Introduction

In the dynamic landscape of financial markets, swing trading has emerged as a compelling strategy to generate consistent returns. Swing trading involves identifying and capitalizing on short- to medium-term price movements, typically over a period ranging from a few days to several weeks. Among the various swing trading approaches, employing in-the-money (ITM) options has garnered significant attention. ITM options offer traders the leverage to amplify their profits while mitigating potential risks.

Image: www.pointzero-trading.com

This in-depth guide will delve into the intricacies of swing trading ITM options, providing a comprehensive overview of the concepts, strategies, and nuances involved. By leveraging expert insights and practical examples, we aim to empower traders of all experience levels with the knowledge and skills to navigate this dynamic market effectively.

Understanding ITM Options

An option contract grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined strike price on or before a specific expiration date. ITM options refer to options where the strike price is below the current market price of the underlying asset in the case of call options, or above the market price for put options.

For instance, if the stock XYZ is trading at $100, an ITM call option with a strike price of $95 would give the holder the right to purchase the stock at $95 per share. Conversely, an ITM put option with a strike price of $105 would entitle the holder to sell the stock at $105 per share.

Mechanics of Swing Trading ITM Options

Swing trading ITM options involves identifying stocks that exhibit strong momentum or potential for a breakout. Traders typically enter the trade by purchasing ITM options with the expectation that the underlying asset will continue its bullish or bearish trend, enabling them to sell or exercise the option at a profit.

During a bull market, traders often employ ITM call options. Here, the trader anticipates that the stock will rise in value, allowing them to sell the call option for a profit or exercise the option to acquire the underlying asset at a discounted price. Conversely, in a bearish market, traders may opt for ITM put options, speculating that the stock will decline in value and providing them with the opportunity to sell the put option or exercise the option to sell the underlying asset at a premium.

Key Strategies and Considerations

Swing trading ITM options requires careful consideration of factors such as strike price, expiration dates, and the implied volatility of the options. Selecting the appropriate strike price involves balancing the potential reward with the likelihood of the option expiring out-of-the-money (OTM). Longer expiration dates provide more time for the trade to unfold but also result in higher option premiums.

Traders can employ various strategies to optimize their ITM options trades. Some common approaches include:

-

Deep ITM options: Purchasing ITM options with a strike price significantly below the current market price in the case of call options, or above the market price for put options, can reduce the time decay associated with near-term expiration dates.

-

Higher Delta options: Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Options with higher deltas are more responsive to price movements, potentially leading to larger profits but also incurring higher premiums.

-

Combining options strategies: Sophisticated traders may employ combinations of different option types, such as spreads or straddles, to enhance their returns or manage risk. These strategies involve buying and selling multiple options contracts with varying strike prices or expiration dates.

Image: best-forex-indicators.com

Risk Management and Discipline

While ITM options offer the potential for higher returns, it’s crucial to recognize the inherent risks involved. As with any trading strategy, thorough risk management and strict discipline are essential to protect capital.

-

Trade size: Determine the appropriate size of each trade based on your risk tolerance and account balance. Avoid committing an excessively large portion of your portfolio to any single trade.

-

Stop-loss orders: Implement stop-loss orders to automatically exit a trade once the underlying asset reaches a predetermined price, limiting potential losses.

-

Monitor market conditions: Continuously monitor market conditions and the performance of your trades. Make adjustments or exit positions promptly if the trend reverses or market conditions change significantly.

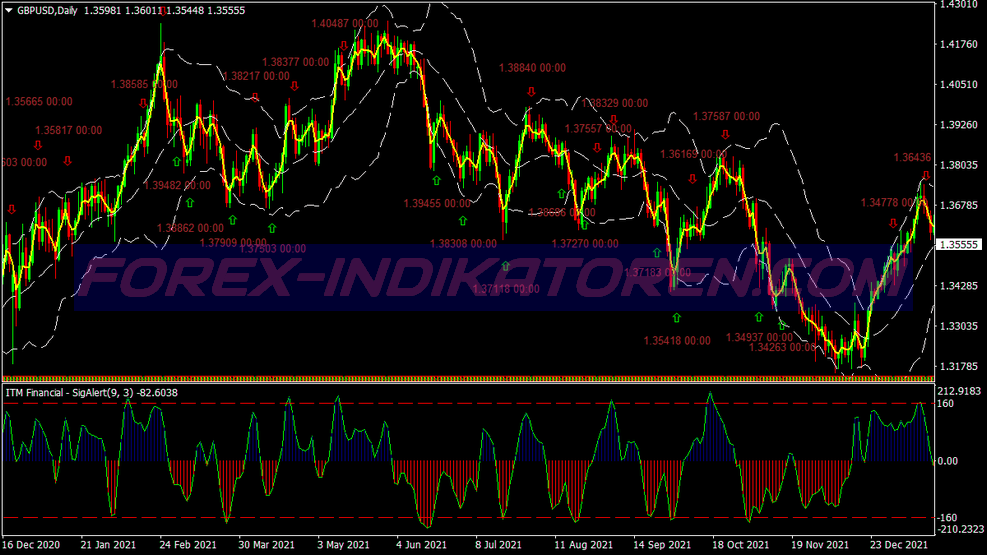

Swing Trading Itm Options

Image: www.forex-indikatoren.com

Conclusion

Swing trading ITM options requires a blend of knowledge, experience, and a disciplined approach. By embracing the concepts outlined in this comprehensive guide, traders can enhance their understanding of ITM options and develop effective strategies to maximize their returns. Remember, the financial markets are ever-changing, demanding adaptability and a continuous learning mindset to stay ahead of the curve. Always seek professional guidance and conduct thorough research before implementing any trading strategy to mitigate risks and achieve long-term success.