Image: www.youtube.com

Introduction

The world of options trading offers boundless opportunities for investors seeking to maximize their returns. Among the array of strategies available, weekly options trading stands out as a potent tool for capitalizing on short-term market movements. This guide delves into the intricate details of weekly options trading, empowering you with the knowledge and techniques to harness its potential effectively.

Delving into the Dynamics of Weekly Options

Weekly options, as the name suggests, are contracts that expire every Friday. This unique feature sets them apart from their longer-term counterparts, providing traders with a shorter time horizon to reap the rewards or manage the risks associated with their positions. Weekly options are more speculative than monthly options but can provide substantial returns if executed judiciously.

Essential Concepts: Understanding the Market Landscape

A thorough comprehension of key concepts is paramount to successful weekly options trading. Options are derivative instruments that confer the right but not the obligation to buy (call options) or sell (put options) an underlying asset at a specified price (strike price) on or before the expiration date. This flexibility allows traders to speculate on the future direction of the market or hedge against potential losses.

Image: tradethatswing.com

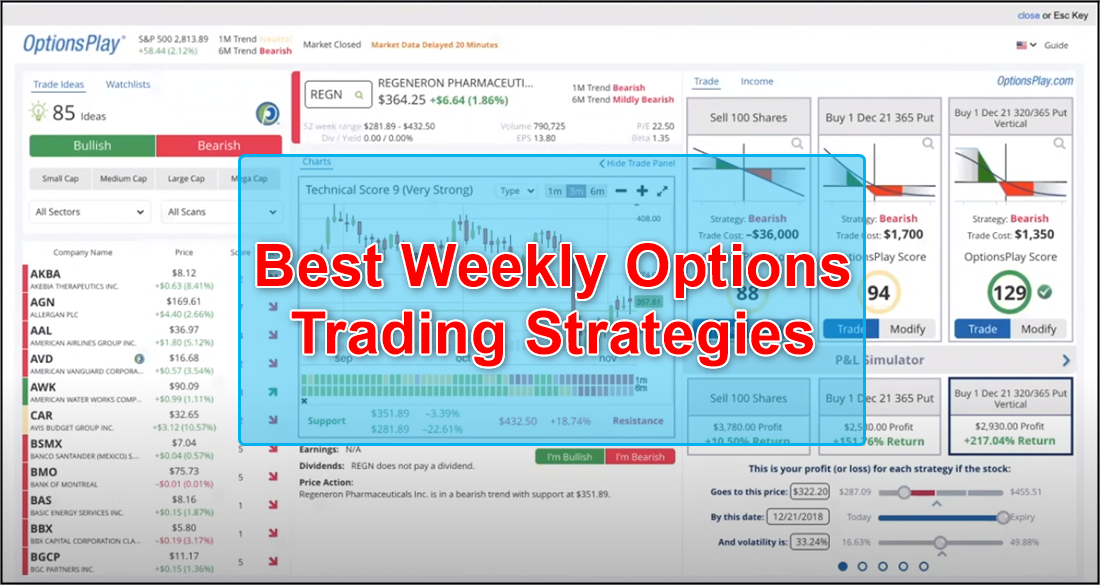

Trading Strategies: Mastering the Art of Options

Diving into the realm of weekly options trading demands a strategic approach. Several techniques have emerged over time, each tailored to specific market conditions and risk appetites. Delta-neutral strategies aim to minimize price fluctuations by pairing options with opposite deltas, reducing the impact of volatility on the overall position. Directional strategies, on the other hand, capitalize on predicted market movements, utilizing call options for bullish expectations and put options for bearish outlooks.

Latest Developments and Emerging Trends

The dynamic nature of financial markets necessitates staying abreast of the latest developments in weekly options trading. The advent of automated trading platforms has revolutionized the landscape, enabling traders to execute strategies with precision and speed. Moreover, the rise of algorithmic trading has introduced sophisticated techniques that analyze market data and make trading decisions autonomously.

Real-World Applications: Harnessing Options for Profit and Protection

Weekly options trading finds practical applications in various scenarios. Investors can leverage call options to potentially magnify their gains when expecting an uptrend in the underlying asset’s price. Conversely, put options offer protection against market downturns by profiting from price declines. Skilled traders employ strategies like covered calls or cash-secured puts to generate income while managing risk.

Weekly Options Trading Strategy

Image: stockscreenertips.com

Conclusion

Weekly options trading presents a powerful tool for adept investors seeking to harness market opportunities. By grasping the fundamental concepts, mastering trading strategies, and staying updated with the latest advancements, traders can unlock the potential of this dynamic arena. Remember, as with any investment strategy, thorough research, prudent risk management, and unwavering discipline pave the way to success in weekly options trading. Embrace this knowledge and empower yourself in the pursuit of enhanced financial outcomes.