Mastering the Art of Profiting from Market Neutrality

In the realm of options trading, where calculated risks and strategic maneuvering reign supreme, the iron condor emerges as a sophisticated and versatile strategy that can yield impressive returns for those who navigate its nuances with precision. Consisting of four strategically placed options contracts, the iron condor is designed to capitalize on a specific market scenario known as “low volatility.”

Image: www.pinterest.com

An iron condor is a neutral options strategy, meaning it does not bet on a specific direction of the underlying asset’s price movement. Instead, it aims to profit from the decay of implied volatility over time. Implied volatility is a market’s perception of the future volatility of an underlying asset, and its value is a key determinant of options prices. When implied volatility remains low and the underlying asset’s price stays within a narrow range, the iron condor can generate substantial profits.

Components of an Iron Condor

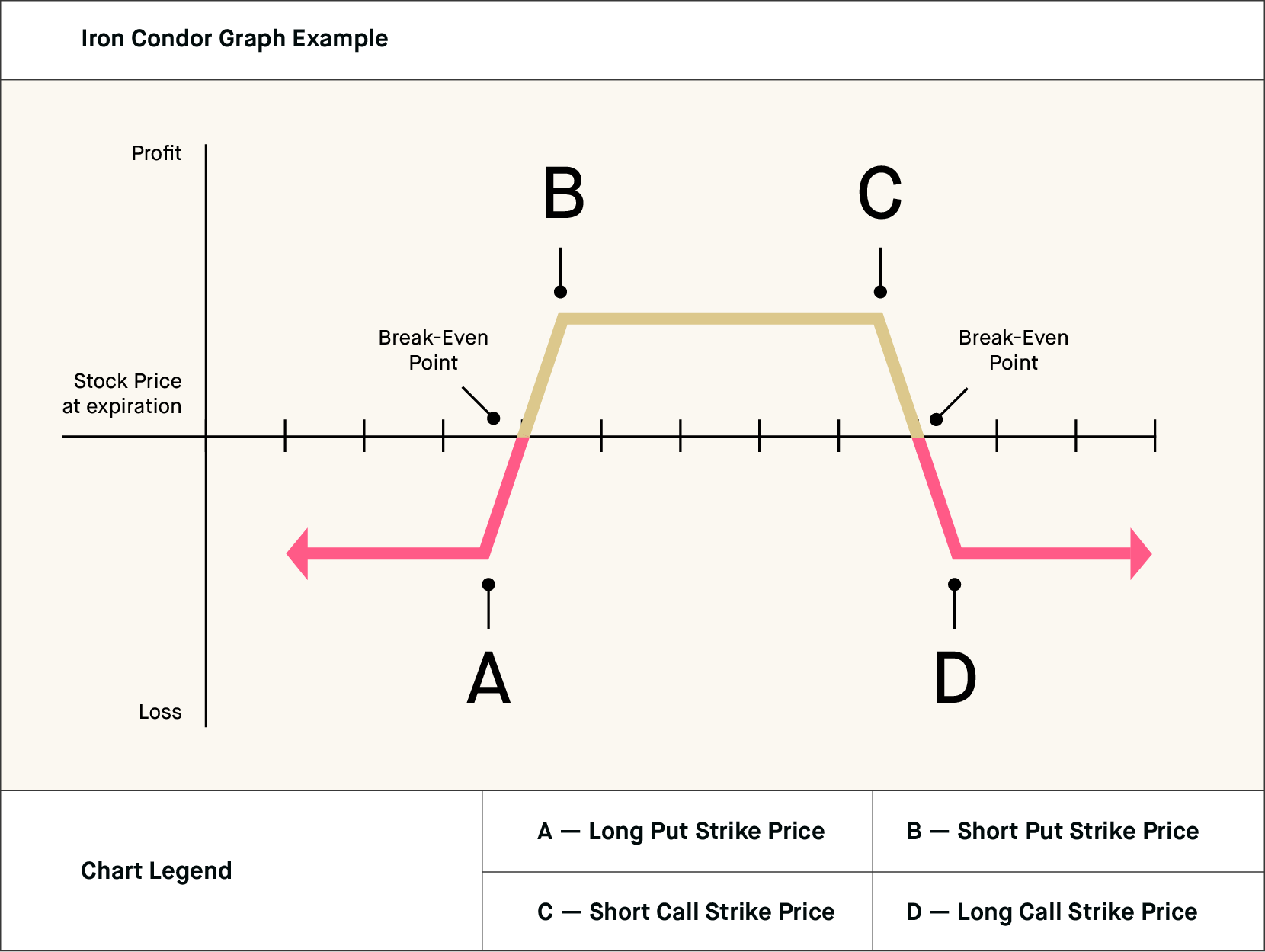

An iron condor comprises four options contracts sold on the same underlying asset but with different strike prices and expiration dates:

-

Short Put Option: Sold at a strike price below the current market price.

-

Short Call Option: Sold at a strike price above the current market price but lower than the short put.

-

Long Put Option: Bought at a strike price lower than the short put.

-

Long Call Option: Bought at a strike price higher than the short call.

The strike prices and expiration dates of these options contracts are meticulously chosen to create a “bell curve” shape in terms of their risk and reward profiles. The short put and short call options generate a positive cash flow at the sale, while the long put and long call options require an upfront investment.

Profit Potential and Risk

The iron condor’s profit potential is limited to the net premium received from selling the short options minus the net premium paid for buying the long options. The maximum profit is achieved when the underlying asset’s price remains between the strike prices of the short put and the short call until the options expire.

The risk involved in an iron condor is defined by the difference between the strike prices of the long and short options on each side of the strategy. In the ideal scenario, the underlying asset’s price will remain within this range throughout the life of the options. However, if the price moves outside this range, losses can accrue.

Market Conditions for Success

The iron condor is a strategy that benefits from low implied volatility and sideways movement in the underlying asset’s price. High volatility and sudden price fluctuations can erode the premium decay that is essential for profitability. Therefore, traders who employ this strategy should carefully monitor market conditions and adjust their risk parameters accordingly.

Image: learn.robinhood.com

What Is An Iron Condor In Options Trading

Image: www.pinterest.com

Conclusion

The iron condor is a sophisticated options trading strategy that can generate significant returns in low-volatility environments. By selling short options at higher prices and simultaneously buying long options at lower prices, traders create a delicate balance of risk and reward. However, it is crucial to approach this strategy with a thorough understanding of its mechanics and market conditions. Only those who have mastered the art of option pricing and risk management should venture into the intricate world of iron condors.