Options trading can be a complex but rewarding endeavor. It’s crucial to understand the key concepts that govern the market. One such critical factor is the break-even price, which deserves thorough exploration. This article will delve into the dynamics of the break-even price, empowering you with the knowledge to navigate options trading confidently.

Image: www.youtube.com

In the realm of options, a break-even price is the point at which the profit you gain from the option’s movement equals the premium you paid to acquire it. In essence, it’s the price at which you neither profit nor incur losses. Understanding this concept is paramount for successful trading strategies and risk management.

Break-Even Price Dynamics

The break-even price for a call option is determined by adding the strike price to the premium paid. Conversely, for a put option, it is calculated by subtracting the premium from the strike price.

Consider this example: Suppose you purchase a call option with a strike price of $100 and pay a premium of $5. To break even, the underlying asset’s price at expiration must exceed $105 ($100 strike price + $5 premium). Conversely, for a put option with the same strike price and premium, the break-even price would be $95 ($100 strike price – $5 premium).

It’s essential to recognize that the break-even point only indicates the price at which you won’t lose money. Profitability is dependent on the market’s movement relative to the break-even price.

Trading Strategies Leveraging Break-Even Price

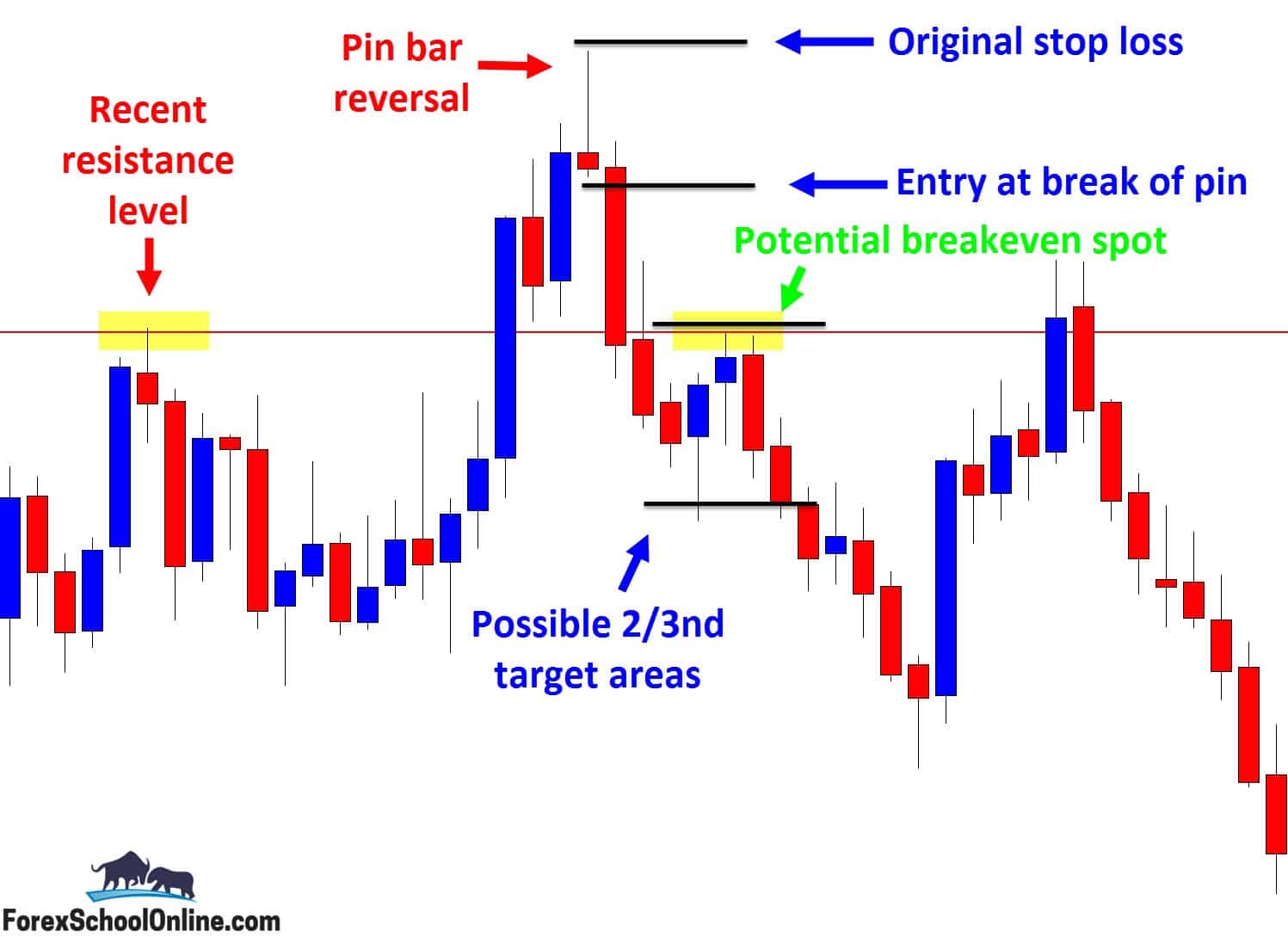

Traders employ diverse strategies that hinge on break-even price analysis. Options strategies often involve creating spreads to reduce risk and enhance potential profits. One common technique is the bull call spread, where a trader buys a lower strike call option and sells a higher strike call option with the same expiration date. If the underlying asset’s price rises above both strike prices, the trader will profit from the spread. The break-even point for such a spread is typically between the two strike prices.

Traders may also opt for bear put spreads, which involve selling a lower strike put option and buying a higher strike put option. This strategy is beneficial in markets expected to decline. The break-even point for a bear put spread lies below both strike prices.

Tips and Expert Advice for Success

Several tips and expert advice can help you enhance your trading decisions:

- Thoroughly Research: Gain in-depth knowledge of options, trading strategies, and market trends. Understanding market dynamics is vital for informed decision-making.

- Manage Risk: Options trading involves inherent risk. Implement appropriate risk management strategies, including setting stop-loss orders and monitoring market volatility.

- Choose Options with Higher Liquidity: Opt for options with high trading volume and open interest to ensure liquidity and minimize slippage issues.

- Consider Market Factors: Assess supply and demand, economic conditions, regulatory changes, and company-specific news that can influence asset prices.

- Seek Professional Advice (Optional): If necessary, consider consulting financial professionals for personalized guidance and support.

By adhering to these tips and incorporating expert advice into your trading practices, you can increase your chances of successful outcomes.

Image: www.forexschoolonline.com

Frequently Asked Questions (FAQs)

- Q: How is the break-even price for a call option different from that of a put option?

A: For a call option, the break-even price is the strike price plus the premium, while for a put option, it’s the strike price minus the premium. - Q: Can options generate profits below the break-even price?

A: No, options cannot generate profits below the break-even price. However, the trader avoids losses by exiting at the break-even point. - Q: Are there other factors besides the break-even price that influence option trading?

A: Yes, other factors like time decay, volatility, and interest rates also impact option pricing.

Trading Options Break Even Price

Image: derivbinary.com

Conclusion

Understanding the intricacies of the break-even price is crucial for success in options trading. By applying the concepts discussed, implementing effective strategies, and embracing expert advice, you can significantly improve your chances of profiting while managing potential risks. Remember, investing involves inherent uncertainties, so make well-informed decisions and always consider seeking professional guidance when needed.

Are you intrigued by the world of options trading? Share your thoughts and questions in the comments section below! Your insights are valuable in shaping the discourse around this captivating topic.