Introduction

The world of options trading can be a complex and dynamic one, with a plethora of strategies and approaches to navigate. Among the most crucial elements in this realm are the Greeks, a set of metrics that provide valuable insights into the behavior of options contracts. One of the key figures among these Greeks is Dan Passarelli, a renowned options trader known for his expertise in analyzing and applying the Greeks to maximize trading returns. In this article, we delve into the world of trading option Greeks, exploring their significance, explaining their functions, and examining the influential contributions of Dan Passarelli to this field.

Image: traders.com

Understanding Option Greeks

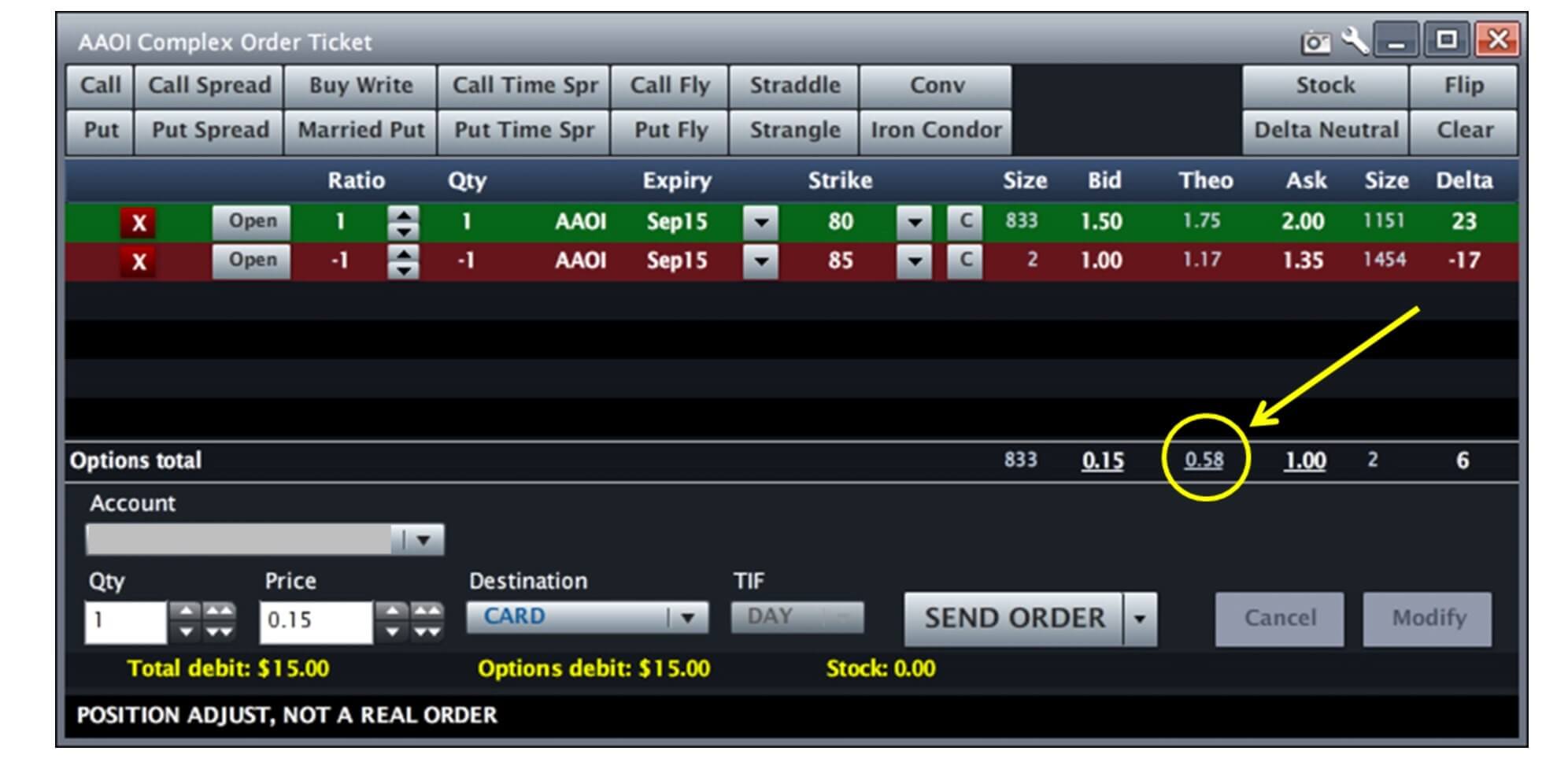

Option Greeks are mathematical measures that quantify the sensitivity or responsiveness of an option’s price to different underlying factors. By understanding the Greeks, traders can assess the potential risks and rewards associated with an options position and make informed trading decisions. The four primary Greeks are Delta, Gamma, Vega, and Theta.

- **Delta** represents the change in an option’s price for every point move in the underlying asset’s price.

- **Gamma** measures the change in Delta for every point move in the underlying asset’s price.

- **Vega** quantifies the change in an option’s price for every 1% change in the implied volatility.

- **Theta** captures the change in an option’s price over time as its expiration date approaches.

The Contributions of Dan Passarelli

Dan Passarelli has made significant contributions to the field of options trading and Greek analysis. His unique approach to understanding and utilizing the Greeks has revolutionized the way traders evaluate options positions. Passarelli emphasizes the importance of considering all four Greeks simultaneously, rather than focusing on individual metrics in isolation. By embracing this holistic perspective, traders can gain a comprehensive view of an options contract’s behavior and make more informed trading decisions.

Applying the Greeks in Options Trading

The Greeks can be employed in various ways to enhance options trading strategies. For instance, Delta can help traders determine the direction and magnitude of potential price movements in the underlying asset. Gamma provides insights into the curvature of the option’s price-response curve, allowing traders to assess the option’s sensitivity to changes in the underlying asset’s price. Vega enables traders to gauge the impact of implied volatility fluctuations on option pricing. Finally, Theta can assist traders in understanding the time decay of options, which is crucial for managing positions approaching expiration.

Image: options.cafe

Trading Option Greeks Dan Passarelli

Image: www.goodreads.com

Conclusion

Trading option Greeks is an indispensable aspect of options trading, providing traders with valuable tools to assess and manage risks. Dan Passarelli’s pioneering work in this field has illuminated the significance of considering all four Greeks collectively. By embracing a comprehensive understanding of the Greeks and applying them strategically, traders can enhance their decision-making capabilities and improve their chances of success in the dynamic world of options trading.