Speculative Trading in a Volatile Market

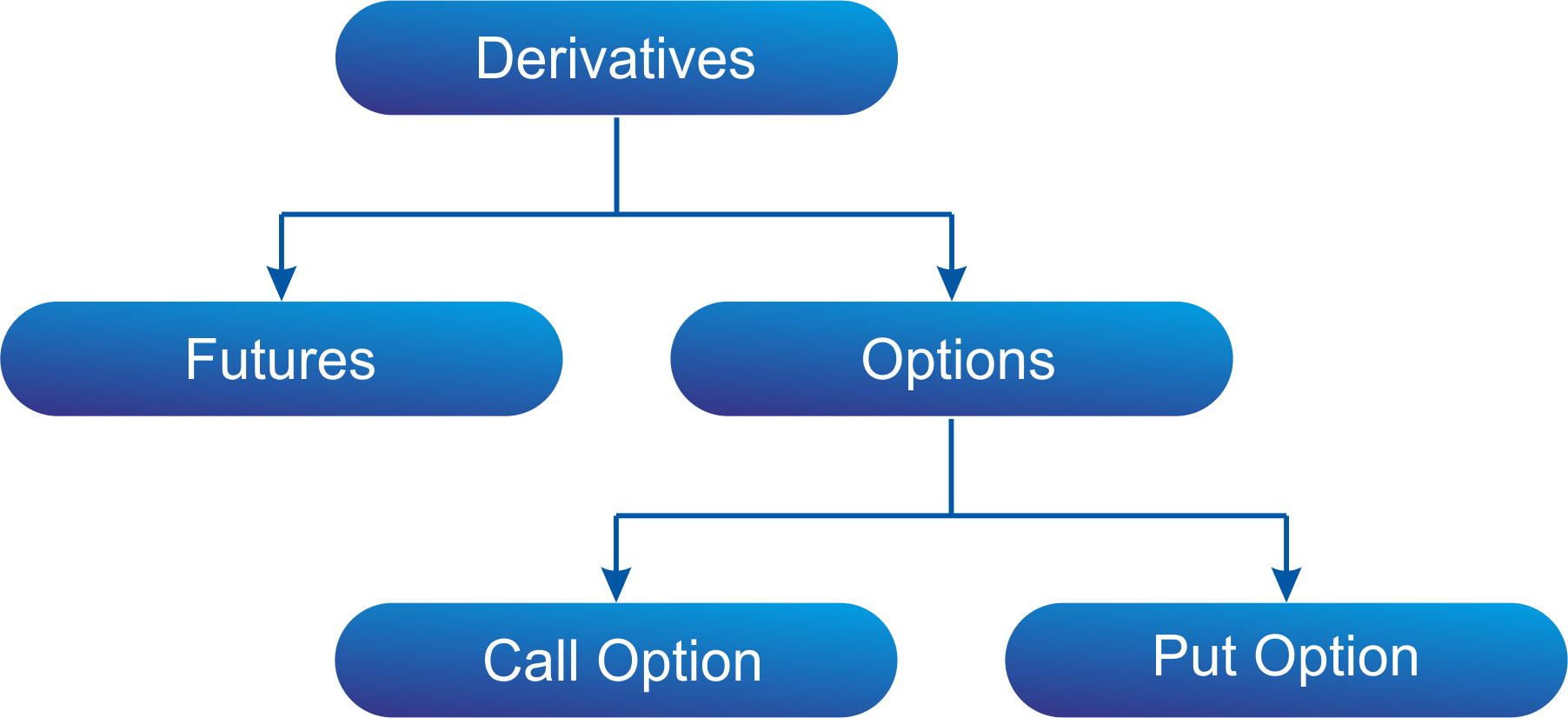

In the fast-paced world of finance, trading in futures and options has become increasingly popular among speculative investors seeking to capitalize on market movements. These sophisticated financial instruments offer both opportunities and risks for traders willing to navigate the inherent volatility. This article delves into the intricacies of futures and options trading, exploring their history, essential concepts, and strategic applications in speculative ventures.

Image: www.youtube.com

Futures Contracts: Hedging and Speculating

Futures contracts emerged as a means for mitigating risk in agricultural markets, allowing farmers to lock in future prices for their produce. Today, these standardized contracts play a crucial role in speculative trading. By locking in the price of an underlying asset at a specific future date, traders can speculate on its price direction. If the market moves in their favor, they stand to profit; however, if prices fluctuate adversely, they may incur losses.

Understanding Options: Flexibility and Leverage

Options, on the other hand, are derivative instruments that grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. Call options confer the right to buy, while put options provide the right to sell. Speculative traders utilize options to capitalize on anticipated price movements while managing their risk exposure. Options provide leverage, allowing traders to control larger positions with minimal capital outlay.

Leveraging Volatility for Profit

The allure of futures and options trading lies in their ability to leverage market volatility. When markets exhibit significant price swings, speculative traders can employ these instruments to maximize their potential profits. However, it is crucial to remember that volatility is a double-edged sword, and traders must carefully manage their risk appetite to avoid significant losses.

Image: probizadvisor.com

Essential Strategies for Speculative Trading

Strategic understanding is paramount in futures and options speculative trading. Some of the most commonly utilized strategies include:

-

Directional Trading: Predicting and profiting from the direction of an asset’s price movement.

-

Bull and Bear Spreads: Combinations of futures or options positions that capitalize on expectations of a breakout or continuation in price trends.

-

Volatility Trading: Leveraging market volatility to profit from fluctuations in the price of futures or options contracts.

-

Spread Trading: Simulating the buying and selling of multiple contracts simultaneously to reduce risk and enhance profitability.

Risk Management in Speculative Trading

While futures and options offer opportunities for speculative gain, they also carry significant risk. Prudent traders employ robust risk management strategies, including:

-

Position Sizing: Carefully determining the appropriate size of trades based on available capital and risk tolerance.

-

Stop-Loss Orders: Automated orders that limit potential losses by triggering sell orders when prices move against a trader’s position.

-

Hedging: Utilizing futures or options positions to offset potential risks in other investments.

-

Diversification: Spreading positions across multiple assets or markets to mitigate portfolio risks.

Trading In Futures And Options Speculative

Image: www.trutradingco.com

Conclusion: Embracing the Speculative Arena

Trading in futures and options requires a blend of strategic prowess, risk management, and market understanding. While the inherent volatility of these financial instruments presents potential rewards, it also underscores the importance of prudent trading practices. With thorough research, thoughtful execution, and a disciplined approach, speculative investors can navigate the challenges of futures and options trading to seek financial gains in the ever-evolving market landscape.