Embark on an Exhilarating Trading Adventure

Image: marketxls.com

Are you yearning to unlock the lucrative potential of the stock market but fear the complexities of traditional trading? Look no further than options trading on Robinhood! This innovative platform empowers you with a user-friendly interface and cutting-edge tools, making options trading accessible to everyone. Join us on an exhilarating exploration of this dynamic investment strategy, where every step towards success is illuminated with clarity.

Step 1: Unveiling the World of Options

Options are financial contracts that grant you the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a predetermined price (strike price) within a specified time (expiration date). Armed with this newfound knowledge, you can navigate the options market with confidence.

Step 2: Mastering the Robinhood Platform

Begin your adventure by registering for a Robinhood account, designed with simplicity and ease of use in mind. Engage with their intuitive user interface that presents real-time data, advanced charting tools, and comprehensive research resources at your fingertips.

Step 3: Exploring Different Options Strategies

Discover the diverse spectrum of options strategies tailored to various risk tolerances and investment goals. Comprehend the mechanics of buying and selling calls, puts, covered calls, and protective puts. With each strategy, uncover its nuances, potential returns, and risk parameters.

Image: www.youtube.com

Step 4: Selecting the Right Stocks

Identifying the underlying stocks for your options trades is a crucial step. Research potential companies thoroughly, analyzing their financial performance, industry trends, and management team. Armed with this knowledge, make informed decisions that align with your investment thesis.

Step 5: Understanding Risk and Margin Requirements

Embrace risk management as a cornerstone of your trading journey. Determine your risk tolerance and the amount of capital you can afford to lose. Robinhood provides a comprehensive margin calculator that empowers you to execute trades within the permissible limits.

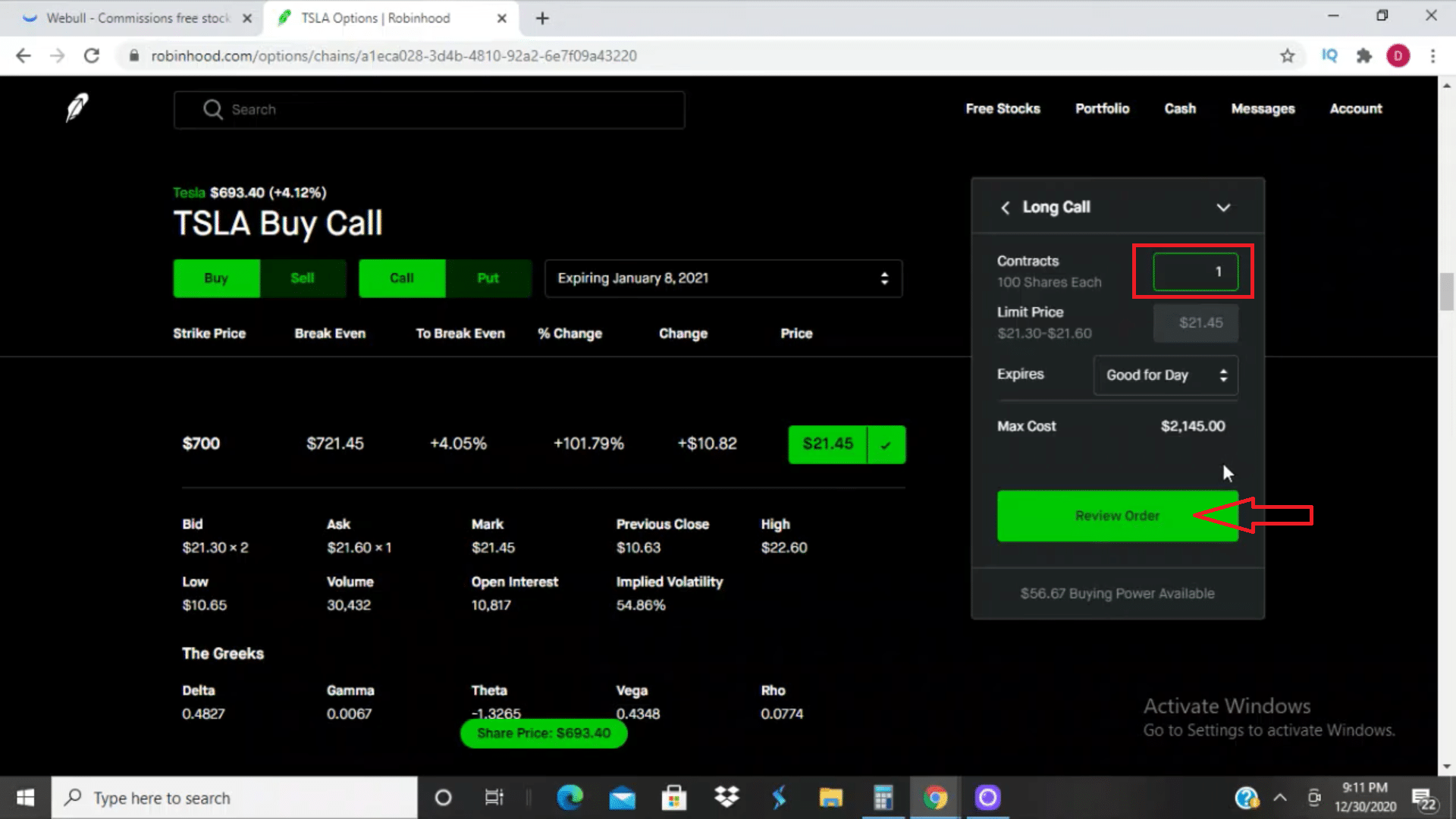

Step 6: Executing Your First Trade

With your knowledge and strategizing complete, it’s time to execute your first options trade. Navigate Robinhood’s intuitive trade ticket, input the necessary parameters, and confidently submit your order. Witness the execution of your trade, marking the commencement of your trading adventure.

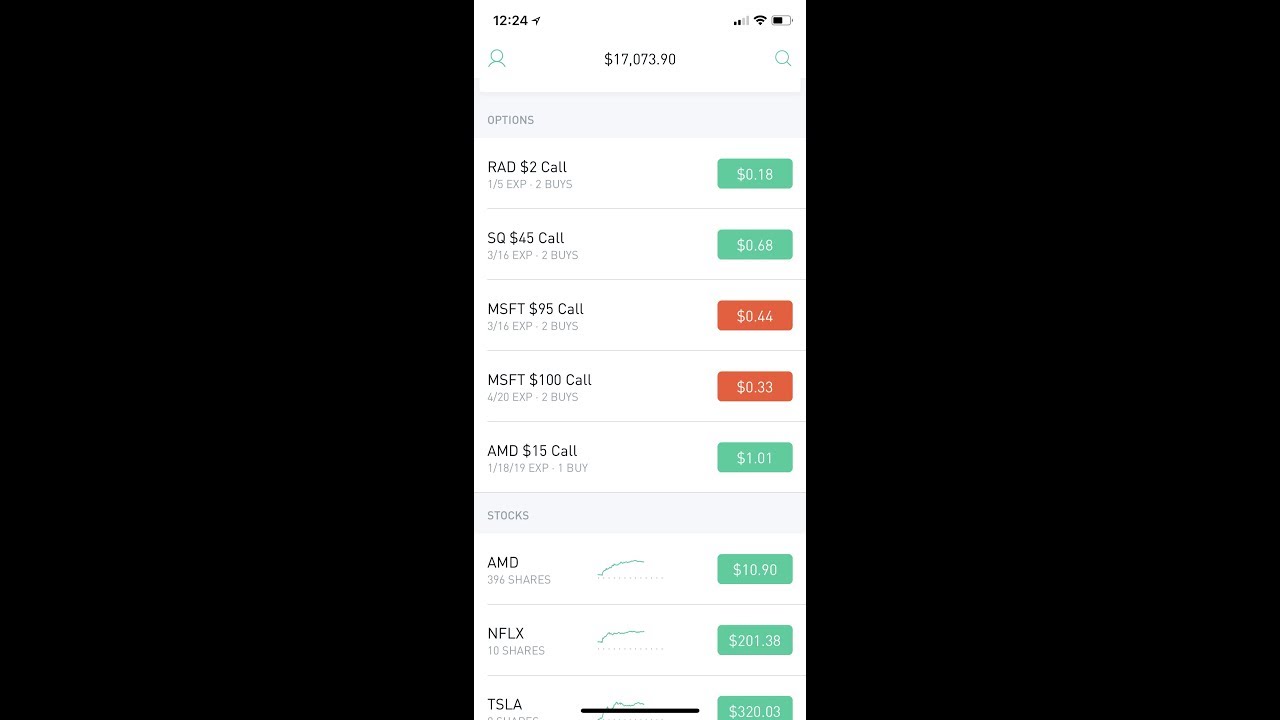

Step 7: Monitoring and Managing Your Positions

Once your trade is executed, it’s vital to monitor its performance regularly. Track the underlying stock price, market sentiment, and any news or events that could impact its value. Make adjustments to your strategy or exit your position as needed, guided by sound judgment and analysis.

Step 8: Embracing Continuous Learning

The financial markets are a constantly evolving landscape. To succeed in options trading, embrace continuous learning. Stay abreast of market trends, analytical techniques, and emerging strategies. Attend webinars, read industry publications, and connect with experienced traders to expand your knowledge base.

Step By Step Options Trading Robinhood

Image: www.youtube.com

Conclusion

Congratulations! You have embarked on the path to mastering options trading on Robinhood. Remember, the key to success lies in understanding the mechanics, managing risk, and continuously honing your skills. With dedication and a thirst for knowledge, you can unlock the lucrative potential of options trading and achieve your financial aspirations.