In the dynamic world of investing, the VIX, or the CBOE Volatility Index, stands as a beacon of uncertainty. As a real-time measure of market volatility, it provides invaluable insights into investor sentiment and the overall health of the market. For those seeking to harness the power of volatility, trading VIX options offers a strategic tool, allowing investors to capitalize on fluctuations while managing risk.

Image: www.financestrategists.com

What are VIX Options?

VIX options are financial contracts that derive their value from the underlying VIX index. These contracts provide traders with the opportunity to speculate on the future direction of volatility. They come in two primary forms:

VIX Call Options: Give the buyer the right, but not the obligation, to purchase VIX futures at a predetermined price on a specific expiration date.

VIX Put Options: Grant the buyer the right, but not the obligation, to sell VIX futures at a predetermined price on a specific expiration date.

By utilizing VIX options, traders can position themselves to profit from both increases and decreases in volatility. This versatility makes them a valuable tool for both managing risk and generating returns in volatile markets.

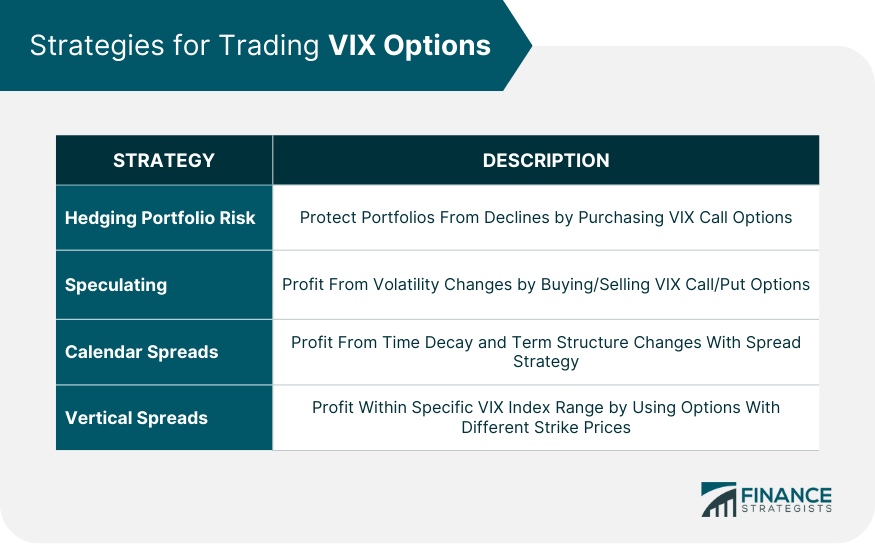

Trading VIX Options Strategies: A Detailed Guide

Navigating the complexities of VIX options trading requires a deep understanding of underlying concepts and strategic approaches. Here’s a comprehensive guide to empower traders of all levels:

1. Understand Volatility as a Double-Edged Sword:

While volatility can present opportunities, it’s crucial to recognize its inherent duality. High volatility can drive both gains and losses, making it essential to strike a balance between risk and reward.

2. Utilize Historical Data and Technical Analysis:

Historical VIX data and technical analysis can provide valuable insights into past patterns and potential future movements. By studying charts, traders can identify trends, patterns, and support and resistance levels.

3. Set Realistic Targets and Manage Risk:

Determining realistic targets and implementing robust risk management strategies is paramount. Never commit more than you can afford to lose, and consider incorporating stop-loss orders to limit potential losses.

4. Consider Using Limit Orders:

Limit orders allow traders to specify the maximum price they are willing to pay (for call options) or receive (for put options). This helps prevent excessive losses or unexpected gains.

5. Hedge Positions with Other Assets:

Consider hedging VIX options positions with other assets that have a low correlation to volatility. This helps mitigate overall portfolio risk and enhance portfolio stability.

Expert Insights: Unlocking the Potential of VIX Options

“Trading VIX options is not for the faint of heart, but it can be a highly rewarding endeavor for those who take the time to master the intricacies.” – John Bollinger, renowned technical analyst

“Remember that VIX options have a limited lifespan, so careful timing is essential to maximize returns.” – Steven Seyfert, volatility expert and author

“Discipline is paramount. Set a clear trading plan and stick to it, even amidst market fluctuations.” – Brian Dolan, TD Ameritrade’s chief currency strategist

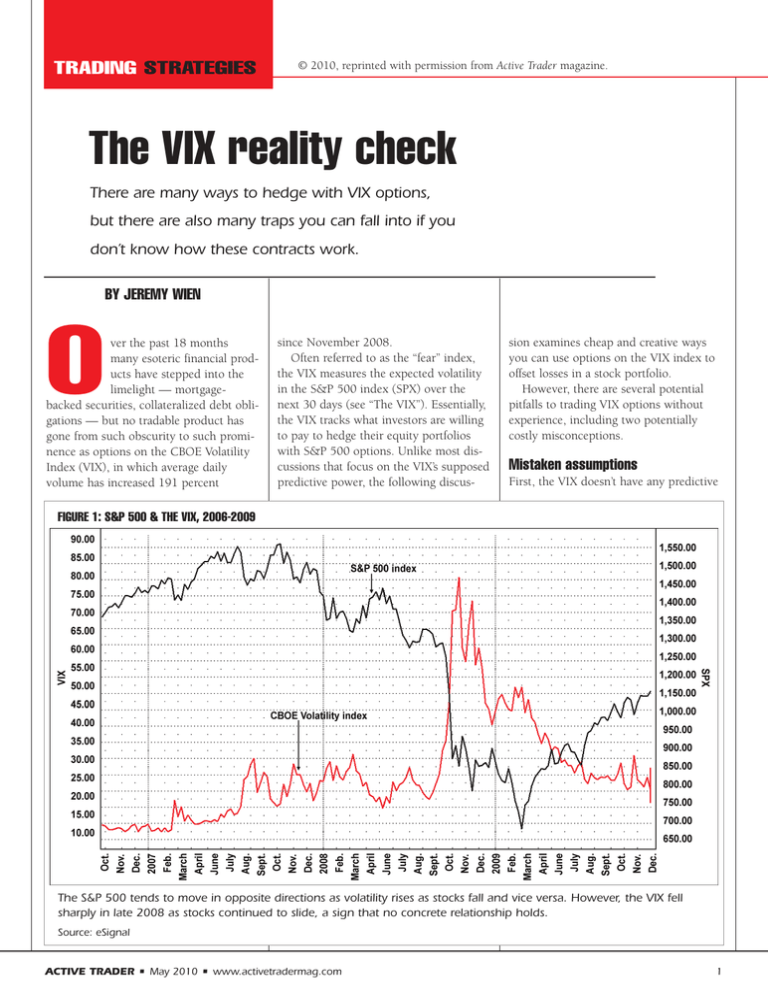

Image: studylib.net

Trading Vix Options Strategies

Image: inthemoneytrades.blogspot.com

Conclusion: Empowering Investors with VIX Options Strategies

Mastering the art of trading VIX options requires a combination of knowledge, strategy, and emotional resilience. By embracing these principles, investors can uncover the secrets of volatility and unlock the potential for lucrative returns while minimizing risk. Remember, market volatility is a never-ending dance, and those who learn to navigate it wisely will emerge as victors in the unpredictable realm of investing.