Imagine yourself standing at the crossroads of financial decision-making, contemplating the intricate world of options trading. As you navigate this unfamiliar territory, you may encounter a lingering question: what are the costs associated with this financial endeavor at Merrill Lynch? Enter this comprehensive guide, designed to illuminate the intricacies of option trading costs at Merrill Lynch and empower you with knowledge.

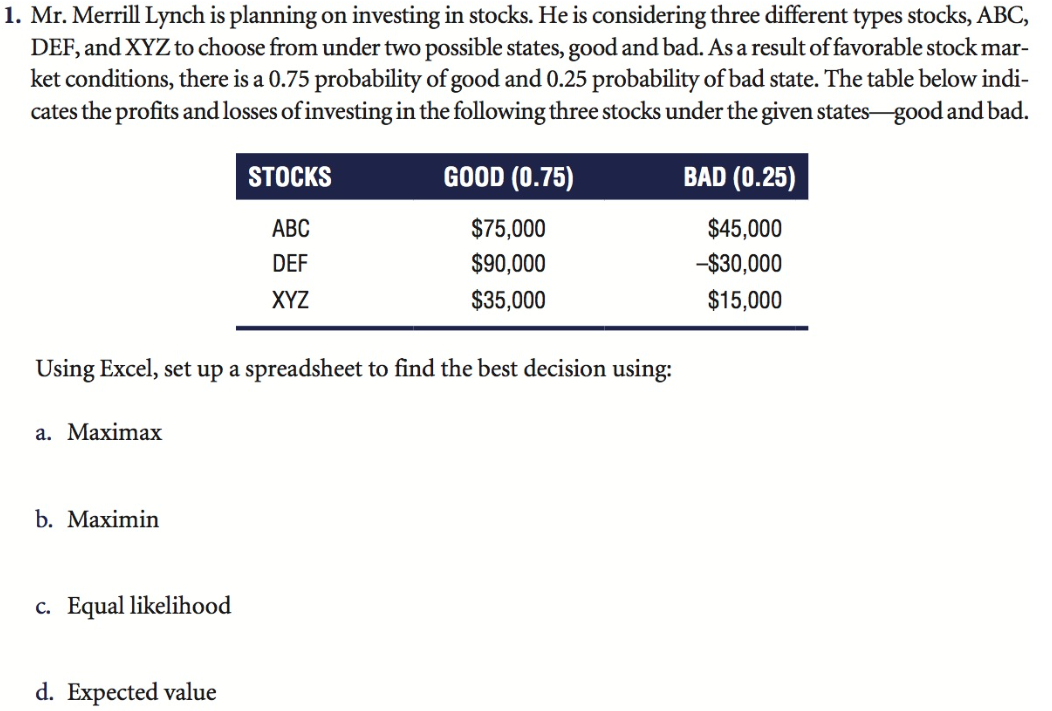

Image: static4.businessinsider.com

Understanding Option Trading: A Gateway to Risk and Rewards

Option trading, a complex yet potentially lucrative financial instrument, grants traders the right—not the obligation—to buy or sell an underlying asset at a predetermined price within a specified timeframe. This flexibility, however, comes with its inherent risks and costs.

Decoding the Costs of Option Trading at Merrill Lynch

When embarking on an options trading journey with Merrill Lynch, several types of costs must be taken into account:

1. Commissions: The Gateway Fee

Commissions, the lifeblood of brokerages, represent the fees charged by Merrill Lynch for executing your trade orders. These fees vary depending on the type of option contract traded and the order type employed. Nevertheless, they are an inevitable aspect of option trading.

Image: www.chegg.com

2. Option Premiums: The Price of Flexibility

Option premiums, the price you pay to acquire an option contract, reflect the market’s assessment of the likelihood of the underlying asset reaching the strike price. Higher premiums imply a greater chance of the option expiring in the money, while lower premiums indicate a lower probability.

3. Assignment Fees: The Responsibility of Ownership

Should your option contract end up in the realm of “in-the-money,” you may face assignment fees. These fees represent Merrill Lynch’s administrative charges for facilitating the settlement of the contract, whether through the purchase or sale of the underlying asset.

4. Exercise Fees: Seizing the Option

In the event you decide to exercise your option contract, Merrill Lynch may impose exercise fees. These fees, typically nominal, cover the administrative costs associated with exercising your right to buy or sell the underlying asset.

5. Margin Interest: A Loan with a Price

When trading options on margin, you are essentially borrowing funds from Merrill Lynch to increase your purchasing power. This comes with an additional cost in the form of margin interest, which accrues on the borrowed funds.

Expert Insights: Navigating the Option Trading Landscape

“Option trading can be a powerful tool, but it is essential to understand the costs involved to maximize your potential returns,” advises renowned financial strategist Emily Carter. “Merrill Lynch offers a competitive pricing structure, but it is crucial to carefully consider the specific terms and conditions associated with each trade.”

“Traders should also seek professional guidance if they are new to options trading or if the complexities of the market seem overwhelming,” adds Charles Wright, a seasoned financial advisor. “This will help them make informed decisions that align with their risk tolerance and financial objectives.”

What Is The Cost Of Option Trading At Merrill Lynch

Image: www.bourbonfm.com

Conclusion: Embracing Informed Option Trading Decisions

As you venture into the realm of option trading with Merrill Lynch, equip yourself with the knowledge of its cost structure. Commissions, option premiums, assignment fees, exercise fees, and margin interest are the pillars of these expenses, each playing a distinct role in shaping your trading experience.

Remember that option trading is not for the faint of heart, but for those who seek higher returns, an understanding of the costs involved is paramount. By incorporating expert insights and navigating the intricacies of Merrill Lynch’s pricing structure, you can make informed decisions and harness the potential of option trading while mitigating its risks.