In today’s fast-paced and volatile financial markets, options trading has emerged as a powerful tool for savvy investors seeking enhanced returns and risk management strategies. By thoughtfully navigating the intricacies of options trading, you can unlock the potential to amplify your financial aspirations. This article will guide you through the process of opening an options trading account, providing you with the knowledge and confidence to embark on this exciting journey.

Image: www.ifcm.co.uk

Understanding Options Trading: A Symphony of Possibilities

Options contracts, the cornerstone of options trading, are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a predefined period. These contracts empower investors with the flexibility to tailor their investments to specific market scenarios, hedging against market downturns or capitalizing on price fluctuations.

Choosing the Right Broker: A Foundation for Success

The choice of an options broker is paramount in determining the success of your options trading endeavors. Thoroughly evaluate potential brokers based on their reputation, trading platform capabilities, commission structures, account minimums, and educational resources. Seek out a broker that seamlessly aligns with your investment goals and risk tolerance.

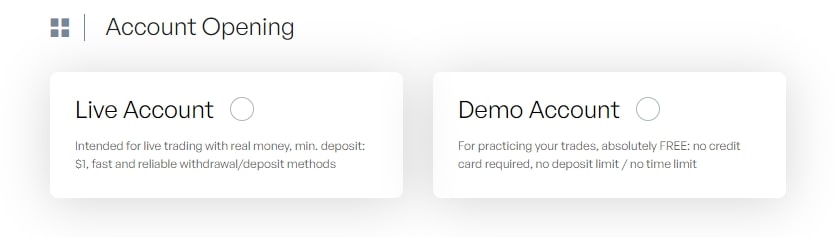

Navigating the Application Process: Simplicity Unveiled

Opening an options trading account is a straightforward process that typically involves completing an online application form. This form requires you to provide personal and financial information, including your investment objectives and risk tolerance. After submitting the application, the broker will review your details and approve your account within a short period.

Image: www.mstock.com

Understanding the Risks Involved: A Prudent Approach

It’s crucial to approach options trading with a clear understanding of the inherent risks involved. Options contracts can carry the potential for significant losses, especially in volatile market conditions. Therefore, it’s imperative to assess your risk tolerance and invest only what you can afford to lose.

Educating Yourself: The Foundation of Informed Decisions

Knowledge is an invaluable asset in the world of options trading. Enhance your understanding by delving into books, articles, and online resources dedicated to the subject. Attend webinars and workshops offered by reputable sources to stay abreast of the latest market trends and trading strategies.

Practice with Caution: The Path to Proficiency

Once you’ve established a solid knowledge base, consider practicing your options trading skills in a simulated trading environment. Paper trading accounts or trading simulators allow you to experiment with different strategies and test your decision-making capabilities without risking real capital.

Open An Options Trading Account

Conclusion: Unlocking Financial Potential with Confidence

Opening an options trading account is a significant step towards financial empowerment. By embracing the principles of options trading, you gain access to a wealth of strategies and risk management tools that can potentially enhance your returns. Remember to approach this journey with a measured and thoughtful approach, constantly educating yourself and managing your risks responsibly. Embark on the path of options trading with determination and enthusiasm, unlocking the potential to shape your financial future with confidence.