Introduction

In the world of financial markets, the concept of volatility is a double-edged sword. While it can bring about significant profit opportunities for options traders, it can also lead to substantial losses if not managed properly. This is where the selection of the right option trading strategy becomes crucial. By carefully considering the volatility of the underlying asset, traders can optimize their strategies to maximize their chances of success. This article delves into the intricacies of using volatility to select the best option trading strategy, providing invaluable insights for both seasoned veterans and aspiring traders seeking to enhance their proficiency in the options market.

Image: seekingalpha.com

Understanding Volatility

Volatility, in financial terms, measures the rate at which the price of an asset changes over time. It’s often depicted as a percentage and quantifies the magnitude of price fluctuations. High volatility indicates rapid and significant price movements, while low volatility suggests a more stable and predictable price trend. Volatility is a key indicator of risk in the options market, as it directly influences the potential profits and losses from options trading.

Strategy Selection Based on Volatility

The volatility of the underlying asset plays a pivotal role in determining the most appropriate option trading strategy. Different volatility levels call for distinct strategies to effectively capture market movements and generate favorable outcomes.

When volatility is high, which signifies significant price fluctuations, short-term option strategies are often more suitable. These strategies aim to exploit rapid price changes and capture quick profits by taking advantage of the increased premiums associated with higher volatility. Examples of short-term strategies include scalping, day trading, and momentum trading.

In low volatility environments, on the other hand, long-term option strategies tend to perform better. These strategies involve holding options for extended periods, aiming to profit from gradual price movements or anticipate market trends. Examples of long-term strategies include covered calls, protective puts, and iron condors.

Historical and Implied Volatility

Options traders have two main types of volatility to consider: historical volatility (HV) and implied volatility (IV). Historical volatility measures the realized volatility of an asset over a specific period in the past, providing traders with insights into the asset’s past price fluctuations. Implied volatility, on the other hand, is a forward-looking measure that reflects the market’s expectations of future volatility. It’s derived from the prices of options and incorporates market sentiment, supply and demand dynamics, and other factors.

Traders often use a combined analysis of HV and IV to make informed decisions about strategy selection. When IV is significantly higher than HV, it indicates that the market is pricing in expectations of higher future volatility. In such cases, selling options can be a lucrative strategy, as the premiums tend to be inflated due to the elevated IV.

Image: www.dolphintrader.com

Volatility and Risk Management

While volatility can present opportunities for profit, it also brings inherent risks that need to be carefully managed. Higher volatility results in wider price swings, which can amplify both potential profits and losses. Prudent traders should always consider their risk tolerance and adjust their strategies accordingly. Effective risk management techniques, such as position sizing, stop-loss orders, and hedging strategies, can help mitigate risks and preserve capital.

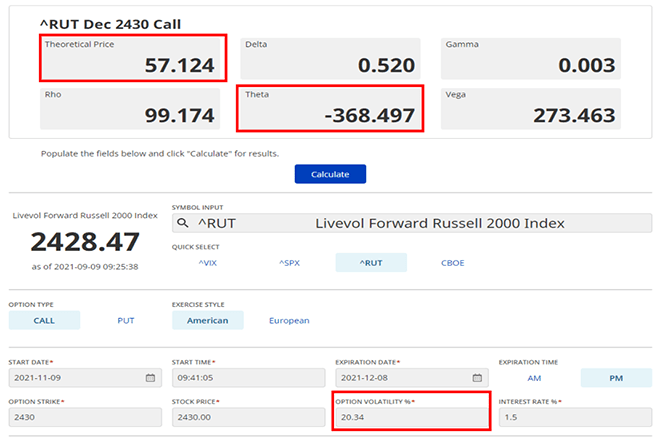

Using Volatility To Select The Best Option Trading Strategy

Image: ibkrcampus.com

Conclusion

Mastering the art of selecting the right option trading strategy involves a comprehensive understanding of volatility and its impact on option prices and market movements. By meticulously analyzing both historical and implied volatility, traders can tailor their strategies to align with the prevailing market conditions, optimizing their chances of success. However, it’s imperative to exercise prudence and employ sound risk management practices, as volatility can be a double-edged sword that requires a balanced approach to reap its rewards while mitigating its potential pitfalls.

Embracing volatility as a key factor in strategy selection empowers options traders to make informed decisions, navigate market fluctuations effectively, and unlock the full potential of the options market. By continuously honing their knowledge and refining their skills, traders can enhance their profitability and establish a solid foundation for long-term success in this dynamic and ever-evolving financial landscape.