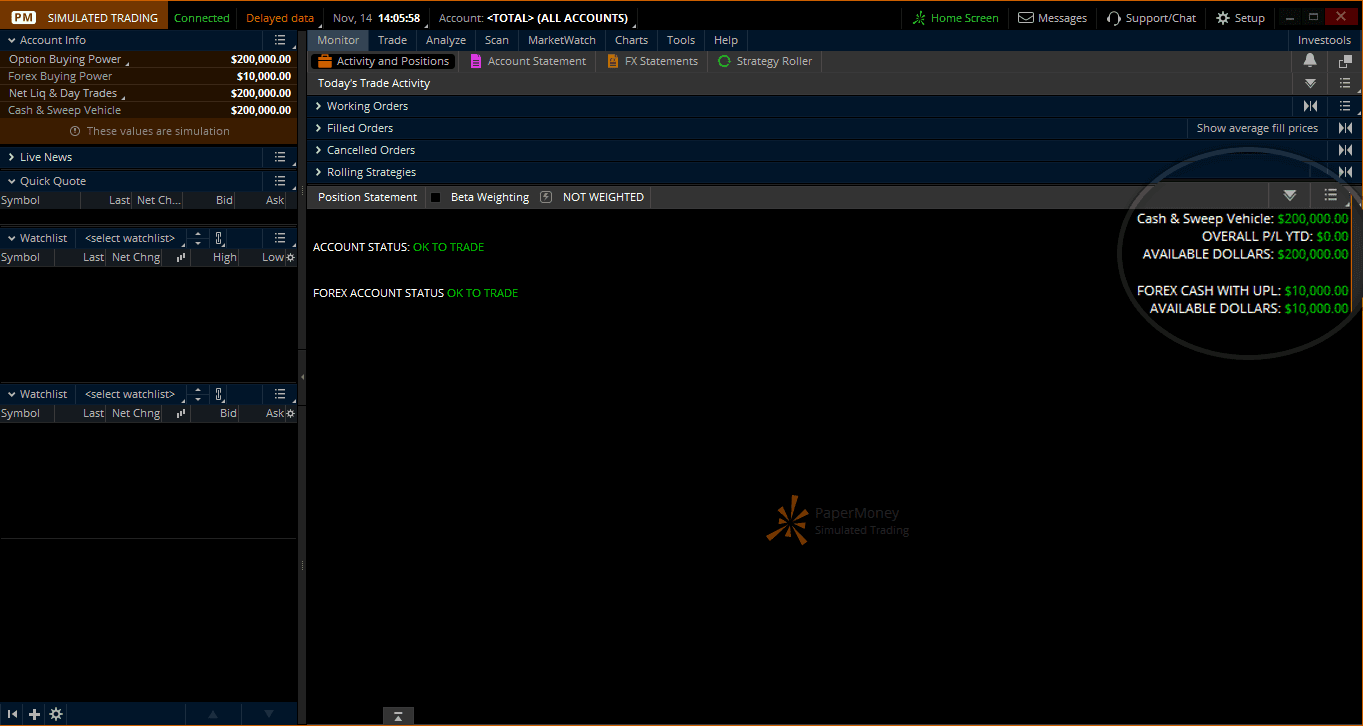

Have you ever dreamed of trading options without risking real money? If so, then thinkorswim paper money is the perfect solution. This powerful platform allows you to test your trading strategies, build your skills, and gain valuable experience before putting your own capital on the line.

Image: www.youtube.com

Whether you’re a seasoned trader or just starting out, thinkorswim paper money can provide invaluable insights into the world of options trading. In this comprehensive guide, we’ll delve into the nuances of this platform and equip you with the knowledge you need to succeed in the options market.

Paper Trading: A Safe and Effective Learning Tool

Paper trading is a simulated trading environment where you can buy and sell options without using real money. This allows you to practice your trading strategies, test different scenarios, and identify potential profit opportunities without risking your capital.

Thinkorswim paper money is particularly popular among traders due to its advanced features and user-friendly interface. With live market data, historical charting capabilities, and a comprehensive suite of trading tools, thinkorswim provides a realistic trading experience that closely mimics real-world conditions.

Step-by-Step Guide to Using Thinkorswim Paper Money

Getting started with thinkorswim paper money is a straightforward process:

- Create a thinkorswim account: Visit the TD Ameritrade website and open a paper trading account.

- Download and install the thinkorswim platform: Download the platform from the TD Ameritrade website and install it on your computer.

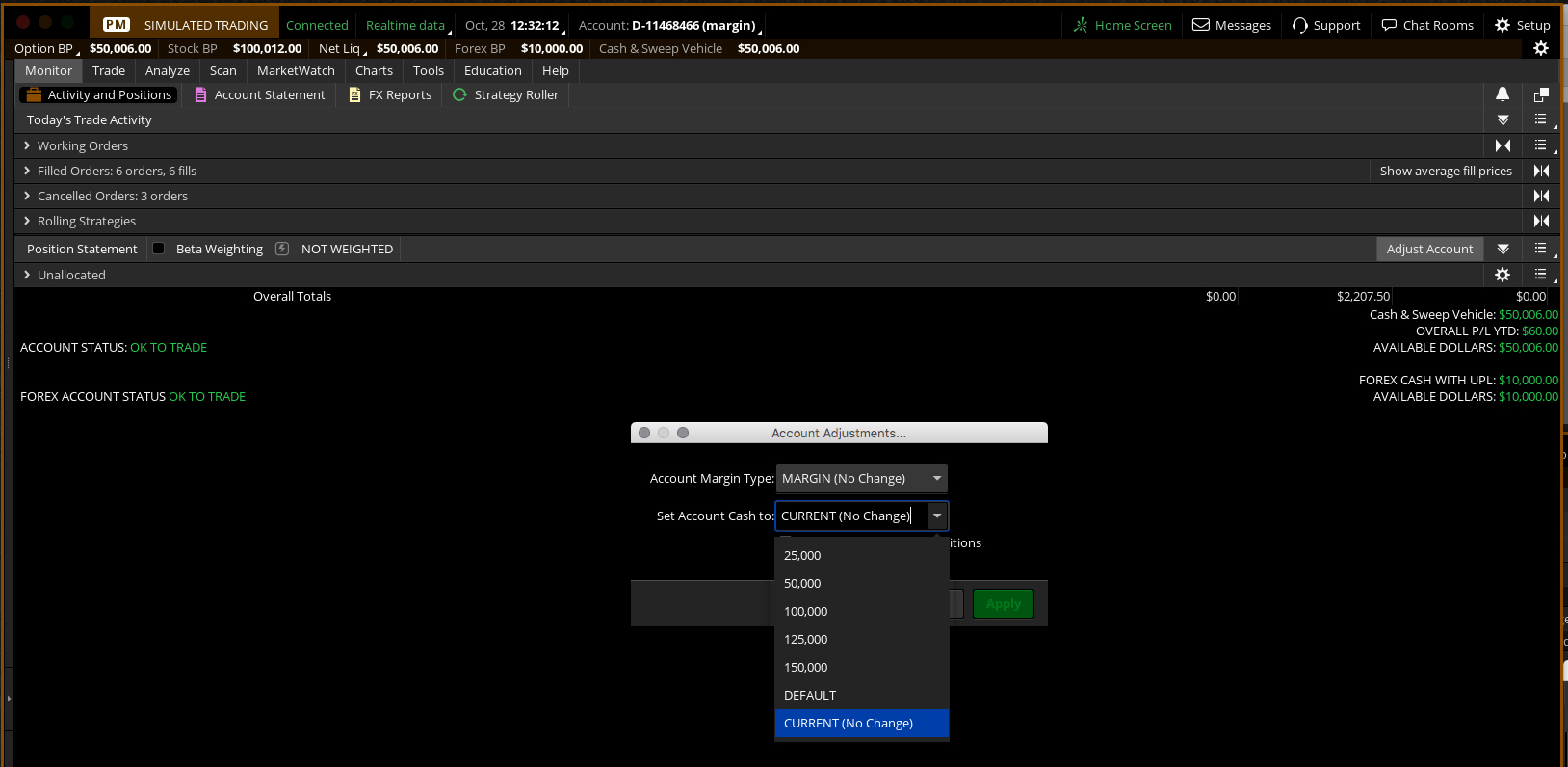

- Fund your paper trading account: Your paper trading account will be funded with virtual currency, which you can use to trade options.

- Begin trading: Once your account is funded, you can start trading options just as you would in a live trading account.

Tips and Expert Advice for Successful Paper Trading

To maximize your success with thinkorswim paper money, follow these tips from experienced traders:

- Define clear trading goals: Determine your trading objectives and create a trading plan that outlines your strategy and risk tolerance.

- Test multiple strategies: Experiment with different trading strategies to find what works best for you.

- Manage your risk: Understand the risks involved in options trading and implement proper risk management techniques.

- Learn from your mistakes: Paper trading allows you to make mistakes without financial consequences. Use these opportunities to learn from your errors and improve your trading.

Image: wealthyeducation.com

FAQ on Thinkorswim Paper Money

Here are some commonly asked questions about thinkorswim paper money:

- Q: Is thinkorswim paper money free?

A: Yes, thinkorswim paper money is a free platform provided by TD Ameritrade.

- Q: How long does the virtual money in my paper trading account last?

A: The virtual money in your paper trading account does not expire.

- Q: Can I switch between paper trading and live trading with the same account?

A: Yes, you can transfer funds between your paper trading account and your live trading account.

- Q: What is the difference between paper trading and live trading?

A: The main difference is that you do not risk real money in paper trading.

Trading Options Thinkorswim Paper Money

Image: thestocksreport.com

Conclusion

Thinkorswim paper money is an invaluable tool for traders of all levels. It provides a safe and effective environment to learn, experiment, and refine your trading skills without risking real capital. By following the tips and advice outlined in this guide, you can maximize your success with this powerful platform and become a more confident and knowledgeable trader.

So, are you ready to unlock the potential of thinkorswim paper money and embark on your trading journey? The knowledge and experience you gain through this platform will provide you with a solid foundation for success in the options market.