Introduction

Image: www.ukmoney.net

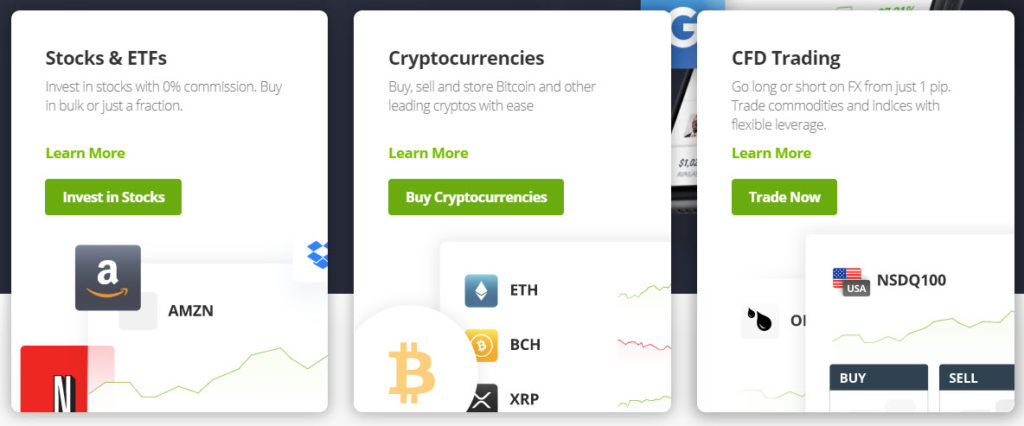

Investing in options can be a lucrative endeavor but selecting the right platform is crucial for successful trading. The UK market offers a wide range of options trading platforms, each with its own strengths and limitations. This comprehensive guide will delve into the key considerations, expert insights, and actionable tips to help you navigate this complex landscape and choose the platform that perfectly aligns with your trading aspirations.

Navigating the Options Trading Arena

Options trading involves speculating on the future movement of an underlying asset without owning it directly. Options traders use these financial instruments to hedge against risk, seek speculative gains, and increase their portfolio’s diversification. With numerous options trading platforms to choose from in the UK, understanding their offerings and choosing the right one can be a daunting task.

Assessment Criteria for Options Trading Platforms

Before embarking on your platform selection journey, consider these essential factors:

-

Regulation and Security: Choose platforms regulated by reputable financial authorities to ensure your funds and investments are protected.

-

Trading Instruments: Evaluate the range of options contracts offered, including their strike prices and expiration dates. Determine if the platform supports your preferred trading styles and strategies.

-

Pricing and Fees: Understand the trading fees, including commissions, spreads, and overnight financing charges. Compare these costs across platforms to minimize the impact on your profit margin.

-

User Interface and Usability: Select a platform with an intuitive and user-friendly interface that streamlines your trading experience. Look for trading tools, charts, and technical indicators that enhance your analysis and execution.

-

Customer Support: Reliable customer support is essential, especially when encountering technical issues or trading inquiries. Assess the availability and responsiveness of the platform’s support team.

Expert Insights and Actionable Tips

To optimize your options trading journey, heed the advice of industry experts:

-

Start with a Practice Account: Before venturing into live trading, familiarize yourself with the platform and hone your skills using a free demo account.

-

Focus on Education: Continuously enhance your options trading knowledge through online courses, webinars, and industry publications.

-

Manage Your Risk: Implement sound risk management strategies, such as establishing stop-loss orders and position sizing, to mitigate potential losses.

-

Seek Professional Advice: Consider consulting with a financial advisor for personalized guidance and tailored trading recommendations.

Conclusion

Choosing the right UK options trading platform is a crucial step towards achieving your trading objectives. By considering the key factors outlined above, seeking expert insights, and implementing actionable tips, you can confidently select a platform that empowers you with the necessary tools, support, and safeguards to navigate the options market with confidence and maximize your trading potential. Remember, the quest for investment success is an ongoing journey, and continuous learning and strategic decision-making will guide you towards your financial aspirations.

Image: www.the-monarch.co.uk

Uk Options Trading Platforms

Image: www.icpro.org