Harnessing the Power of Volatility

Options trading is a complex yet lucrative investment strategy that offers traders the potential for significant returns by leveraging underlying asset price movements. Among the diverse range of options trading techniques, variance spread options trading stands out as a unique and powerful approach that empowers traders to capitalize on volatility, the ever-present force in financial markets.

Image: devhunteryz.wordpress.com

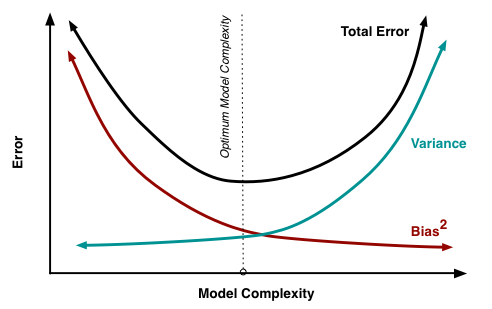

Variance spreads, as the name suggests, are specialized options trading strategies designed to profit from changes in the volatility of an underlying asset. Unlike traditional options strategies that focus on directional price movements, variance spreads derive their value from the market’s perception of future volatility. This nuanced approach has captivated the interest of astute options traders worldwide, making it an indispensable element of their arsenals.

Delving into the Mechanics of Variance Spreads

To fully grasp the essence of variance spread options trading, it is essential to understand the underlying concepts and mechanics. Variance spreads are created by simultaneously buying and selling two options on the same underlying asset, with different strike prices and expirations. The bought option is typically an out-of-the-money option, while the sold option is an in-the-money option.

The net premium paid or received for the variance spread represents the trader’s net outlay or income at the inception of the trade. The profit or loss potential of the strategy is determined by the subsequent changes in the underlying asset’s volatility. If volatility increases, the spread will generally gain value, resulting in a profit for the trader. Conversely, if volatility decreases, the spread will typically lose value, leading to a loss for the trader.

Types of Variance Spreads

The realm of variance spread options trading encompasses a myriad of strategies, each tailored to specific market conditions and risk appetites. Some of the most prevalent types include:

- Calendar Spread: Embraces two options with different expirations, allowing traders to position themselves for anticipated changes in volatility over time.

- Butterfly Spread: A combination of three options with varying strike prices, designed to capitalize on moderate volatility movements.

- Iron Condor: A four-legged strategy involving buying out-of-the-money call and put options while simultaneously selling in-the-money call and put options to capture limited volatility fluctuations.

- Strangle: Involves buying both out-of-the-money call and put options with the same expiration, providing exposure to significant volatility changes.

Applications in the Real World

Variance spread options trading has found widespread adoption in the real world, empowering traders with versatile tools to navigate the ever-changing market landscape. Some common applications include:

- Hedging against volatility risk: Traders can utilize variance spreads to mitigate the adverse effects of unpredictable volatility fluctuations on their portfolios.

- Speculating on volatility: By carefully assessing market conditions, traders can employ variance spreads to speculate on future volatility changes, potentially generating substantial returns.

- Income generation: Certain variance spread strategies are designed to generate consistent income by capitalizing on persistent volatility.

Image: www.evba.info

Variance Spread Options Trading

Image: www.quantstart.com

Conclusion

In the complex world of options trading, variance spread options trading emerges as a formidable strategy that enables traders to tap into the dynamics of volatility. Through a thorough understanding of the underlying concepts, traders can harness the power of variance spreads to enhance their returns and mitigate risks. As markets continue to evolve and volatility remains a constant, variance spread options trading is poised to remain a cornerstone of sophisticated options trading arsenals. Its ability to profit from changes in volatility, combined with its flexibility and diverse applications, makes it an indispensable tool for traders seeking to excel in the ever-dynamic financial landscape.