Introduction

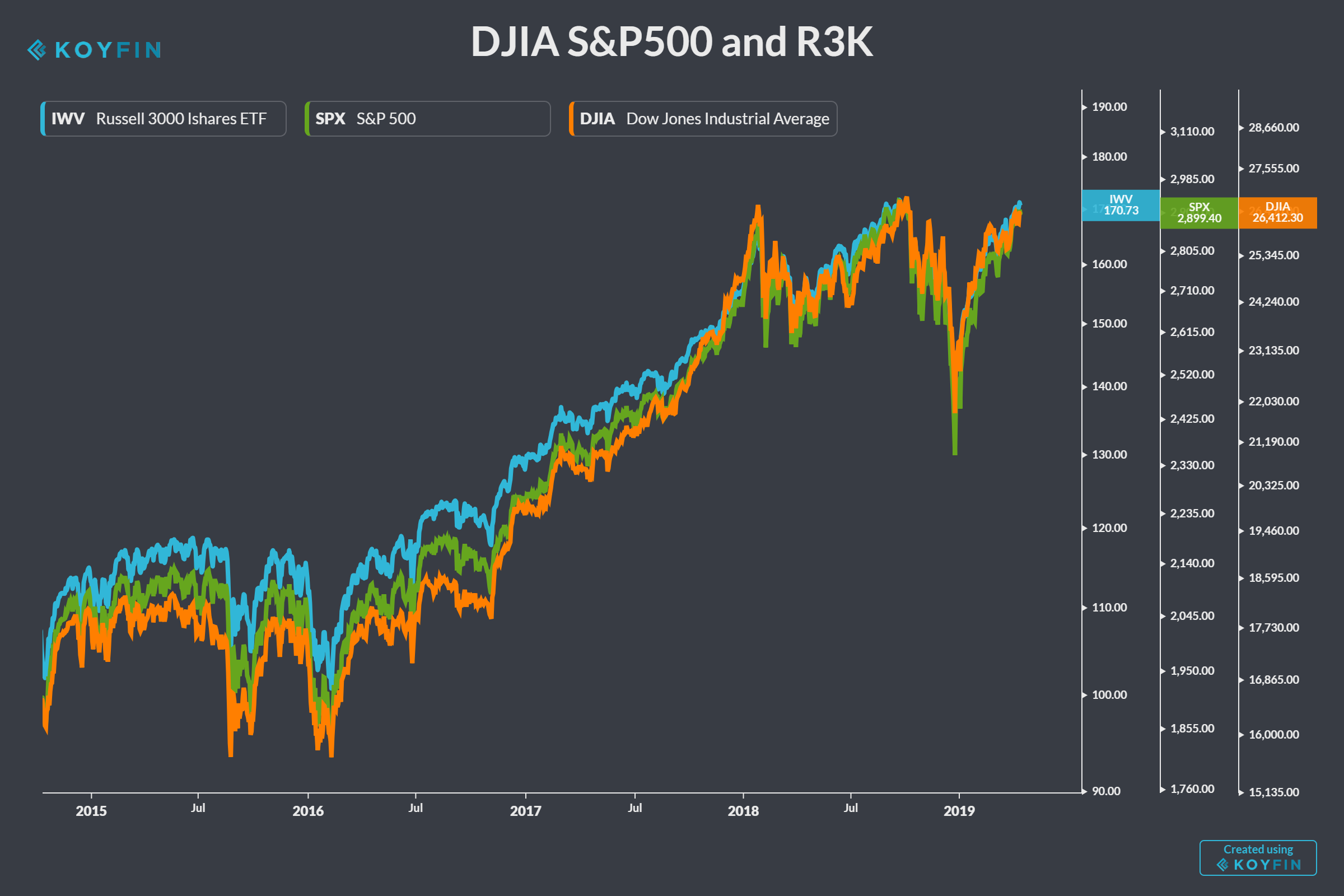

Image: allstarcharts.com

In the dynamic realm of financial markets, few instruments hold as much allure and complexity as index options. Among them, trading Dow Jones Index options stands out as an exhilarating yet intricate endeavor. Embarking on this journey requires not only a firm grasp of fundamental principles but also the ability to navigate its ever-changing terrain. This comprehensive guide aims to equip traders of all levels with the knowledge and strategies needed to unlock the potential of these powerful derivatives.

The Dow Jones Index: A Market Barometer

The Dow Jones Industrial Average, popularly known as the Dow, is an iconic stock market index composed of 30 major US blue-chip companies. As a widely recognized benchmark of the broader economy, its performance has a profound influence on investor sentiment and global markets.

Options: A Two-Edged Sword

Options grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Their versatility allows for tailored risk and reward management, making them indispensable tools in any well-diversified portfolio.

Diving into Dow Jones Index Options

Trading Dow Jones Index options involves predicting the future movement of the index. Traders can choose between call options, which give the right to buy, and put options, which give the right to sell. The strike price represents the index level at which the option can be exercised, while the expiration date sets the window of opportunity.

Understanding Key Concepts

- Premium: The price paid to acquire an option.

- Intrinsic Value: The option’s value if it were exercised immediately.

- Time Value: The portion of the premium attributable to the remaining time until expiration.

- Volatility: A measure of the expected price swings in the underlying index, influencing option premiums.

Exploring Trading Strategies

- Bullish Call Spread: For traders anticipating an uptrend, simultaneously buying a long-term call option with a higher strike price and selling a short-term call option with a lower strike price.

- Bearish Put Spread: For those expecting a downtrend, purchasing a long-term put option with a lower strike price and writing a short-term put option with a higher strike price.

- Covered Call: Generating income by selling a call option when holding the underlying index.

- Protective Put: Hedging against index declines by buying a put option against existing long positions.

Embracing Expert Insights

“In options trading, leverage is key,” advises renowned trader Warren Buffett. “But it’s like holding a tiger by its tail. If you hold on too long, it will hurt you.”

“Risk management is paramount,” cautions Mark Cuban. “Don’t bet more than you can afford to lose.”

Mastering the Art

Trading Dow Jones Index options requires a unique blend of knowledge, skill, and discipline. Continuous study, prudent risk management, and a resolute emotional fortitude are all essential attributes of successful traders.

Conclusion

Delving into the world of Dow Jones Index options offers immense opportunities and challenges. By embracing the principles and strategies outlined in this guide, traders can navigate this complex terrain with confidence and potentially reap its rewards. Remember, the path to mastery requires unwavering dedication and the wisdom to navigate the inherently unpredictable nature of financial markets.

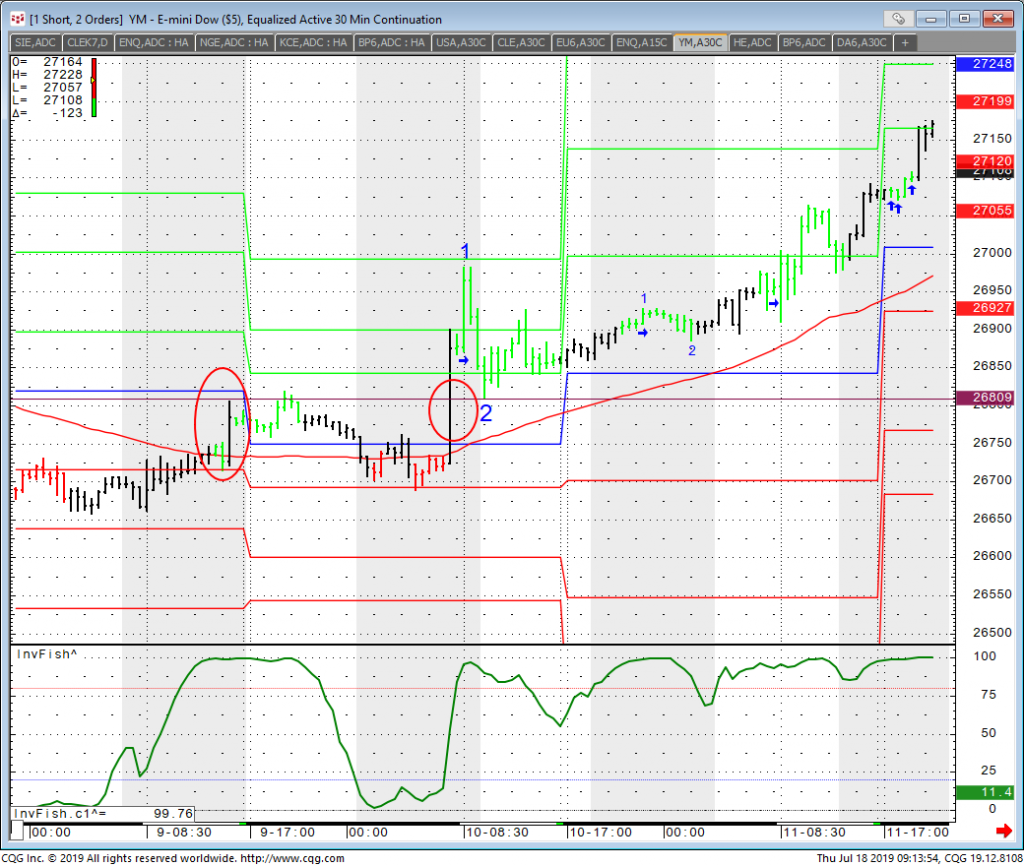

Image: www.cannontrading.com

Trading Dow Jones Index Options

Image: www.ccn.com