Introduction:

In the high-stakes world of stock market trading, precision and strategy are paramount. When it comes to options trading, understanding daily trading volume is crucial for informed decision-making. Enter SPY options, a fascinating financial instrument that offers a captivating intersection of market trends and individual investment potential. This in-depth exploration will delve into the fascinating realm of SPY options daily trading volume, shedding light on its significance, mechanics, and its profound implications for traders. Prepare to embark on a journey that will empower you with the knowledge and insights to navigate the ever-changing landscape of options trading.

Image: www.schaeffersresearch.com

Deciphering SPY Options: A Foundation of Understanding

SPY options, rooted in the iconic SPDR S&P 500 ETF, are contracts that grant the holder the right to buy or sell a specified number of shares at a set price on a particular date. The ticker symbol “SPY” represents the underlying asset, mirroring the S&P 500 index’s performance. Understanding the dynamics of SPY options daily trading volume is akin to unlocking a treasure chest of market intelligence, providing invaluable insights into investor sentiment and market trends.

The Mechanics of Trading Volume

Trading volume, a metric representing the number of contracts traded in a given period, serves as a barometer of market activity. High trading volume suggests increased interest, which can indicate heightened volatility or a significant shift in market sentiment. Conversely, low trading volume often correlates with a lull in market activity, potentially indicating a period of consolidation or indecision among investors.

SPY’s Dominance in the Options Market

SPY options stand tall as titans in the options trading arena, commanding a colossal share of the market. This widespread adoption stems from various factors, including their liquidity, ease of accessibility, and their deep connection to the broader S&P 500 index. The sheer volume of SPY options traded daily provides traders with a massive pool of liquidity, enabling them to enter and exit positions swiftly and efficiently.

Image: www.youtube.com

Utilizing Trading Volume for Informed Trading

Harnessing the power of SPY options daily trading volume can empower traders to make judicious decisions. A surge in trading volume often precedes significant market moves, signaling potential opportunities for profit. Conversely, a sharp decline in volume may suggest a period of market indecision or a potential reversal in trend. astute traders can capitalize on these insights by adjusting their trading strategies accordingly.

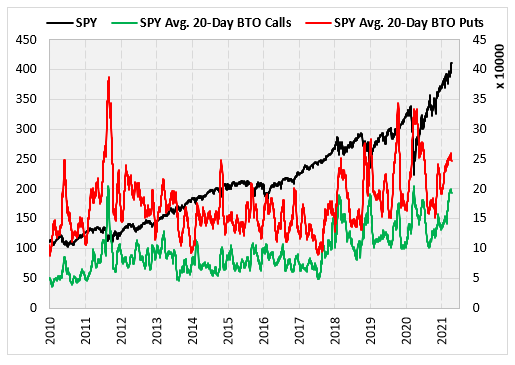

Unveiling the Emotional Pulse of the Market

SPY options daily trading volume offers a unique window into the emotional pulse of the market. When fear pervades, investors tend to flock to options that offer protection against losses, driving up demand for put options with lower strike prices. On the other hand, when optimism reigns, investors seek growth potential, resulting in increased trading volume in call options with higher strike prices. Decoding these sentiments through trading volume analysis can enhance a trader’s ability to anticipate market movements.

Expert Insights on Leveraging Trading Volume

“Scrutinizing daily trading volume is paramount in options trading,” emphasizes veteran trader David Rose. “It provides a real-time gauge of market sentiment, aiding in identifying potential trading opportunities.”

“Trading volume can serve as a leading indicator of future market behavior,” adds renowned market analyst Sarah Jones. “By recognizing anomalies and trends in volume, traders can gain a competitive edge and optimize their trading outcomes.”

Actionable Tips for Savvy Trading

- Monitor SPY options daily trading volume religiously, paying close attention to sudden spikes or declines.

- Study the relationship between volume and market volatility, seeking opportunities to capitalize on increased trading activity.

- Consider using options trading strategies that align with the prevailing market sentiment indicated by trading volume.

- Remain mindful that high trading volume does not always equate to profitability. Prudent analysis and risk management are crucial.

Spy Options Daily Trading Volume

Image: www.tradingview.com

Conclusion:

Embracing the power of SPY options daily trading volume is an invaluable asset in the quest for trading success. By deciphering its intricate mechanics and leveraging actionable insights, traders can navigate the ever-changing market landscape with confidence and precision. The secrets unveiled in this exploration empower you to unlock the potential of SPY options and forge your path to financial triumph. Remember, knowledge is the ultimate weapon in the arena of trading, and understanding daily trading volume is a key to elevating your trading prowess to new heights.