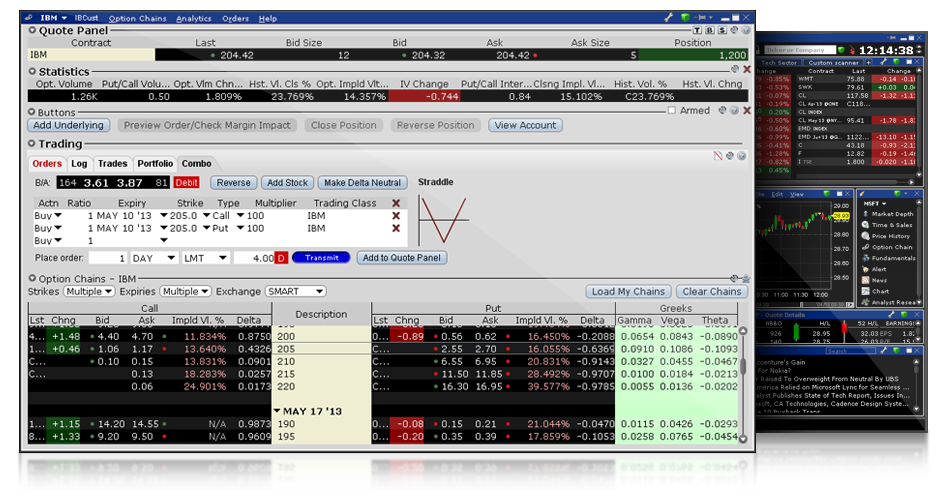

Options trading has emerged as a popular investment strategy for both seasoned traders and those seeking alternative income streams. Interactive Brokers, a renowned brokerage firm, has gained recognition for its comprehensive options trading platform and competitive pricing. Understanding the cost involved in options trading on Interactive Brokers is crucial for aspiring traders to make informed decisions. This article aims to provide an in-depth analysis of the pricing structure associated with options trading on this platform.

Image: www.interactivebrokers.com

Navigating the Options Trading Landscape

Options, in the realm of finance, represent contracts that confer the right, not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Options trading involves the buying and selling of these contracts, enabling traders to speculate on the price movements of the underlying asset. Interactive Brokers offers a wide array of options, including calls, puts, and spreads, to cater to diverse trading strategies.

The pricing of options contracts encompasses two primary components: the premium and the commission. The premium, paid by the option buyer, represents the price of the contract, while the commission is charged by the brokerage firm for facilitating the trade. The premium is determined by several factors, including the strike price, time to expiration, volatility, and supply and demand dynamics in the market.

Delving into Interactive Brokers’ Pricing Structure

Interactive Brokers employs a competitive pricing structure for options trading, which varies based on the type of option, trading volume, and account tier. The platform offers a tiered pricing model, with lower commissions for higher trading volumes.

For individual options trades, Interactive Brokers charges a base commission of $0.65 per contract, with a minimum commission of $1.00. This commission rate applies to both opening and closing trades. Additionally, the platform levies a regulatory fee of $0.005 per contract for options trades executed on U.S. exchanges.

Active traders who generate high trading volumes may qualify for reduced commissions through Interactive Brokers’ tiered pricing program. The Tiered Rate Program offers discounts based on the number of contracts traded per month. For example, traders executing over 30,000 contracts per month qualify for a commission rate of $0.40 per contract.

Understanding Margin and Borrowing Rates

When trading options on Interactive Brokers, the platform provides margin facilities to eligible traders, allowing them to leverage their capital and potentially increase their returns. However, it’s important to note that margin trading involves inherent risks, and traders should carefully consider their financial situation before utilizing this feature.

Interactive Brokers charges interest on margin balances at a competitive rate. The margin rate varies based on factors such as account type, borrowing amount, and creditworthiness. Traders are advised to refer to Interactive Brokers’ Margin Rates schedule for the most up-to-date information.

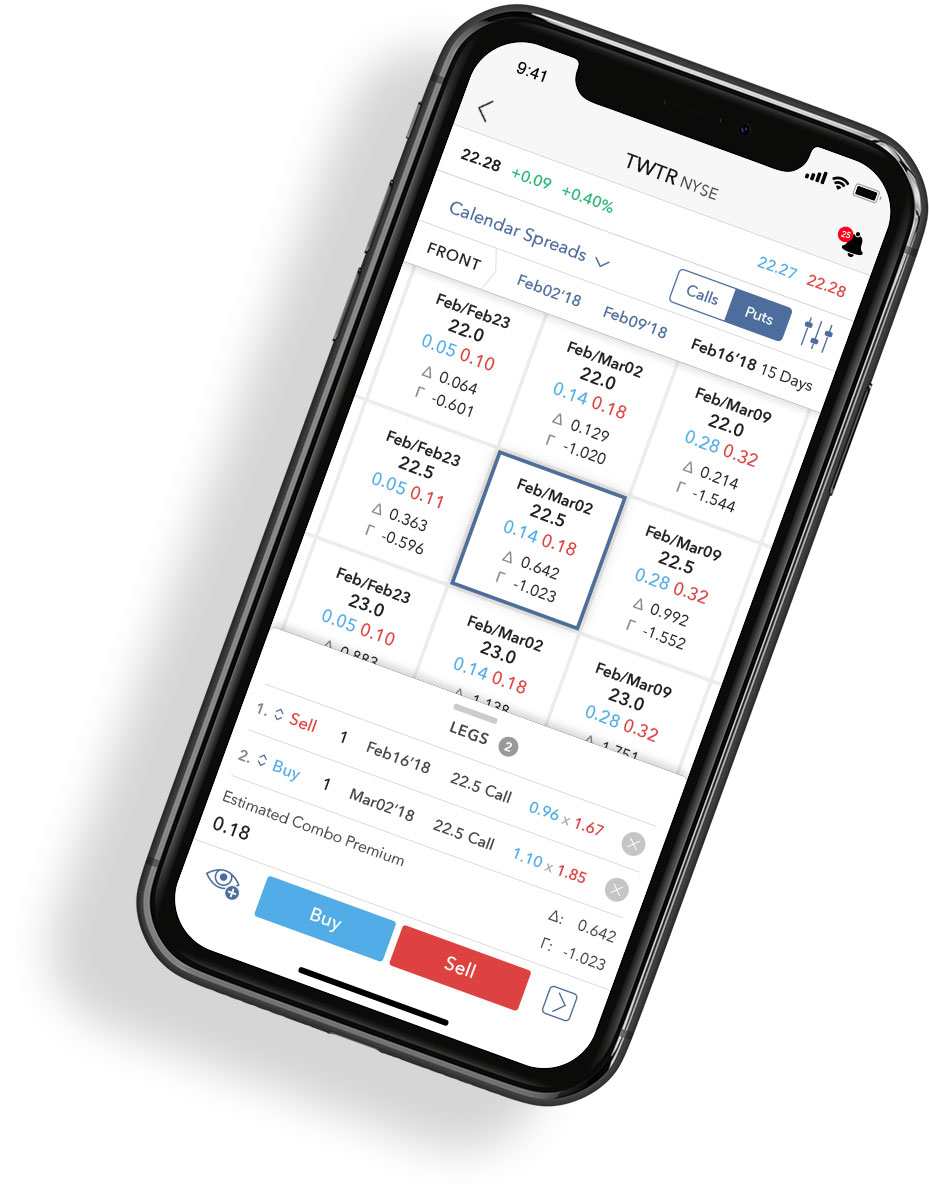

Image: congxeppcg.com

Leveraging Educational Resources

Interactive Brokers recognizes the importance of investor education and provides a comprehensive suite of educational resources to support traders’ options trading endeavors. The platform offers online tutorials, webinars, and educational videos covering various aspects of options trading, from basic concepts to advanced hedging strategies.

Aspiring traders are encouraged to take advantage of these resources to enhance their understanding of options trading and make informed decisions. The educational materials provided by Interactive Brokers contribute to a more comprehensive trading experience for clients.

What Is The Price For Options Trading On Interactive Brokers

Image: www.ibkrguides.com

Conclusion: Empowerment through Informed Decisions

Options trading on Interactive Brokers offers a flexible and potentially lucrative investment opportunity. Understanding the pricing structure associated with options trading on this platform is essential for traders to make informed decisions. Interactive Brokers’ competitive pricing, tiered commission program, and margin facilities empower traders to customize their trading strategies while managing costs effectively.

By leveraging Interactive Brokers’ educational resources, aspiring traders can gain the necessary knowledge to navigate the complexities of options trading. Armed with this information, traders are better equipped to pursue successful options trading endeavors and achieve their financial goals.