In the realm of financial markets, options trading offers a unique blend of potential rewards and inherent risks. Understanding and implementing effective risk management strategies is crucial to navigate these waters successfully. This article delves into the intricacies of options account risk management, providing invaluable insights to help traders safeguard their hard-earned capital.

Image: www.youtube.com

Options Trading: Understanding the Dynamics

Options are derivative instruments that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a particular date (expiration date). They are highly versatile financial tools that can be employed for various strategies, including hedging, speculation, and income generation.

However, the substantial leverage provided by options magnifies both the potential profits and the downside risks. Traders need to strike a delicate balance between maximizing returns and mitigating potential losses. Effective risk management strategies play a pivotal role in ensuring this equilibrium.

Pillars of Options Account Risk Management

A comprehensive risk management framework for options trading comprises several key pillars:

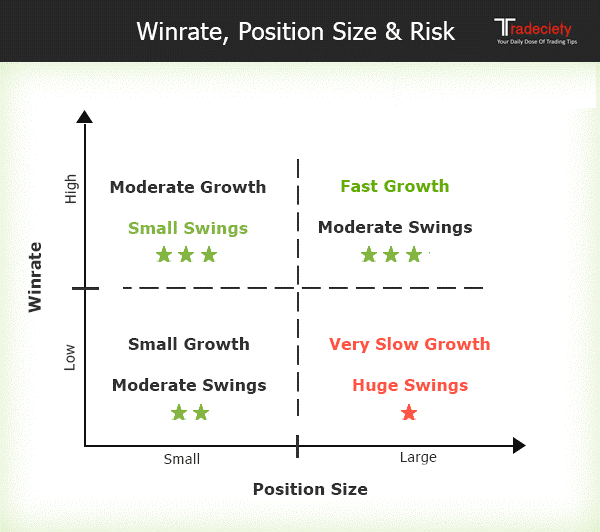

1. Determine Risk Tolerance and Trade Size: Before embarking on any trading journey, traders must objectively assess their risk appetite and financial capacity. Trade size should be calibrated accordingly, ensuring that potential losses do not exceed the tolerable level.

2. Diversification: Options traders should strive to diversify their portfolios across multiple underlying assets and expiration dates. This strategy reduces the concentration of risks and dampens the impact of adverse market events on any single position.

3. Order Types and Execution: Understanding and utilizing different order types, such as limit orders and stop-loss orders, empowers traders to manage risk proactively. Limit orders execute trades only at predetermined prices, preventing uncontrolled execution during unfavorable market conditions. Stop-loss orders automatically exit positions when the price reaches a specified level, protecting traders from excessive losses.

4. Leverage: As mentioned earlier, options trading involves substantial leverage. Managing leverage prudently is paramount. Traders should avoid excessive leverage that amplifies both profits and losses disproportionately. Margin requirements, the primary tool for leveraging trades, must be carefully monitored and managed.

5. Monitoring and Adjustment: Risk management is not a one-time exercise. Markets are inherently dynamic, and effective risk management demands constant monitoring and adjustment of positions. Regular reviews of market conditions, account performance, and risk tolerance ensure that strategies remain aligned with the trader’s objectives.

Advanced Risk Management Techniques for Seasoned Traders

As traders gain experience and confidence, they may explore more sophisticated risk management techniques, such as:

1. Hedging: Hedging involves offsetting the risk of an existing position by taking an opposite position in a related financial instrument. Frequently used for managing market volatility, hedging can mitigate losses, although it typically comes at the cost of reduced potential profits.

2. Delta Neutral Strategy: This strategy aims to achieve delta neutrality, where the combined delta of positions in an options portfolio totals zero. By doing so, traders neutralize the impact of price fluctuations on the portfolio’s overall risk exposure, making it less sensitive to market direction.

3. Options Greeks: Understanding and interpreting Greeks, such as delta, gamma, and theta, is crucial for quantifying and managing risk in options trading. These metrics provide insights into the sensitivity of options prices to underlying asset price, time decay, and other factors.

Image: truetrader.net

Tradings Options Account Risk Management

Image: tradeciety.com

Conclusion

Navigating the options market effectively demands a comprehensive and proactive approach to risk management. By implementing the principles outlined in this article, traders can enhance their trading strategies, safeguarding their capital and positioning themselves for success. Risk management is an ongoing journey, requiring continuous learning, adaptation, and discipline. Embracing this mindset will empower traders to venture into the world of options trading with confidence and prudence.