In the world of finance, there is a plethora of terms and acronyms that can be baffling to the uninitiated. IV, or Implied Volatility, is one such term that is often encountered in the context of options trading. But what exactly does IV mean and why should you care?

Image: www.pinterest.com

Understanding Implied Volatility

Implied Volatility (IV) is a forward-looking measure of how much the price of an underlying asset is expected to fluctuate over the remaining life of an option contract. It is expressed as an annualized percentage and is derived from the pricing of the option itself. In essence, IV represents the market’s expectation of the asset’s volatility, and it is a crucial factor in determining the option’s price.

What IV Tells You

IV provides valuable insights into the market’s sentiment towards an underlying asset. A high IV implies that the market anticipates significant price movements in either direction, while a low IV suggests that the market expects the asset to remain relatively stable.

High IV can be an indication of upcoming events, such as earnings announcements or economic data releases. Traders may purchase options with high IV to capitalize on the potential for substantial price swings. Conversely, low IV can indicate market complacency, which can be an opportunity for investors to sell or write options to generate income.

The Impact of IV on Option Pricing

IV exerts a significant influence on option pricing. Options with higher IV are typically priced higher than those with lower IV, as they offer the potential for greater gains or losses. The higher the IV, the more expensive it will be to purchase an option, as the market commands a premium for the increased level of uncertainty.

Traders need to be mindful of the impact of IV on their option strategies. Understanding how IV affects option pricing can help them make informed decisions about whether to buy, sell, or write options.

Image: fluentslang.com

Implied Volatility and the Greeks

IV is closely related to the Greeks, which are a set of metrics that measure the sensitivity of an option’s price to changes in underlying factors. Among the Greeks, Delta and Vega are particularly influenced by IV.

Delta measures the change in an option’s price for every $1 movement in the underlying asset. A higher IV increases Delta, making the option more responsive to price changes.

Vega measures the change in an option’s price for every 1% change in IV. When IV increases, Vega also increases, indicating that the option’s price is more sensitive to changes in volatility.

Using IV in Option Trading Strategies

Traders can leverage IV to their advantage by incorporating it into their option trading strategies. Some common strategies include:

-

Buying options with high IV: Traders may purchase options with high IV in anticipation of a large price movement in either direction. If the predicted volatility materializes, the options can generate significant profits.

-

Selling options with low IV: Traders may sell options with low IV when the market is expecting a relatively stable period. By selling options, traders collect premiums and profit from time decay if volatility remains low.

-

Using IV skews: IV skews refer to differences in IV across different strike prices or expiration dates. Traders may take advantage of IV skews to identify potential trading opportunities.

What Does Iv Mean In Option Trading

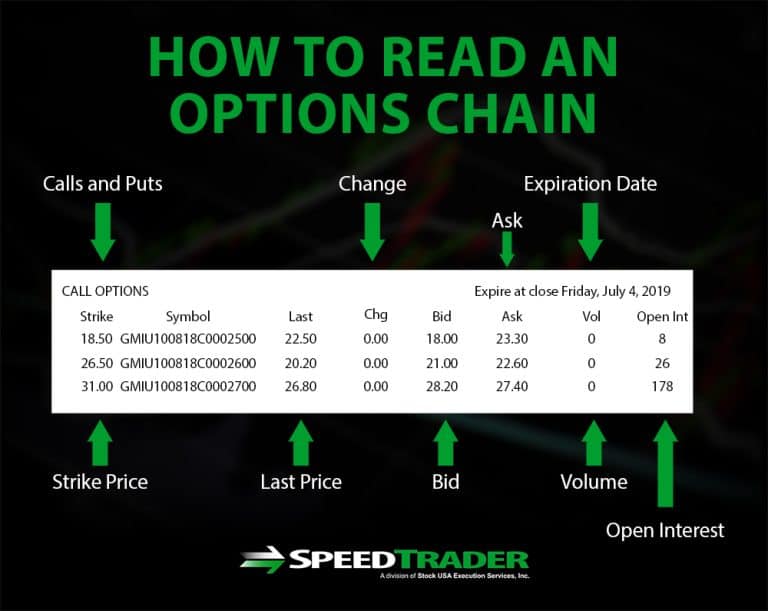

Image: speedtrader.com

Conclusion

Implied Volatility (IV) is a crucial concept in option trading that represents the market’s expectation of the underlying asset’s future price fluctuations. Understanding IV and its impact on option pricing is essential for informed decision-making. By incorporating IV into their trading strategies, traders can capitalize on market volatility and enhance their chances of success in the dynamic world of options trading.