Introduction

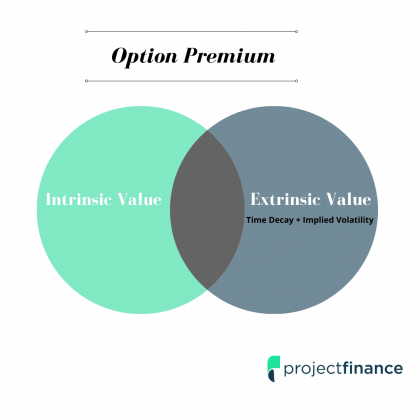

Image: www.projectfinance.com

Options trading is a fascinating yet complex arena that offers both potential rewards and risks. At the heart of understanding options lies a crucial concept known as extrinsic value. What exactly is extrinsic value and why does it matter? Read on to unravel the intricacies of this fundamental element in option trading.

Extrinsic value, in essence, is the premium paid for an option beyond its intrinsic value. While intrinsic value refers to the immediate worth of an option based on its underlying asset’s price, extrinsic value reflects factors such as time to expiration, volatility, and interest rates.

Understanding the Components of Extrinsic Value

-

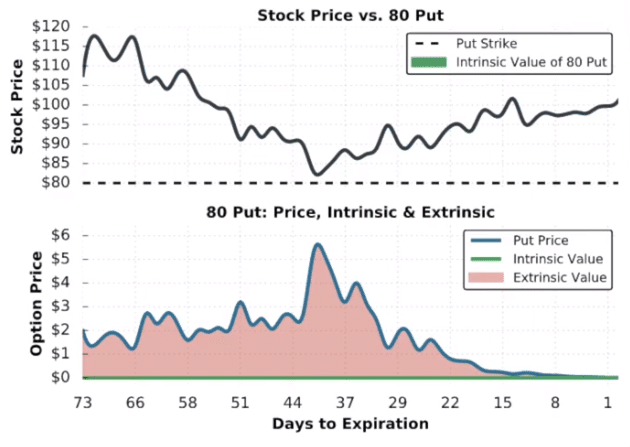

Time Value: The remaining time until the option expires contributes to its extrinsic value. As time passes, the likelihood of the underlying asset reaching a price that makes the option profitable diminishes. This time decay factor is a crucial element in extrinsic value.

-

Volatility: Market volatility is an important determinant of extrinsic value. Higher volatility indicates greater fluctuations in the underlying asset’s price, making it more likely that the option will reach a profitable position. Consequently, higher volatility increases extrinsic value.

-

Interest Rates: Interest rates play a role in extrinsic value, particularly for longer-term options. Higher interest rates make holding long-term options more expensive, reducing their desirability and thus their extrinsic value.

The Impact of Extrinsic Value

Extrinsic value can have a significant impact on option trading strategies:

-

Short-Term Options: Options with shorter expiration dates generally have lower time value and higher extrinsic value, offering greater potential returns. However, this also exposes traders to faster time decay.

-

Long-Term Options: Longer-term options tend to have higher time value and lower extrinsic value, carrying lower upfront premiums but providing more time for the underlying asset to reach a profitable price.

Trading Strategies Involving Extrinsic Value

Understanding extrinsic value opens up opportunities for effective trading strategies:

-

Time Decay Trading: Traders can profit from the decay in time value by selling short-term options that have a higher extrinsic value. As time passes, the extrinsic value decreases, potentially leading to a profitable trade.

-

Volatility Trading: Buying options when volatility is low and selling them when it is high can be a profitable strategy, leveraging the impact of extrinsic value on option prices.

Conclusion

Extrinsic value is a vital aspect of option trading, reflecting the premium paid beyond the intrinsic value of an option. By understanding its components and how they influence option prices, traders can make informed decisions and employ effective trading strategies. Remember to approach option trading with prudence and consult with experienced professionals if needed. Equip yourself with the knowledge of extrinsic value and unlock the potential of this exciting financial realm.

Image: www.awesomefintech.com

What Is Extrinsic Value In Option Trading

Image: www.projectfinance.com