Introduction

Navigating the tax complexities of options trading can be a daunting task. Whether you’re a seasoned trader or just starting out, understanding your tax obligations is crucial to avoid costly surprises. Enter tax calculators for options trading – a powerful tool that can simplify this process and empower you to make informed financial decisions.

Image: heartlanddailynews.com

Tax calculators for options trading have become indispensable for traders seeking transparency and accuracy in their tax calculations. These sophisticated software programs incorporate the latest tax laws and regulations, ensuring that you stay up-to-date with the ever-changing tax landscape.

Tax Implications of Options Trading

Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) on or before a certain date (the expiration date). The tax treatment of options trading depends on several factors, including the type of option, holding period, and the trader’s tax status.

Short-Term and Long-Term Gains: Options held for less than a year (short-term) are taxed at ordinary income tax rates. Options held for a year or more (long-term) are taxed at the more favorable capital gains rates. Capital gains rates vary depending on your taxable income and filing status.

Calculating Your Tax Liabilities

Tax calculators for options trading leverage sophisticated algorithms to calculate your tax liabilities based on your specific trading activities. These calculators typically require you to input information such as the type of options traded, purchase and sale dates, strike prices, and premiums paid. The software then crunches this data and generates a detailed report outlining your taxable gains or losses, and the applicable tax rates.

By utilizing a tax calculator, you can avoid costly errors and ensure that you’re paying the correct amount of taxes. This can save you time, money, and potential penalties.

Tips and Expert Advice

Choose the Right Calculator: Not all tax calculators are created equal. Choose a reputable, user-friendly calculator that is regularly updated to reflect tax code changes.

Keep Accurate Records: Maintaining organized records of your trading activities is essential for accurate tax calculations. Keep track of all trades, including purchase and sale dates, strike prices, premiums, and expiration dates.

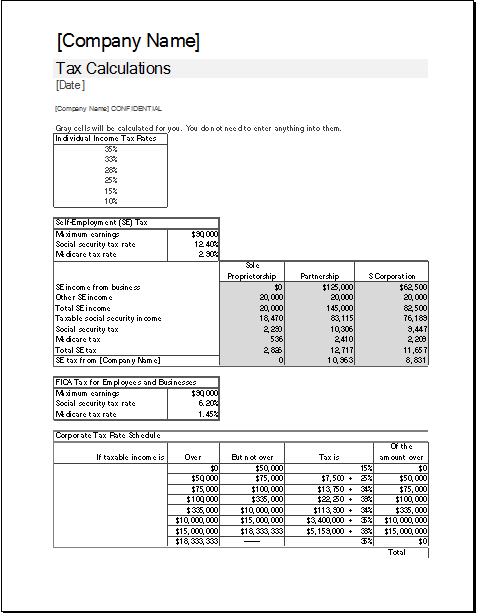

Image: www.xltemplates.org

Frequently Asked Questions

- Q: Can I use a tax calculator for all types of options trading?

- A: Yes, tax calculators for options trading can handle various types of options, including calls, puts, straddles, and spreads.

- Q: How often should I use a tax calculator?

- A: It’s recommended to use a tax calculator whenever you trade options to stay up-to-date with your tax liabilities and identify potential tax savings opportunities.

- Q: Are tax calculators accurate?

- A: Tax calculators are designed to provide accurate estimates, but they’re not a substitute for professional tax advice. It’s always advisable to consult a qualified tax professional to verify your calculations.

Tax Calculator For Options Trading

Image: elchoroukhost.net

Conclusion

Whether you’re a seasoned options trader or just starting out, using a tax calculator for options trading is a smart move. These calculators simplify the complex tax implications of options, empowering you with the knowledge to make informed decisions and navigate the tax landscape confidently.

Are you interested in learning more about optimizing your tax strategies for options trading? Stay tuned for our upcoming article, which will delve deeper into specific tax-saving strategies and expert guidance.