Have you ever been curious about the world of options trading but felt overwhelmed by the complexity? In this comprehensive guide, we’ll unravel the mysteries of trading option put call and equip you with the knowledge to make informed investment decisions.

Image: japaneseclass.jp

*Understanding Option Put Call*

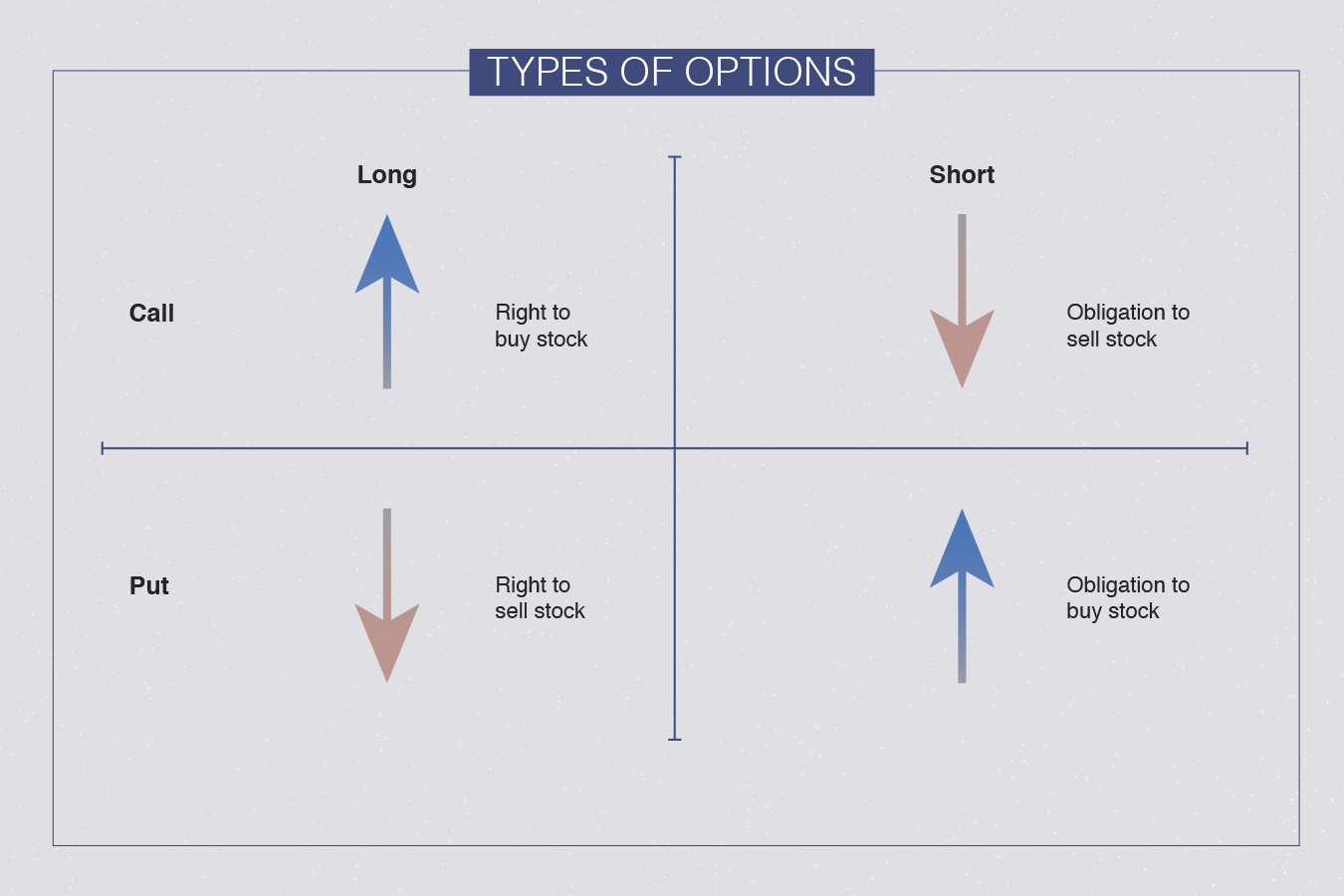

Options are financial instruments that offer the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock or index) at a predetermined price (strike price) on or before a set date (expiration date). An option put gives the holder the right to sell the underlying asset, while an option call grants the right to buy.

*Trading Option Put Call Strategies*

The strategy of trading option put call involves buying an option put call and simultaneously selling a corresponding option call or put to reduce the overall cost and risk. This strategy is commonly used to generate income through premiums received while limiting potential losses.

For example, an investor may buy an option put on a stock they believe will decrease in value while selling an option call with the same strike price and expiration date. If the stock price falls, the investor profits from the option put while the sold option call limits potential losses.

*The Evolution of Option Put Call*

The concept of options trading has been traced back to ancient Greece, where merchants used written contracts to speculate on the prices of olive oil and wheat. In the 17th century, the Amsterdam Stock Exchange became the first organized market for options trading, and the practice spread to other European cities.

The introduction of standardized options contracts in the 20th century revolutionized the options market. Previously, each contract had to be individually negotiated, but standardized contracts made trading more accessible and efficient.

Image: unbrick.id

*Benefits and Risks of Option Put Call*

Benefits:**

- Potential for high returns:** Options trading offers the potential for substantial profits, especially for experienced traders.

- Limited risk:** With proper risk management techniques, such as covering trades with opposite positions, the risk of losses can be managed.

- Diversification:** Options trading can provide diversification to an investment portfolio.

Risks:**

- Complexity:** Options trading involves complex strategies that require a thorough understanding of market dynamics.

- Leverage:** Options are often leveraged instruments, which can amplify both profits and losses.

- Time decay:** The value of options contracts decays over time, which can lead to losses if not managed properly.

*Tips for Trading Option Put Call*

**1. Understand the risks:** Before entering into any options trade, it is crucial to understand the potential risks involved.

**2. Research the underlying asset:** Options are derivatives of the underlying asset, so it’s essential to research the performance, volatility, and factors influencing its price.

*Expert Advice for Option Put Call*

**1. Start with small positions:** Begin options trading with small positions until you become comfortable with the strategies and risks involved.

**2. Diversify your portfolio:** Don’t concentrate your investments in a few options contracts. Spread your risk by diversifying your portfolio across different underlying assets and options strategies.

*FAQ on Option Put Call*

Q: What is the difference between an option put and an option call?

A: An option put gives the holder the right to sell, while an option call grants the right to buy the underlying asset.

Q: How do I calculate the profit from an option put call trade?

A: The profit is determined by subtracting the cost of the option puts purchased from the income earned from selling the option call, considering the strike prices, premiums, and any fees.

Q: What are the risks involved in option put call trading?

A: Risks include market volatility, time decay, the underlying asset’s performance, and the trader’s risk management practices.

Trading Option Put Call

Image: dermothilary.blogspot.com

*Conclusion*

Trading option put call can be a complex but rewarding investment strategy. By understanding the strategies, risks, and expert advice presented in this guide, you can make informed decisions and potentially profit from the options market. Are you ready to delve into the world of option put call trading?