In the world of financial trading, options offer a powerful tool for risk-tolerant investors seeking enhanced returns. One strategy, swing trading OTM (out-of-the-money) options, combines the benefits of options with a strategic timing approach to capture market movements over a short to medium-term horizon.

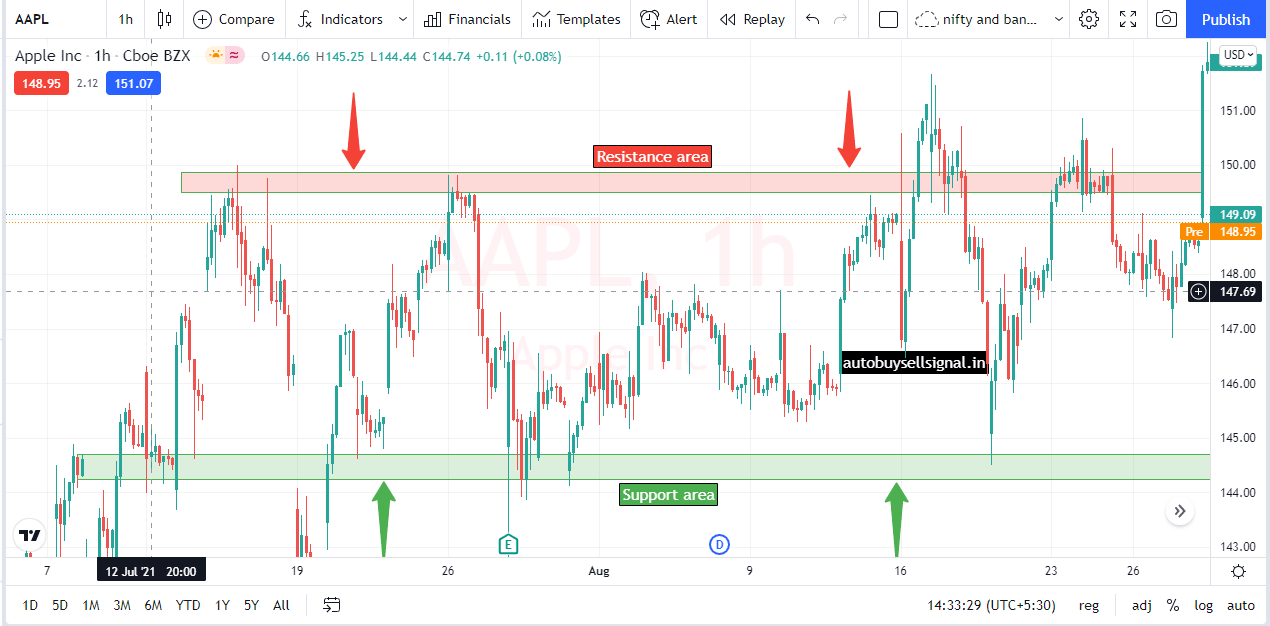

Image: autobuysellsignal.in

The Art of Swing Trading OTM Options

OTM options are contracts that give the buyer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price (strike price) on or before a certain date (expiration date). Swing trading involves buying OTM options that are currently trading below their strike price, anticipating that the underlying asset will move in the desired direction within a few days or weeks, allowing the option to appreciate in value.

Benefits of Swing Trading OTM Options

– Asymmetrical Returns: OTM options offer the potential for asymmetrical returns, meaning that profits can be disproportionately larger than losses. If the underlying asset moves in the desired direction, the option can experience exponential growth, amplifying returns.

– Limited Risk: Unlike traditional stock investments, OTM options come with limited risk as you only pay the premium to acquire the contract. The potential loss is capped at the premium paid, providing a defined risk profile.

– Timing Precision: Swing trading allows traders to identify optimal entry and exit points for their options positions. By leveraging technical analysis and market monitoring, traders can capitalize on short-term price fluctuations.

Tips for Swing Trading OTM Options

– Select High-Probability Trades: Focus on identifying trades with a high probability of success based on technical analysis, market sentiment, and fundamental factors.

– Manage Risk Effectively: Determine an appropriate position size and set stop-loss orders to mitigate potential losses.

– Time the Market: Swing trading requires patience and timing. Identify market trends and enter trades at strategic points to maximize profit potential.

– Monitor Position Actively: Regularly track the performance of your options positions and make adjustments as needed to capture profit or limit losses.

Image: www.csggroup.org

FAQ on Swing Trading OTM Options

Q: What are the risks associated with OTM options trading?

A: Risks include the potential for losing the premium paid, slippage when executing trades, and the volatility of the underlying asset.

Q: How do I determine appropriate strike prices for OTM options?

A: Strike prices should be selected based on technical analysis, market conditions, and the trader’s risk tolerance and desired profit potential.

Q: How can I learn more about swing trading OTM options?

A: Resources such as online courses, books, and mentorship programs provide valuable education on swing trading strategies.

Swing Trading Otm Options

Image: forexpops.com

Conclusion

Swing trading OTM options can be a rewarding strategy for those willing to embrace risk in pursuit of enhanced returns. By understanding the principles, selecting trades wisely, managing risk effectively, and leveraging market knowledge, traders can harness the power of OTM options to capture market opportunities and maximize their trading potential.

Are you intrigued by the world of swing trading OTM options and eager to explore this strategy further? Share your thoughts and questions in the comments below!