Options trading is an alluring financial instrument that can transform your investments into a lucrative venture. While options trading can be complex, it’s not impossible to navigate, especially with the right guidance.

Image: www.etnasoft.com

The Power of Options Trading

Options trading empowers investors with the flexibility to leverage the movement of an underlying asset without committing to buy or sell it outright. Through buying or selling options contracts, you have the right but not the obligation to exercise that contract’s specific action at a predefined price and date. This dynamic allows for strategic risk management, speculative trading, and even income generation.

Navigating the Options Market

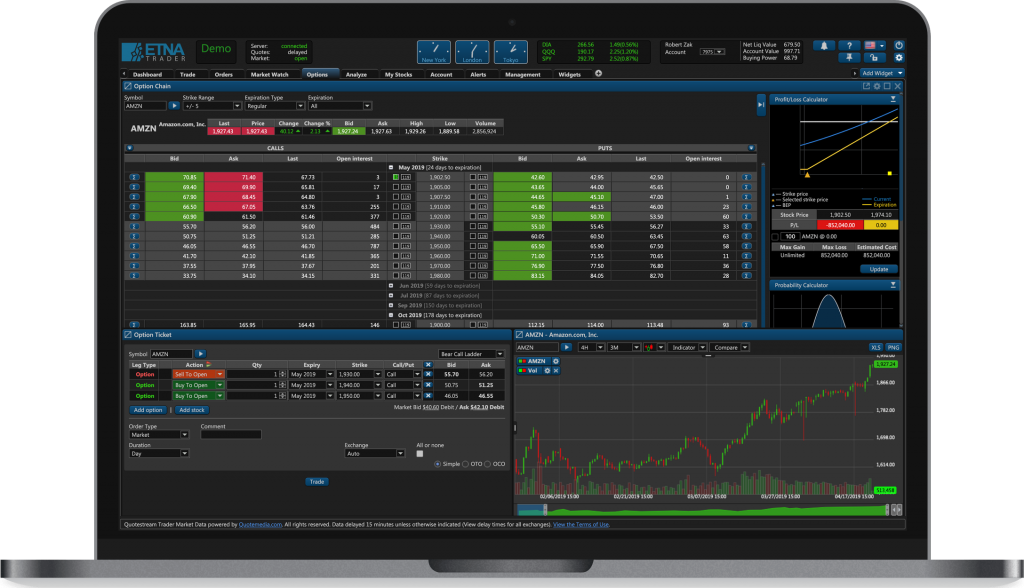

To get started, you’ll need a reliable platform, like an online broker. Choose one that offers a user-friendly interface, competitive fees, and research tools to assist your decision-making. Success in options trading hinges on understanding market trends, risk management techniques, and the strategies employed by seasoned traders. Online forums, industry publications, and seasoned traders’ guidance can all contribute to your knowledge base.

Decoding the lingo

Initially, the terminology of options trading can be daunting but with time and effort, it becomes second nature. Key terms include: call (buying the right to buy an asset), put (buying the right to sell an asset), premium (the price paid for an option), strike price (the agreed-upon price at which you can exercise your option), and expiration date (the date your option expires).

Image: www.youtube.com

Strategies for Success

Various options trading strategies exist, each tailored to different risk appetites and market outlooks. Covered calls, naked puts, straddles, and strangles are just a few examples. It’s imperative to research and fully comprehend these strategies before implementing them in your own trades.

Expert Advice and Time-Tested Tips

Heed the advice of seasoned professionals: diversify your portfolio, manage your risk exposure, and stay informed about market trends. Additionally, paper trading (simulated trading with virtual funds) can provide a risk-free environment to hone your skills before venturing into real-time trading.

FAQs on Options Trading

Q: Can I lose more money than I invested in options trading?

A: Yes, it’s possible, particularly when trading naked options. Options trading carries inherent risks.

Q: What’s the best trading strategy for beginners?

A: Covered calls are a relatively low-risk strategy well-suited for beginners.

Q: How much capital do I need to start options trading?

A: The amount varies based on your chosen strategy and risk management style.

Website For Options Trading

Image: www.pinterest.com

Unlock Your Financial Potential

Website for options trading: Journey into the dynamic world of options trading. Are you ready to leverage this knowledge and make informed trading decisions?