Introduction

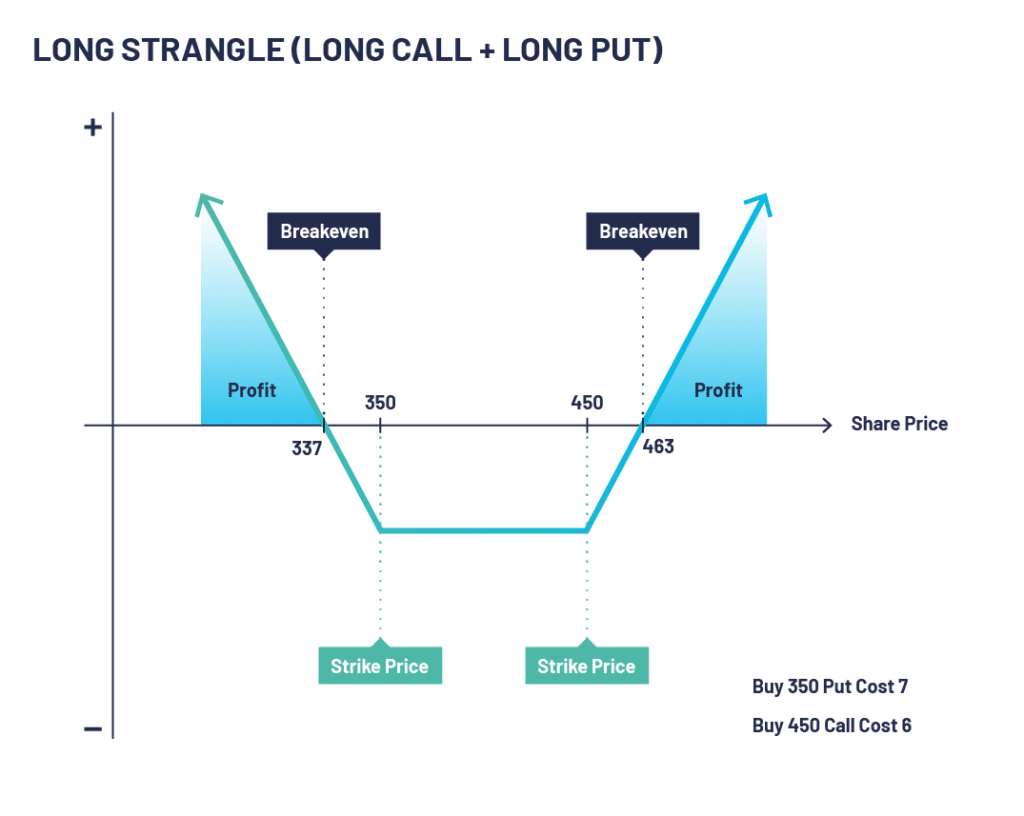

In the realm of options trading, finding innovative strategies that can generate income consistently is a never-ending pursuit. Strangle options trading emerges as a versatile approach that has the potential to provide investors with substantial returns. This strategy involves simultaneously buying both a put and a call option at different strike prices, capturing price movements in both directions.

Image: optionsdesk.com

Strangle options trading derives its name from the “strangling” effect it creates on the underlying asset’s price action. By purchasing both a put and a call option, traders are betting that the underlying asset’s price will fluctuate significantly, regardless of the direction. This strategy becomes particularly effective in high-volatility markets, where the potential for substantial price swings is greater.

Overview of Strangle Options Trading

Definition

A strangle options strategy involves buying both a put and a call option with the same expiration date but different strike prices. The put option grants the right to sell the underlying asset at a predetermined price (strike price) on or before the expiration date, while the call option grants the right to buy the underlying asset at a predetermined price on or before the same expiration date.

History and Meaning

Strangle options trading has been used by investors for decades as a way to profit from volatile markets. The strategy gained popularity during the 1987 stock market crash, when many investors used it to hedge their portfolios against potential losses. Over time, strangle options trading has become a more sophisticated strategy, with traders now using it to generate income in various market conditions.

Image: www.youtube.com

How Strangle Options Trading Works

To execute a strangle options strategy, traders must purchase both a put option and a call option on the same underlying asset, with different strike prices. The strike price for the put option should be below the current market price of the underlying asset, while the strike price for the call option should be above the current market price.

The profit potential from a strangle options strategy arises from the fluctuation of the underlying asset’s price. If the price of the underlying asset moves significantly in either direction, the value of one option will increase, potentially offsetting the loss on the other option. This allows traders to capture profits from both bullish and bearish market movements.

Latest Trends and Developments

Strangle options trading is continuously evolving, with traders developing new and innovative variations to improve the strategy’s performance. Some of the latest trends and developments include:

- Widely traded assets: Strangle options trading is now used on a wide range of underlying assets, including stocks, indices, currencies, and commodities, providing traders with diversification opportunities.

- Advanced trading platforms: With the advent of advanced trading platforms, traders now have access to sophisticated tools and analytics that facilitate strangle options trading and risk management.

- Social trading: Social media platforms and online forums have fostered communities where traders exchange ideas and strategies, including variations of strangle options trading.

Tips and Expert Advice

To effectively execute a strangle options strategy, consider the following tips and expert advice:

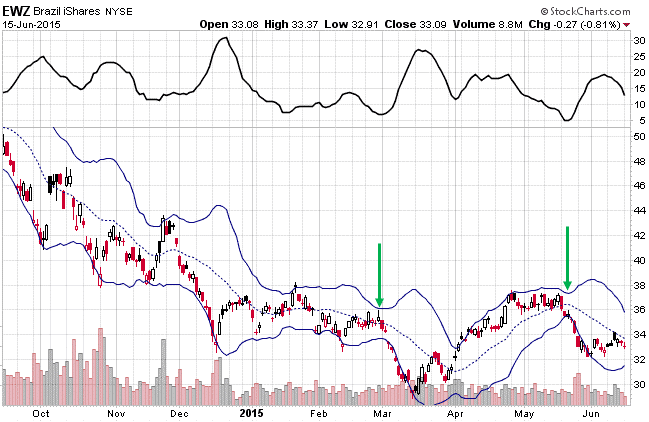

- Choose volatile underlying assets: Strangle options trading thrives on volatility, so select underlying assets with strong price swings to maximize profit potential.

- Set appropriate strike prices: The strike prices you choose for your put and call options will significantly impact your profitability. Aim for strike prices that provide a reasonable balance between risk and reward.

- Manage risk effectively: Like any investment strategy, strangle options trading involves risk. Implement proper risk management techniques, such as stop-loss orders, to limit potential losses.

Strangle Options Trading & Innovative Income Strategy

Image: ucivexe.web.fc2.com

FAQs on Strangle Options Trading

**Q: What is the difference between a strangle and a straddle options strategy?**

**A:** In a straddle options strategy, traders purchase both a put and a call option with the same strike price. In contrast, a strangle options strategy involves different strike prices for the put and call options.

**Q: How do I determine the profit potential of a strangle options strategy?**

**A:** The profit potential depends on the underlying asset’s price movement and the strike prices of the put and call options. If the price moves significantly in either direction, the value of one option will increase, potentially offsetting the loss on the other.