Introduction

Image: s3.amazonaws.com

In the realm of options trading, where strategies abound, weekly options trading stands out as a potent tool for investors seeking to optimize both returns and risk management. Among the diverse weekly options strategies, covered calls have earned a venerable reputation for their versatility and potential for consistent income generation. This comprehensive guide will delve into the intricacies of weekly options trading covered calls, empowering you with the knowledge and insights necessary to harness its profit-making prowess.

Covered Calls: A Primer

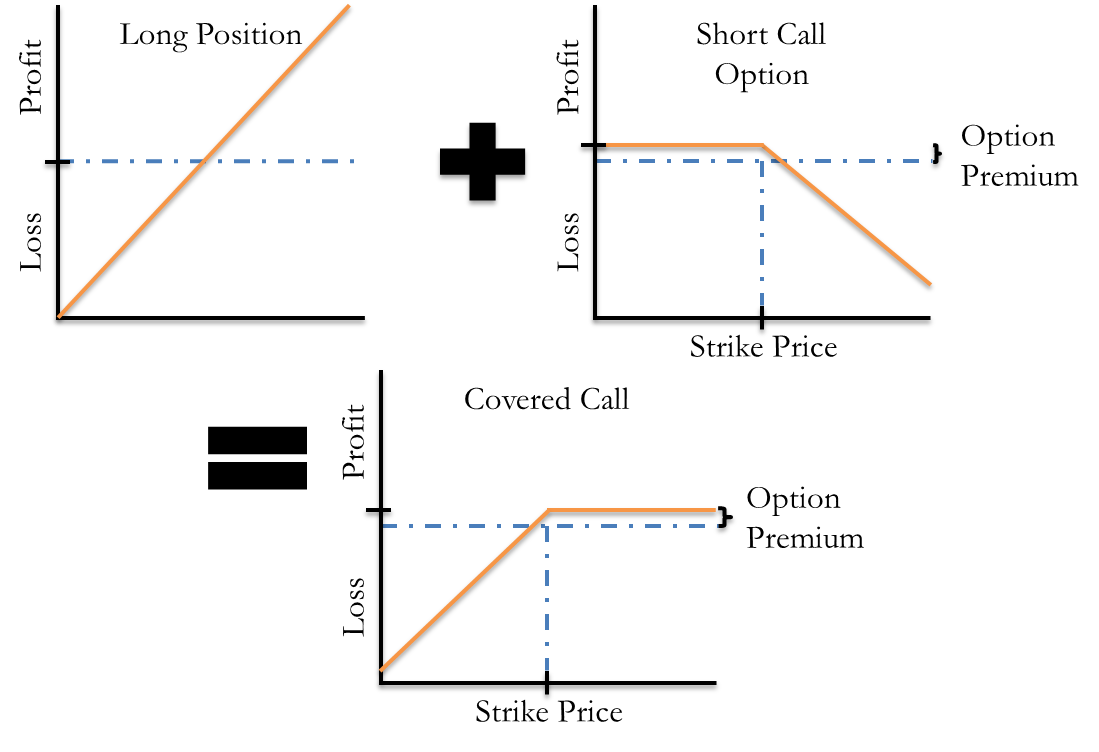

A covered call strategy is an options trading technique where you sell (write) a call option against an underlying stock that you already own or have bought simultaneously. By doing so, you collect a premium from the buyer of the call, effectively locking in a predetermined selling price for your stock. This premium represents the price that the call buyer pays to acquire the right to potentially purchase (exercise) your stock at a designated strike price. If the stock market value remains below the strike price upon option expiration, the call buyer may choose to forfeit the premium paid, in which case the investor retains both the stock and the premium income. Alternatively, if the stock market value exceeds the strike price, the stock may be called away from you at that exercise price.

Benefits of Weekly Options Trading

Utilizing weekly options trading covered calls offers several advantages:

- Income generation: The sale of call options generates immediate income in the form of the option premium. This income can provide a consistent revenue stream, particularly in volatile markets.

- Risk mitigation: By already owning the underlying stock, you limit your potential downside risk to the difference between the stock’s purchase price and the strike price minus the premium earned.

- Flexibility: Weekly options offer shorter expiration periods compared to monthly options. This flexibility allows for more frequent adjustments and tactical decision-making in response to changing market conditions.

- Time decay: As the options approach expiration, the value of the call option decays rapidly. This effect can amplify the impact of the premium income received on your overall return.

Understanding Key Concepts

To fully grasp the mechanics of weekly options trading covered calls, several key concepts warrant clarification:

- Strike price: The predefined price at which the call buyer can purchase your stock.

- Premium: The upfront payment received for selling the call option.

- Maximum profit: The maximum profit is achieved when the stock price remains below the strike price, allowing you to retain both the stock and the premium earned.

- Maximum loss: The maximum loss is capped at the difference between the stock’s purchase price and the strike price minus the premium received.

Practical Implementation

Implementing a weekly options trading covered call strategy involves the following steps:

- Stock selection: Choose high-quality stocks with strong fundamentals and above-average implied volatility.

- Strike price determination: Consider strike prices that provide a balance between premium yield and potential stock price appreciation.

- Premium collection: Sell the covered call option, capturing the premium.

- Option management: Monitor the stock price and options market conditions, making adjustments as necessary.

- Profit realization: Upon expiration, the call option either expires worthless, or the shares are sold at the strike price.

Strategies for Success

To enhance your success with weekly options trading covered calls, consider the following strategies:

- Choose undervalued stocks: Target stocks that are trading at a discount to their intrinsic value.

- Sell out-of-the-money calls: Strike prices slightly above the current market price offer a higher premium and greater flexibility.

- Manage risk: Regularly review your stock positions and adjust covered call strategies based on market sentiment and stock performance.

- Seek education and practice: Continuously enhance your understanding of options trading through books, online resources, and paper trading simulations.

Conclusion

Weekly options trading covered calls can be a highly effective strategy for maximizing returns and managing risk in the financial markets. By understanding the intricacies of this strategy and implementing it skillfully, you can enhance your financial literacy and position yourself for long-term investment success. Remember, however, that all trading strategies carry inherent risks and should be executed with due diligence and prudent risk management principles.

Image: www.optionstradingreviews.com

Weekly Options Trading Covered Calls

Image: www.netpicks.com