Every trader aspires to achieve profitable returns while mitigating potential risks. Options trading presents an array of unique strategies that can aid in the pursuit of these goals. These strategies involve utilizing financial instruments known as options contracts, which provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price by a specified date. This article endeavors to elucidate the intricacies of these strategies, from the fundamental concepts to practical applications, empowering traders with the knowledge to navigate the options market effectively.

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1536x1086.png)

Image: howtotrade.com

Options Trading Basics: A Foundation of Understanding

An options contract consists of two primary components: the right to buy (call option) or sell (put option) an asset and the stipulated price (strike price) at which the trade can be executed. The contract is valid for a set duration, known as the expiration date. Options trading involves speculating on the future direction of an underlying asset, such as stocks or commodities. Traders can construct various strategies by combining different types of options with varying strike prices and expiration dates.

Unveiling the Potential of Options Trading Strategies

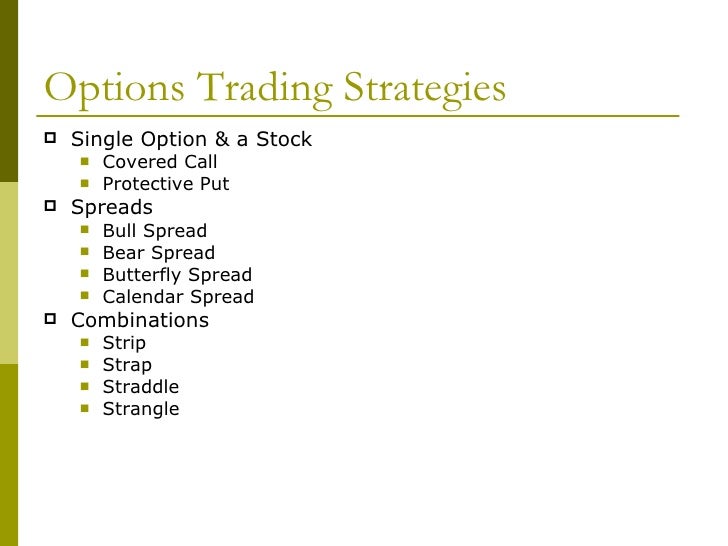

The versatility of options trading lies in the myriad strategies available to traders. Some of the most commonly employed techniques include:

- Covered Call: This strategy combines owning an underlying asset with selling call options on it. The trader receives a premium payment from selling the options while retaining the potential for gains in the asset’s appreciation.

- Protective Put: A protective put strategy involves holding a put option to safeguard against a decline in the underlying asset’s value. This provides a cushion against potential losses, particularly in volatile market conditions.

- Bull Call Spread: This strategy is a bullish play wherein the trader buys a call option with a lower strike price and simultaneously sells another call option with a higher strike price. The trader benefits from the spread widening between the two options.

- Bear Put Spread: Bear put spread, on the other hand, is a bearish strategy. The trader purchases a put option with a lower strike price and sells a put option with a higher strike price, anticipating a drop in the underlying asset’s value.

- Iron Condor: This neutral strategy involves combining a bear put spread with a bull call spread, creating a “condor-shaped” profit profile. The trader speculates on a narrow range-bound movement of the underlying asset.

Harnessing Options Trading Strategies: A Path to Prudent Trading

Integrating options trading strategies into one’s trading repertoire can enhance risk management and potentially lead to increased returns. However, prudent trading practices remain paramount. Options trading involves a degree of risk, necessitating thorough research, analysis, and understanding of the strategies employed. It is imperative for traders to assess their risk tolerance and align their strategies accordingly. Additionally, monitoring market trends, staying abreast of global economic developments, and continually educating oneself are crucial elements of successful options trading.

Image: www.pinterest.com

Trading Strategies Involving Options Video

Image: www.slideshare.net

Conclusion: Embracing Opportunities in the Options Market

The world of options trading presents a vast array of opportunities for traders seeking to enhance their returns. By incorporating options strategies into their trading plans, traders can tailor their approach to their unique risk appetite and investment goals. Options trading can amplify gains while mitigating potential losses, particularly in volatile market environments. However, it is essential to exercise caution, conduct thorough research, and comprehend the intricacies of each strategy before venturing into options trading. With a blend of knowledge, discipline, and prudent risk management, traders can harness the power of options to navigate the financial markets effectively and potentially achieve their desired trading outcomes.