Anyone involved in the stock market or trading has likely often heard of options trading, but what is options trading exactly?

Image: faqinsurances.com

What is Options Trading?

In the world of finance, options trading is a strategy that gives traders the right but not the obligation to buy or sell an underlying asset at a specified price within a set time frame. It’s like having an insurance policy against the volatility of the stock market. By purchasing options contracts, you can hedge your investments, speculate on price movements, or even generate income from premiums.

Options contracts are agreements between two parties, known as the buyer and the seller, to exchange a specific asset, typically stocks or ETFs, at a predetermined price on a future date. These contracts are standardized and traded on options exchanges. As an options trader, you have the flexibility to choose the strike price, duration, and type of options contract that best suits your investment strategy.

Types of Options

There are two main types of options: calls and puts.

Call Options

A call option gives you the right to buy an underlying asset at a specified strike price on or before a specified expiration date. When you buy a call option, you’re betting that the price of the asset will rise above the strike price before the expiration date, allowing you to exercise your option and buy the asset at a lower price.

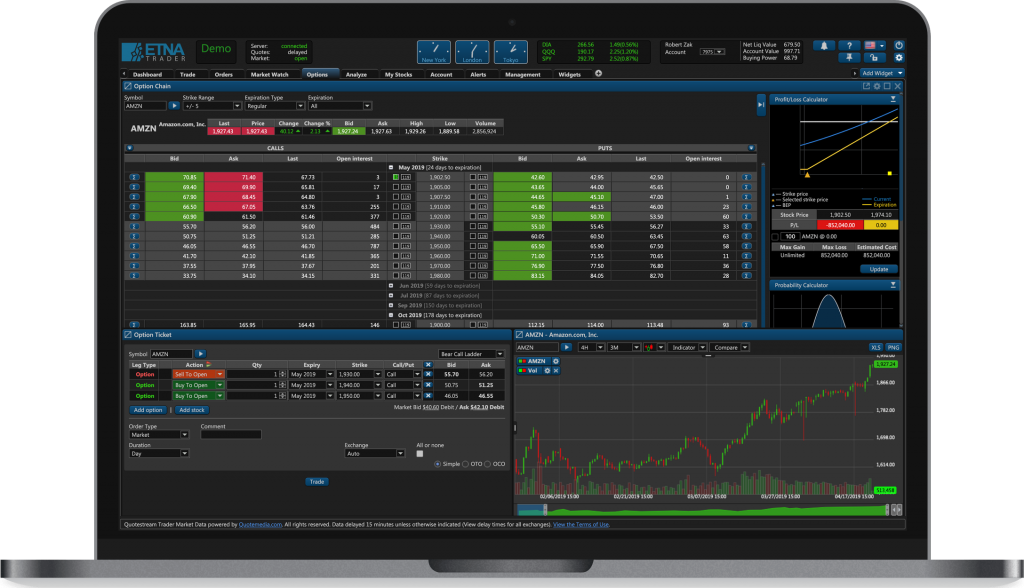

Image: www.etnasoft.com

Put Options

A put option gives you the right to sell an underlying asset at a specified strike price on or before a specified expiration date. When you buy a put option, you’re betting that the price of the asset will fall below the strike price before the expiration date, allowing you to exercise your option and sell the asset at a higher price.

Benefits of Options Trading

Options trading offers several potential benefits, including:

- Hedging: Options can be used to protect your existing investments from market downturns.

- Leverage: Options allow you to control a larger position with a smaller investment, increasing your potential returns.

- Income generation: Selling options premiums can generate income, even in volatile markets.

- Flexibility: Options provide you with flexibility in terms of strike prices, expiration dates, and strategies.

Expert Tips for Options Trading

To help you navigate the world of options trading, here are some expert tips:

- Start small: Begin with small trades until you gain experience and confidence.

- Understand the risks: Options trading involves inherent risks, so it’s crucial to fully comprehend the potential losses.

- Choose liquid options: Opt for options with high trading volume to ensure you can easily enter and exit positions.

- Set realistic expectations: Don’t expect to get rich quick with options trading; it takes time and consistent effort.

- Use technical analysis: Combine options trading with technical analysis tools to improve your decision-making.

- Practice with paper trading: Utilize paper trading platforms to test your strategies before risking real money.

Options Trading Faq

Options Trading FAQ

Q: What’s the difference between an option and a stock?

A: Stocks represent ownership in a company, while options are contracts giving you the right but not the obligation to buy or sell an underlying asset.

Q: Can I lose more money than I invest in options trading?

A: Yes, options trading involves leverage, which can amplify both profits and losses.

Q: What are the Greeks in options?

A: Greeks are mathematical measures used to assess the risk and sensitivity of options contracts.

Q: How do I choose the right strike price?

A: Consider your investment strategy, market conditions, and risk tolerance.

Q: What’s the difference between buying and selling options?

A: Buying options gives you the right to buy or sell, while selling options obligates you to do so.

Conclusion

Options trading can be a powerful tool for investors looking to enhance their returns or hedge against market risks. However, it’s essential to approach options trading with knowledge, risk management, and a sound understanding of the different types of options and strategies available. If you’re new to options trading, it’s strongly recommended to seek guidance from a financial advisor and practice with paper trading before risking real money.

Are you curious about learning more about options trading?