The ever-evolving world of finance offers a plethora of investment opportunities, and options trading has emerged as a potent tool for discerning investors. Amidst the reputable brokerage firms, TD Ameritrade stands out as a beacon of excellence, catering to the diverse needs of both novice and seasoned traders. In this comprehensive guide, we delve into the intricacies of TD Ameritrade options trading, empowering you with the knowledge and strategies to navigate this dynamic realm effectively.

Image: www.forexbrokers.com

Understanding Options and their Significance

Options, financial instruments imbued with inherent flexibility, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). This contractual arrangement offers investors the potential for substantial gains while limiting their risk exposure, making options a versatile tool for both hedging and speculative pursuits.

TD Ameritrade: A Gateway to Options Trading

TD Ameritrade, a pioneer in the online brokerage industry, has established itself as a leading provider of options trading services. Renowned for its user-friendly platforms, robust trading tools, and exceptional customer support, TD Ameritrade caters to a broad spectrum of traders, from beginners seeking guidance to experienced professionals demanding advanced capabilities.

Their intuitive platforms, available on desktop, web, and mobile, provide real-time market data, customizable charts, and sophisticated order entry systems. Furthermore, their dedicated educational resources, encompassing webinars, videos, and articles, empower investors with the knowledge necessary to make informed trading decisions.

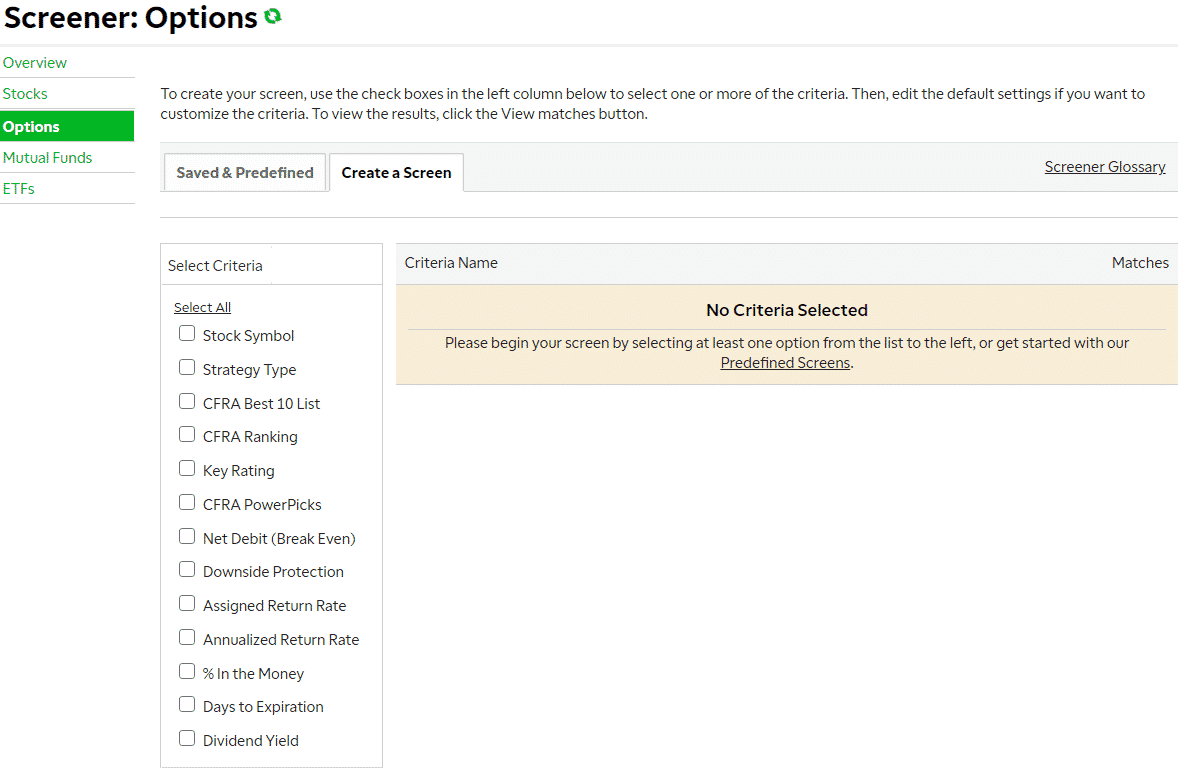

Navigating the TD Ameritrade Options Trading Platform

Upon embarking on your options trading journey with TD Ameritrade, you will encounter a meticulously designed platform that seamlessly integrates the essential tools for successful trading. The user interface, meticulously crafted with both simplicity and functionality in mind, facilitates intuitive navigation, allowing you to swiftly execute trades and monitor market movements.

Their Thinkorswim platform, highly acclaimed within the trading community, stands as a testament to TD Ameritrade’s commitment to innovation. This cutting-edge platform boasts an array of advanced features, including real-time charting, technical analysis tools, and paper trading capabilities, enabling traders to refine their strategies and optimize their performance.

Image: optionstradingiq.com

Exploring Options Strategies for Varied Objectives

The realm of options trading presents a multitude of strategies, each tailored to specific investment goals and risk tolerances. Whether seeking to capitalize on market volatility, hedge against potential losses, or generate supplemental income, there exists an options strategy to suit every aspiration.

Covered calls, a conservative strategy, involves selling (writing) a call option against a stock you own, granting another party the right to purchase those shares at a predetermined price on or before the expiration date. This strategy enables you to potentially generate income while limiting your potential loss to the difference between the strike price and the stock’s current value.

Cash-secured puts, another prudent strategy, entails selling (writing) a put option while holding sufficient funds in your account to cover the potential obligation to purchase the underlying asset at the strike price. This strategy rewards you with premium income while offering downside protection in the event of a market downturn.

These represent merely a glimpse into the diverse array of options strategies available. With prudent research and a thorough understanding of the risks involved, you can harness the power of options trading to pursue your financial objectives effectively.

Striking a Balance: Managing Options Trading Risks

While options trading holds immense promise, it is imperative to recognize and manage the inherent risks associated with this practice. Unforeseen market fluctuations and unpredictable events can potentially erode your capital, making risk management paramount in preserving your financial well-being.

Implement stringent stop-loss orders to automatically exit positions when they reach a predetermined threshold, protecting your capital from excessive losses. Meticulously monitor market conditions and adjust your strategies accordingly to mitigate risk and seize new opportunities.

Maintain a disciplined approach, avoiding impulsive trades and letting sound judgment guide your decisions. Remember, consistent profits in options trading stem from a well-defined strategy, meticulous risk management, and an unwavering commitment to continuous learning and adaptation.

Td Ameritrade Options Trading Covered

Image: www.forexbrokers.com

Conclusion: Unveiling the Potential of TD Ameritrade Options Trading

In conclusion, TD Ameritrade options trading empowers investors with a versatile tool to navigate the dynamic financial markets, presenting opportunities for both income generation and risk management. Their user-friendly platforms, comprehensive educational resources, and advanced trading tools provide a solid foundation for traders of all experience levels to explore the realm of options.

By understanding the basics of options, embracing a strategic approach, and adhering to prudent risk management principles, you can harness the potential of TD Ameritrade options trading to advance your financial aspirations.