In the complex world of option trading, understanding the intricacies of the Greeks is crucial for making informed decisions. One such Greek letter that plays a pivotal role in the strategy of options traders is Gamma. It measures the rate of change in an option’s Delta with respect to the underlying asset’s price. This article delves into the concepts surrounding Gamma, exploring its significance, calculation, and implications for option traders.

Image: www.youtube.com

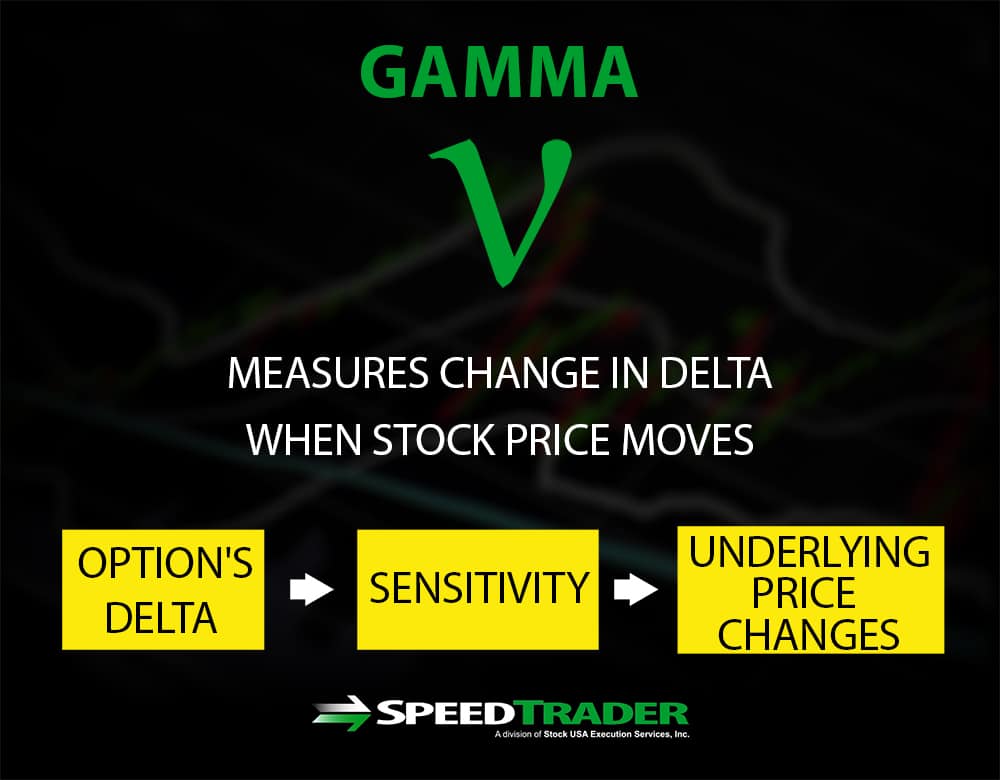

Understanding Gamma: A Measure of Delta’s Sensitivity

Gamma captures the sensitivity of an option’s Delta to movements in the underlying asset’s price. It indicates how much an option’s Delta will change for a given change in the underlying’s price. A positive Gamma signifies that the Delta of the option will increase as the underlying asset’s price rises, while a negative Gamma implies that the Delta will decrease as the underlying’s price rises.

Calculating Gamma

For a given call option, Gamma can be calculated as follows:

Gamma = (1 / S) N'((d1 + (t-T) (r – (sigma^2) / 2)) / (sigma * sqrt(t-T)))

where:

· S is the price of the underlying asset

· N'(.) is the standard normal probability density function

· d1 is the first derivative of the Black-Scholes option pricing model

· t is the current time

· T is the time to option expiration

· r is the risk-free interest rate

· sigma is the volatility of the underlying asset

For a put option, the calculation is slightly different but follows the same principles.

Significance of Gamma in Option Trading

Gamma is a crucial Greek for options traders as it provides valuable insights into the behavior of an option in response to price changes. High Gamma options are particularly sensitive to price movements, which can lead to significant profit or loss potential. Traders can utilize this sensitivity to their advantage by employing strategies that exploit Gamma’s dynamics.

Image: speedtrader.com

What Is Gamma In Option Trading

Image: taxguru.in

Implication for Option Trading Strategies

Traders can leverage Gamma by employing various strategies that capitalize on its impact on Delta. For instance, when expecting a sharp increase in the underlying’s price, a trader might consider buying a high Gamma call option. As the Delta of the call option increases, it will amplify the trader’s potential profit from the underlying’s price appreciation.

Conversely, if a trader anticipates a significant decrease in the underlying’s price, they could sell a high Gamma put option. As the Delta of the put option decreases, it will protect the trader from excessive losses resulting from the underlying’s price decline.

It is important to note that high Gamma strategies can also expose traders to substantial risks, especially if the underlying’s price moves counter to their expectations. Therefore, traders should exercise appropriate risk management and thoroughly understand the potential consequences before engaging in Gamma-based strategies.

In conclusion, Gamma is a fundamental Greek in option trading that measures the sensitivity of an option’s Delta to price changes. By understanding its significance, calculation, and implications, options traders can harness the power of Gamma to enhance their trading strategies and make more informed decisions. However, it is crucial to approach high Gamma strategies with caution and employ sound risk management practices to mitigate potential losses.