If you’ve stepped into the fast-paced world of binary options trading, understanding candlesticks is non-negotiable. These essential tools can illuminate market trends, enabling you to make informed decisions and unlock profitable opportunities. But don’t get caught off guard; candlesticks demand adeptness and precision to unravel their enigmatic secrets. Join us on an enlightening expedition as we delve into the intricacies of trading binary options with candlesticks, mastering the art of predicting market movements with confidence and finesse.

Image: fourlitimo.hatenablog.com

Deciphering the Language of Candlesticks: A Visual Handbook

Candlesticks, visual representations of price movements over a defined time frame, form the backbone of technical analysis in binary options trading. Each candlestick, like a tiny financial hieroglyph, encapsulates the market’s narrative, revealing its battleground of bulls and bears. The body of the candlestick, demarcated by its open and close prices, paints a vivid picture of price movement’s direction and magnitude. Shadows, aptly named wicks, extend from the body, showcasing the candlestick’s highest and lowest ventures.

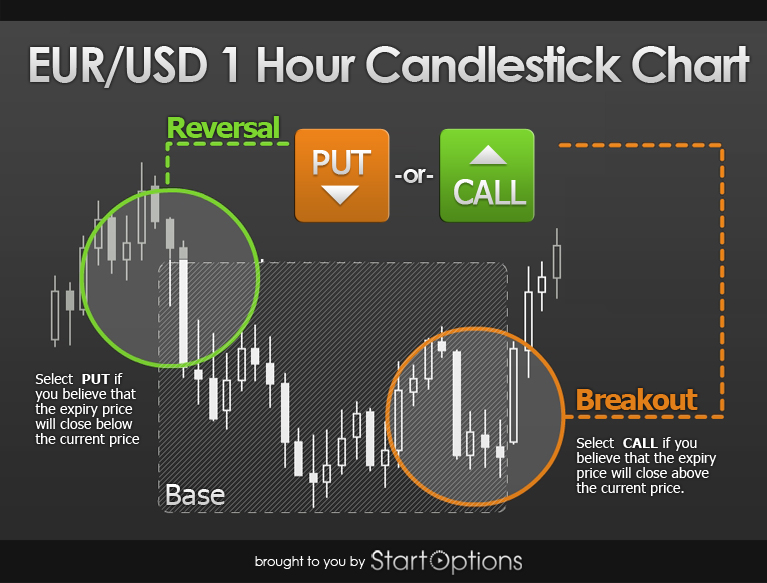

Now, let’s decode the intricate language of candlesticks. A bullish candlestick, like a triumphant knight, stands tall with a hollow body, indicating that the closing price has surpassed the opening price. Its opposite, the bearish candlestick, signifies a triumph of bears, with a filled body symbolizing the opening price’s victory over the closing price. A bullish candlestick whispers of imminent price increases, beckoning astute traders to explore potential Call options. Conversely, bearish candlesticks foreshadow diminishing prices, urging traders to consider Put options. Embrace these candlestick formations as your guiding stars in the cosmos of binary options trading.

Trading Strategies: Harnessing Candlesticks for Profitable Decisions

Unveiling profitable trading strategies is the holy grail of binary options trading, and candlesticks serve as your trusted compass in this quest.

1. Engulfing Patterns: Spotting Market Reversals

Engulfing patterns, like beacon lights in the trading wilderness, announce a powerful shift in market momentum. Prepare for a bullish reversal when a bullish candlestick engulfs the preceding bearish candlestick. Brace yourself for a bearish reversal when the tables turn, and a bearish candlestick engulfs the preceding bullish candlestick. Act with swift precision when these patterns emerge, aligning your trades with the market’s dominant force.

2. Piercing Patterns: Navigating False Breakouts

Piercing patterns, like wily tricksters in the trading arena, challenge our assumptions. When a bearish candlestick pierces a bullish candlestick but fails to close below it, be wary of a deceptive bullish breakout. Conversely, a bullish candlestick piercing a bearish candlestick, yet closing short of its high, hints at a false bearish breakout. Trust in the piercing pattern’s guidance and seize opportunities with calculated precision.

3. Tweezer Tops and Bottoms: Pinpointing Market Indecision

Tweezer tops and bottoms, akin to skilled duellists, reveal moments of market indecision. When two consecutive candlesticks reach the same high, forming a tweezer top, the bulls and bears reach a temporary stalemate. On the flip side, a tweezer bottom, marked by two consecutive candlesticks touching the same low, signals an impasse between the opposing forces. Watch for these formations, for they offer a glimpse into the market’s contemplative state.

Risk Management: A Bastion of Success in Binary Options Trading

Venturing into binary options trading without a robust risk management strategy is akin to embarking on a perilous expedition without a compass. To navigate the complexities of the financial markets, embrace these risk management principles:

1. Define Your Risk Tolerance: Know Your Limits

Determine your risk tolerance, the level of potential loss you’re comfortable with, before engaging in binary options trading. This crucial step sets the foundation for a disciplined trading approach.

2. Manage Your Bankroll Wisely: Bet Small, Trade Long

Never risk more than you can afford to lose. Allocate a small portion of your investment capital to binary options trading, ensuring that potential losses won’t jeopardize your financial well-being. Remember, longevity in the trading arena often trumps short-lived profits.

3. Diversify Your Trades: Spread Your Bets

Don’t put all your eggs in one basket. Diversify your trades by investing in multiple assets and utilizing a range of trading strategies. This prudent approach mitigates risk and enhances your chances of long-term success.

Image: winprofitbinary.blogspot.com

Trading Binary Options With Candlesticks

Image: www.pinterest.com

Conclusion: Embracing Candlesticks, Mastering Binary Options Trading

Trading binary options with candlesticks empowers you with an invaluable tool to decipher market movements and make informed trading decisions. Embrace the transformative power of candlesticks, mastering their intricate language and harnessing their insights to propel your trading journey toward profitability. Remember, consistently profitable trading is an ongoing endeavor, demanding patience, discipline, and a relentless pursuit of knowledge. May the insights shared in this comprehensive guide ignite your trading acumen and illuminate your path to success in the dynamic world of binary options trading.