Delving into the Enigmatic World of Options Trading

Options trading, a multifaceted realm of financial markets, presents traders with the unique opportunity to speculate on the future direction of underlying assets. Its allure lies in its versatility, offering immense profit potential alongside calculated risk management. This comprehensive guide will embark on an in-depth exploration of options trading as speculation, demystifying its intricacies and empowering readers with actionable insights.

Image: spideranderson.blogspot.com

Navigating the Options Market: An Essential Overview

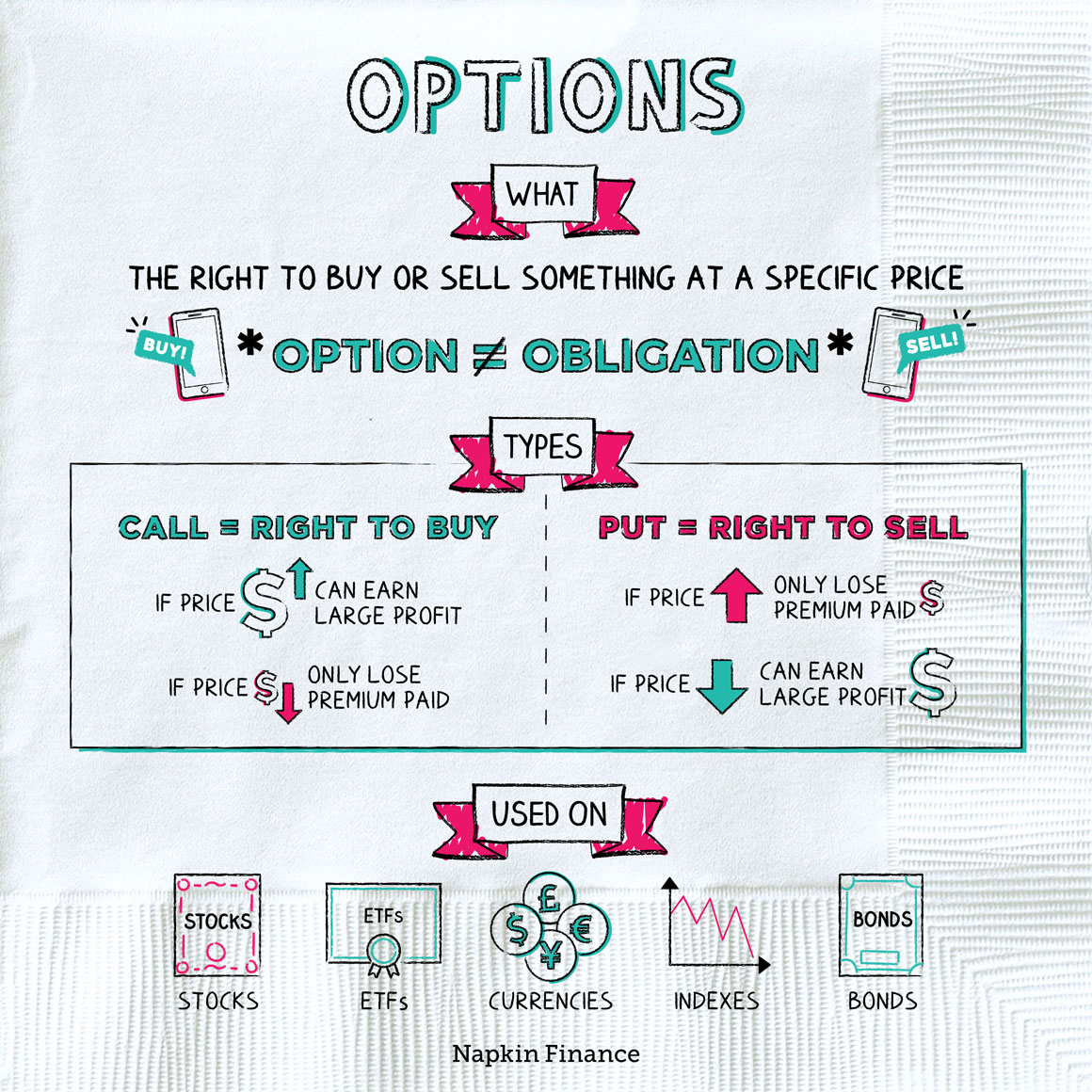

Options are financial contracts that confer upon the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). Call options grant the right to buy, while put options grant the right to sell. The contract’s value is determined by various factors, primarily the underlying asset’s current market price, strike price, time to expiration, and prevailing market volatility.

Speculation: The Art of Forecasting Markets

Speculation, an integral component of options trading, involves predicting the future direction of an asset’s price to profit from its movements. Options provide a flexible instrument for speculation, allowing traders to tailor their strategies based on their market outlook. With call options, traders anticipate price increases, while put options capitalize on price declines. The versatility of options enables traders to speculate on both rising and falling markets.

Examples in Action: Illustrating Options Trading in Practice

Suppose a trader believes the stock price of XYZ Corporation is poised for a surge. By purchasing a call option with a strike price of $100, the trader gains the right to buy the stock at $100 per share, regardless of its prevailing market price. If the stock price rises above $100 before the option expires, the trader can exercise the option, purchasing the stock at the lower strike price of $100 and selling it at the higher market price for profit.

Conversely, a trader anticipating a decline in XYZ Corporation’s stock price can sell a put option with a strike price of $95. If the stock price falls below $95, the trader is obligated to buy the stock at $95 and sell it at the lower market price, profiting from the price decrease.

Image: housing.com

Risks and Rewards: Striking a Balance in Options Trading

Options trading carries inherent risks and rewards. While the profit potential can be substantial, it’s crucial to acknowledge the possibility of losses. The value of options contracts is influenced by complex market dynamics, and traders must exercise caution and prudent risk management. Thorough research and a comprehensive understanding of options trading are paramount before venturing into this potentially lucrative but demanding arena.

Trading Options As Speculation Example

Image: napkinfinance.com

Conclusion: Unveiling the Power of Options Trading

Options trading as speculation unfolds as a captivating blend of market foresight and calculated risk-taking. Understanding the mechanics of options contracts and leveraging the power of speculation can open avenues for profit generation. However, it’s imperative to approach the options market with a prudent mindset, acknowledging potential risks alongside the alluring rewards. By mastering the nuances of this dynamic financial instrument, traders can navigate the complexities of the market and reap the benefits of well-timed speculation.