Introduction

In the fast-paced world of options trading, traders are constantly seeking reliable indicators that can provide valuable insights into market trends. The Aroon indicator is a powerful momentum indicator that has gained widespread recognition for its effectiveness in identifying potential trading opportunities. This comprehensive guide will delve into the intricacies of the Aroon indicator, shedding light on how it can be skillfully incorporated into options trading strategies to maximize returns.

Image: brooksysociety.com

Understanding the Aroon Indicator

Developed by Tushar Chande in the late 1990s, the Aroon indicator measures the strength of a trend based on the time elapsed since the most recent high (Aroon Up) and the most recent low (Aroon Down). The indicator consists of two lines, oscillating between 0 and 100:

- Aroon Up: Calculates the percentage of the number of days since the highest high in the specified period to the total number of days in the period.

- Aroon Down: Calculates the percentage of the number of days since the lowest low in the specified period to the total number of days in the period.

Interpretation and Trading Strategies

-

Upward Trend Identification: When the Aroon Up line crosses above the Aroon Down line, it signals a potential upward trend. This indicates that the price is making higher highs and may continue to rise in the near future.

-

Downward Trend Identification: Conversely, when the Aroon Down line crosses above the Aroon Up line, it indicates a potential downward trend, suggesting that the price is making lower lows and may decline in the coming period.

-

Trend Continuation: Strong trends are characterized by high values of both Aroon Up and Aroon Down, typically above 70. This suggests that the trend is well-established and has momentum.

-

Crossovers: Bullish crossovers occur when the Aroon Up line rises above the Aroon Down line, while bearish crossovers happen when the Aroon Down line rises above the Aroon Up line. Crossovers indicate potential trend reversals.

-

Trend Exhaustion: When both Aroon Up and Aroon Down lines approach 100, it signifies potential trend exhaustion. This suggests that the trend may be slowing down or reversing direction.

Practical Applications in Options Trading

-

Trend Following: Traders can use the Aroon indicator to identify trends and enter trades in the direction of the trend. This involves buying call options during uptrends and put options during downtrends.

-

Trend reversals: Crossovers of the Aroon lines can signal potential trend reversals, which can be exploited by traders to close existing positions or initiate trades in the opposite direction.

-

Confirmation Trades: The Aroon indicator can be used as a confirmation tool to enhance the accuracy of other technical indicators. For instance, traders may only enter a trade when the Aroon lines align with the signals from other indicators.

-

Stop-Loss Placement: The Aroon indicator can assist in determining optimal stop-loss levels. For example, traders may place a stop-loss order below recent swing lows in uptrends or above recent swing highs in downtrends.

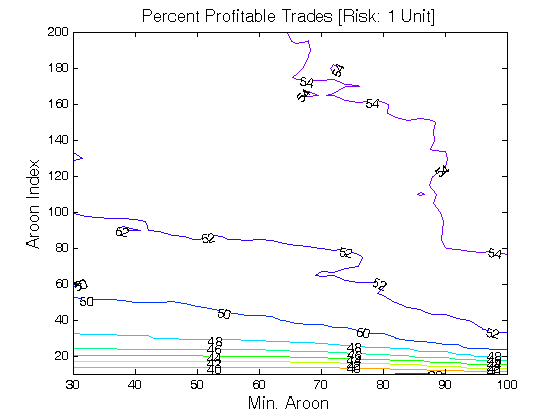

Image: oxfordstrat.com

Expert Insights and Actionable Tips

-

Expert Perspective: “The Aroon indicator is a powerful tool for identifying trends in volatile markets. By understanding its nuances, traders can gain a significant edge in making profitable trading decisions.” – Mark Douglas, Trading Coach

-

Actionable Tip: Combine the Aroon indicator with other technical indicators, such as moving averages or stochastic oscillators, to refine your analysis and enhance your understanding of market dynamics.

Aroon Indicator Options Trading Strategy

Conclusion

The Aroon indicator is an invaluable tool for options traders, providing valuable insights into market trends and enabling traders to make informed decisions. By comprehending the interpretation and trading strategies associated with this indicator, traders can maximize their returns and navigate the complexities of the options market with greater confidence. Remember to always conduct thorough research and consult with financial professionals before making any investment decisions.