In the labyrinthine world of finance, options stand out as versatile and powerful instruments. They empower traders to navigate uncertain markets, manage risk, and potentially generate exponential returns. Embark on this comprehensive guide to demystify the strategy of option trading, equipping you with the knowledge and insights to unlock its hidden potential.

Image: rmoneyindia.com

Unveiling the Options Landscape

Options are financial contracts that bestow upon their holders the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) within a predetermined period (expiration date). Call options grant the holder the right to buy, while put options confer the right to sell. Understanding these fundamental concepts will serve as the cornerstone of your option trading journey.

Decoding Option Strategies

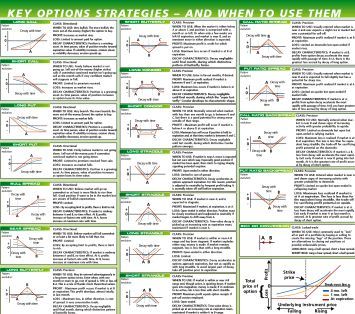

The realm of option trading encompasses a myriad of strategies, each tailored to specific market conditions and risk appetites. Long options are employed in bullish markets, enabling traders to profit from price increases in the underlying asset. Short options, on the other hand, are suitable for bearish markets or hedging purposes, allowing traders to capitalize on price declines. Spreads, combinations of multiple options, provide additional flexibility and risk management tools.

Assessing Market Trends and Developments

Stay abreast of the latest market trends and developments to discern the most favorable conditions for option trading. Monitor economic indicators, company announcements, and industry news to anticipate market movements and make informed trading decisions. Engage with online forums and social media platforms where experienced traders share insights and analysis.

Image: marketsmuse.com

Tips from the Trenches: Expert Advice

-

Identify High-Probability Trades: Seek opportunities with clear directional bias and favorable risk-to-reward ratios.

-

Manage Risk Diligently: Assess potential risks and implement appropriate risk management strategies, such as hedging or position sizing.

-

Understand Greeks: Leverage Greek metrics (Delta, Vega, Theta) to comprehend option behavior and fine-tune strategies.

Incorporating these expert tips into your trading approach will enhance your decision-making and cultivate a foundation for trading success.

Frequently Asked Questions

-

Q: Are options risky?

A: Options trading carries inherent risk. However, prudent risk management can mitigate potential losses.

-

Q: How do I get started with option trading?

A: Begin by educating yourself, practice simulated trading, and seek guidance from experienced traders or brokers.

-

Q: What is the potential return on option trading?

A: The return potential is unlimited, depending on the underlying asset’s price movement and the chosen strategy.

Strategy Of Option Trading

Image: www.youtube.com

Conclusion: Empowering Your Financial Journey

Embarking on the path of option trading unlocks a world of possibilities. This comprehensive guide has illuminated the intricacies of option strategies, market trends, and expert advice. Seek knowledge, stay attuned to market dynamics, and hone your skills continuously.

We would love to hear from you! Drop a comment below if you found this article insightful and have any further questions about option trading. Together, let us delve into the fascinating world of finance and realize the potential that lies within.