I remember that day like it was yesterday. I was a young and aspiring trader, eager to unravel the complexities of the financial markets. In my quest for knowledge, I stumbled upon the world of options trading. I had heard rumors of traders making unimaginable profits by harnessing the power of advanced mathematics. Intrigued and determined to master this enigmatic art, I delved into the realm of numbers.

Image: www.niftytradingacademy.com

Unlocking the Secrets of Probability

At the core of options trading lies a firm foundation of probability and statistics. These mathematical principles allow traders to quantify the likelihood of future events and predict the potential outcomes of their trades. By employing probability distributions and statistical models, traders can estimate the probability of an underlying asset reaching a certain price level at a specific time.

Navigating Risk and Managing Volatility

Risk management is paramount in options trading, and mathematical tools provide traders with the means to assess and control their exposure. Volatility, the ever-fluctuating nature of financial markets, poses a significant challenge. However, mathematical models such as the Black-Scholes formula enable traders to quantify volatility and adjust their strategies accordingly. By understanding the probabilistic nature of volatility, traders can develop sophisticated hedging strategies to mitigate potential losses.

The Intersection of Finance and Mathematics

Options trading stands as a testament to the intersection of finance and mathematics. It requires a deep understanding of financial concepts, such as stock prices, interest rates, and expiration dates, combined with the analytical power of probabilities and statistics. Traders must possess a strong mathematical foundation and a keen ability to synthesize information from multiple sources.

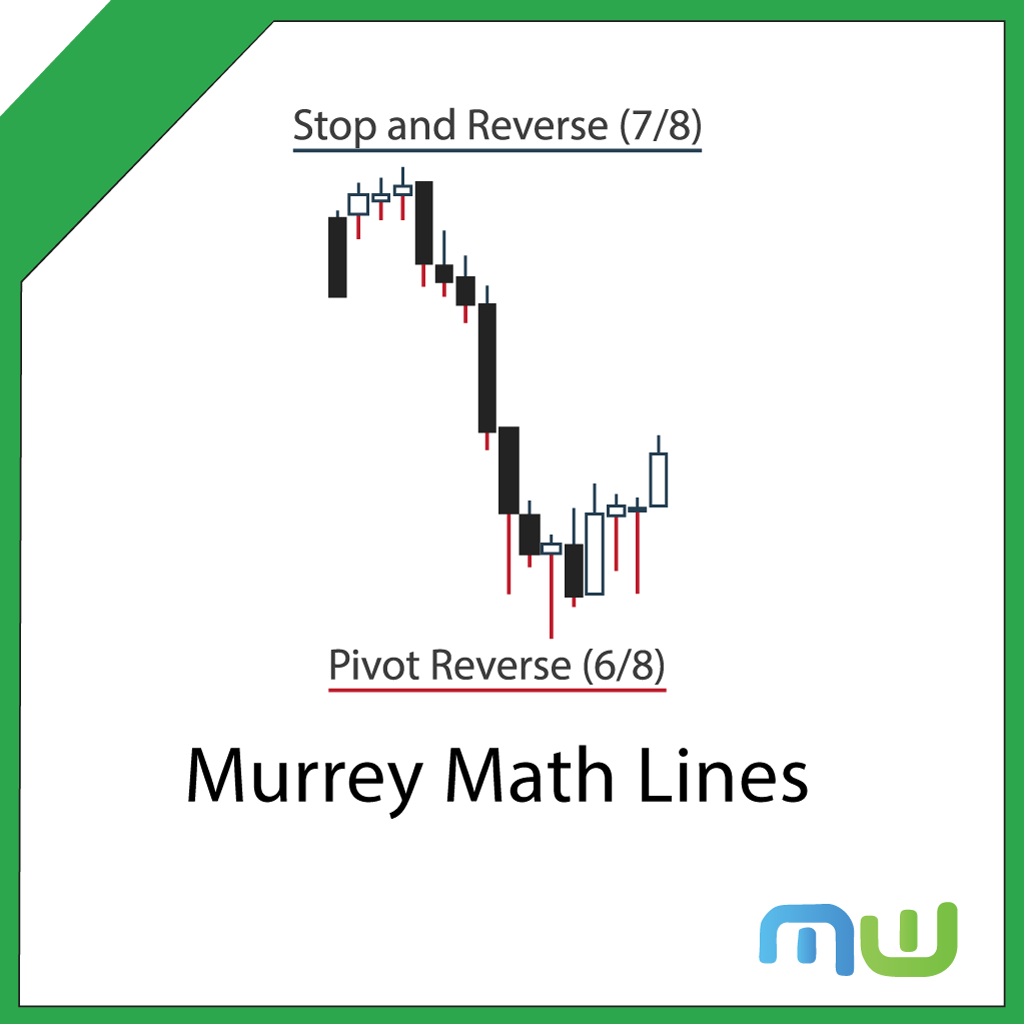

Image: tradingindicators.com

Expert Insights and Practical Tips

To demystify the intricacies of options trading, let’s delve into some insights and proven tips from seasoned traders:

- Understand the Basics: Grasp the fundamentals of options, including types, pricing, and risk/reward ratios.

- Master Probability and Volatility: Become proficient in probability theory and modeling volatility to enhance decision-making.

- Apply Quantitative Models: Utilize mathematical models, such as the Black-Scholes formula, to calculate option prices and assess risk.

- Effective Risk Management: Implement robust risk management strategies, including stop-loss orders and hedging techniques, to minimize losses.

- Continuous Learning: Stay abreast of the latest mathematical advancements and financial market trends to refine your trading strategies.

Frequently Asked Questions

To address common queries on options trading, let’s delve into a comprehensive Q&A section:

- Q: What is an option? A: An option is a contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified date.

- Q: How can mathematics help me in options trading? A: Mathematics provides the tools to analyze probabilities, quantify risks, and develop sophisticated trading strategies.

- Q: Is options trading a profitable venture? A: While options trading has the potential for high returns, it also carries significant risk. Proper risk management and a deep understanding of mathematics are crucial.

Final Thoughts: Unlocking the Power of Numbers

Embracing the mathematical underpinnings of options trading empowers traders to navigate the financial markets with confidence and precision. By harnessing the power of probabilities, statistics, and advanced models, traders can unlock the potential for success in this dynamic arena.

Using Math For Trading Options

Image: www.youtube.com

Are you ready to unleash the mathematical precision of options trading?