Introduction

Binary options trading has emerged as a popular financial instrument, offering beginner traders the opportunity to potentially earn lucrative returns. It presents a unique combination of accessibility and risk, making it an appealing option for those just starting their trading journey. In this comprehensive guide, we will delve into three fundamental binary options trading strategies tailored specifically for beginners, empowering them with the knowledge and tools to navigate the markets with confidence.

Image: www.slideshare.net

Understanding Binary Options and Its Benefits

Binary options derive their name from the inherent simplicity of their mechanics. These contracts oblige the trader to predict the future price direction of an underlying asset, such as stocks, commodities, or indices, over a predefined period. The potential outcomes are binary: either a fixed profit if the prediction aligns with the market movement or a total loss of the invested capital if the prediction is incorrect.

The allure of binary options lies in their high-risk, high-reward nature, captivating traders with the prospect of sizeable returns. Beginner traders are drawn to the accessibility of the markets, as binary options require minimal capital to get started. Moreover, the ease of understanding the underlying concept makes them a suitable option for those new to trading.

Triple Bollinger Bands Strategy

The Triple Bollinger Bands strategy is a popular technical analysis technique employed by traders to identify potential market trends and trade with confidence. By employing three Bollinger Bands, traders can gain valuable insights into market volatility and price movement.

-

Configuring the Bollinger Bands: Set the Bollinger Bands at 20, 40, and 60 standard deviations above and below a 10-period moving average. This creates three distinct bands, with the outer bands signifying potential overbought or oversold conditions.

-

Implementing the Strategy: Wait for the price to touch or break out of the inner Bollinger Band (20 standard deviations). If the price breaks out to the upside, initiate a buy signal. Conversely, a breakout to the downside triggers a sell signal.

-

Managing Risk: Place a stop-loss order a few pips below the Bollinger Band for buy signals and a few pips above the Bollinger Band for sell signals. This helps mitigate losses if the market moves against the prediction.

Moving Average Crossovers Strategy

Moving average crossovers are a fundamental technical analysis strategy that pinpoints potential trading opportunities based on the interaction of two moving averages with different durations. This method leverages the assumption that market trends are likely to continue in the same direction.

-

Selecting Moving Averages: Choose two moving averages with different periods, such as a 50-period exponential moving average (EMA) and a 200-period EMA. The longer EMA provides a smoother trend, while the shorter EMA reacts more quickly to price fluctuations.

-

Trading Signals: A buy signal occurs when the short-term EMA (50-period) crosses above the long-term EMA (200-period). A sell signal is generated when the short-term EMA crosses below the long-term EMA.

-

Risk Management: Employ stop-loss orders to minimize potential losses. Determine the distance between the EMAs and set the stop-loss order at an appropriate distance below the EMAs for buy signals and above the EMAs for sell signals.

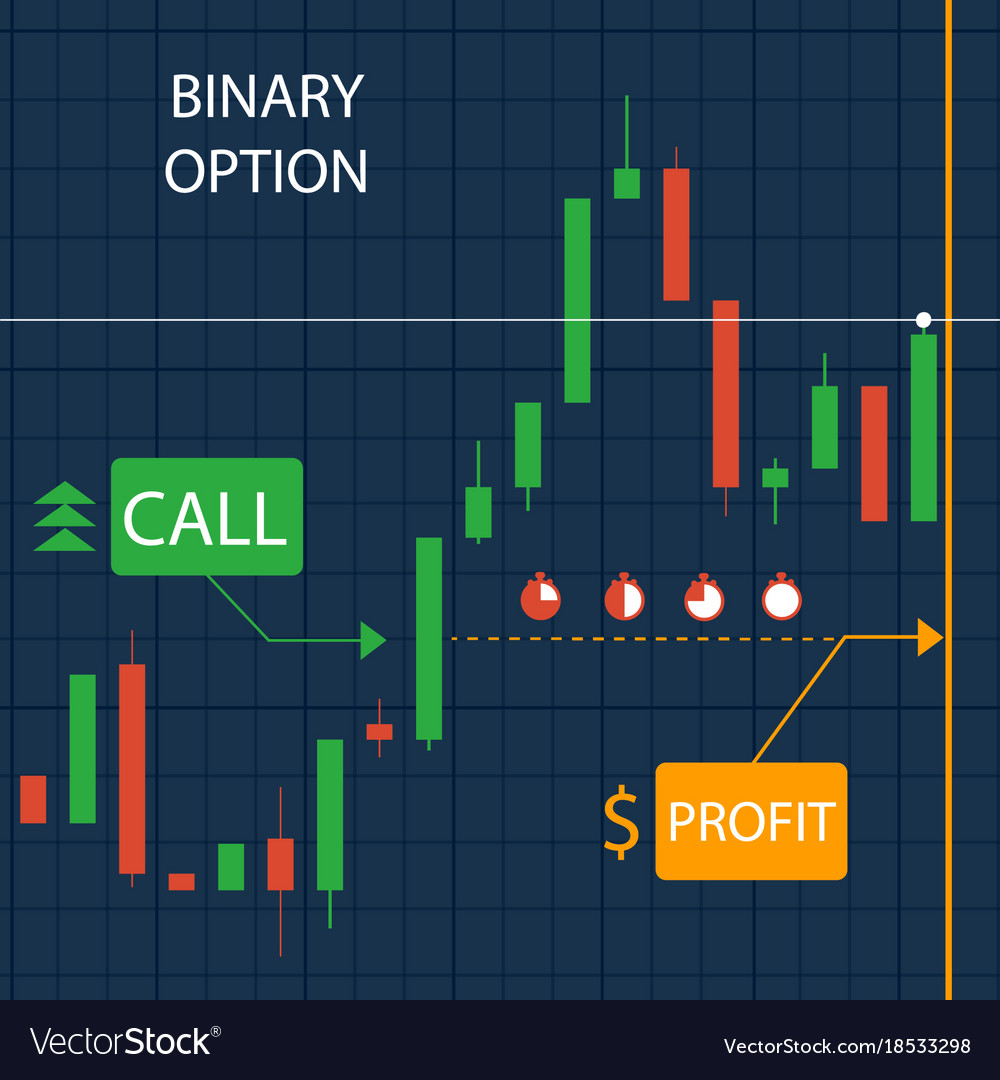

Image: instantforex.com.ng

Pin Bar Strategy

Pin bars are distinctive candlestick formations that provide traders with insights into potential market reversals. These candlesticks feature a small body with a long wick or “pin,” indicating that prices reversed significantly during the trading period.

-

Identifying Pin Bars: Look for candlesticks with a small body less than 50% of the length of the wick. The wick should extend beyond the high (for bullish pin bars) or the low (for bearish pin bars).

-

Trading Signals: A bullish pin bar forming after a downtrend indicates a potential reversal to the upside. A bearish pin bar following an uptrend signals a potential reversal to the downside.

-

Position Management: Enter a position in the direction of the pin bar’s breakout, placing a stop-loss order slightly below the low of the pin bar for bullish trades or slightly above the high of the pin bar for bearish trades.

3 Binary Options Trading Strategies For Beginners

Conclusion

As novice traders embark on their binary options trading journey, it’s imperative to adopt a well-informed approach. Understanding the fundamental principles of binary options trading and meticulously employing the strategies outlined in this guide will empower traders to navigate the markets with heightened confidence and potentially reap the rewards that await them.