Introduction

In the dynamic world of finance, options trading presents both opportunities and challenges, requiring traders to navigate complex strategies and calculate potential outcomes. Spreadsheets, with their versatility and computational capabilities, have become an indispensable tool for options traders, enabling them to effortlessly analyze data, track positions, and make informed decisions.

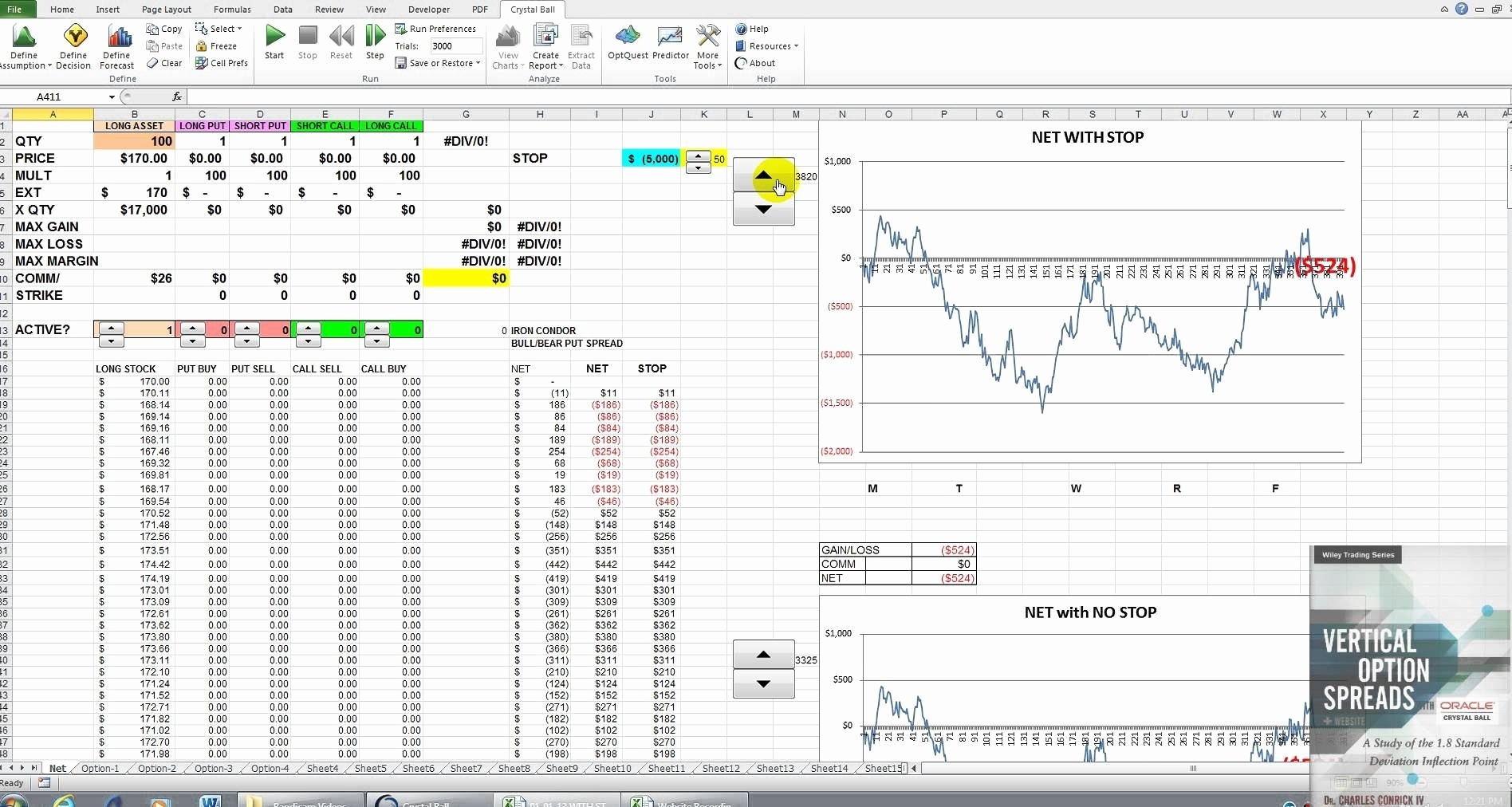

Image: db-excel.com

Whether you’re a seasoned trader or a novice venturing into the options market, spreadsheets can empower you with unparalleled precision and efficiency. This comprehensive guide will delve into the intricacies of using spreadsheets for options trading, guiding you through essential concepts, practical applications, and valuable tips to maximize your spreadsheet’s functionality.

Essential Components of an Options Trading Spreadsheet

A well-structured options trading spreadsheet should incorporate a range of components to effectively manage and analyze your trades. These include:

Historical Data

Historical data provides a valuable foundation for your analysis. Import historical prices, implied volatility, and other relevant data for the underlying asset and options you’re considering.

Options Chain

An options chain displays detailed information on all available options contracts for a given underlying asset, including strike prices, expiration dates, bid/ask prices, and Greeks.

Image: db-excel.com

Trade Log

Maintain a comprehensive log of all your trades, including entry and exit dates, contract specifications, and realized profit/loss. Tracking your trades can help you identify patterns, optimize strategies, and improve your trading performance over time.

Risk Management Metrics

Calculate and monitor key risk metrics such as delta, gamma, theta, and vega to assess the potential impact of market fluctuations on your positions. This information is crucial for managing risk and making informed decisions.

Scenario Analysis

Use the spreadsheet’s computational power to conduct scenario analysis and simulate potential market conditions. This allows you to test different strategies and evaluate potential outcomes before executing trades.

Practical Applications of Spreadsheets in Options Trading

Spreadsheets extend their versatility to a wide range of practical applications in options trading, including:

Option Pricing

Use spreadsheet formulas to calculate the theoretical value of options contracts using popular pricing models such as Black-Scholes-Merton. By comparing the calculated value with the market price, traders can identify pricing inefficiencies and potential trading opportunities.

Trade Optimization

Spreadsheets enable you to evaluate and optimize your trading strategies by analyzing historical data and simulating different scenarios. Through iterative processes, you can refine your strategies, maximize profitability, and minimize risk.

Position Management

Track your open positions in real-time, monitoring their performance and adjusting them as market conditions evolve. Spreadsheets help you manage multiple positions simultaneously, allowing you to stay organized and make informed decisions.

Performance Evaluation

Review your trading history, calculate your return on investment (ROI), and identify areas for improvement. Spreadsheets can generate performance metrics and help you evaluate the effectiveness of your strategies.

Tips for Effective Spreadsheet Use in Options Trading

To maximize the effectiveness of spreadsheets in your options trading, consider the following tips:

Use Templates and Automation

Utilize pre-built templates or create your own customized spreadsheet formats to save time and ensure consistency. Automate calculations and data updates to streamline your workflow.

Learn Formula Syntax

Understand the syntax of spreadsheet formulas to create complex calculations and perform advanced financial analysis. Master functions such as IF, SUMIF, and VLOOKUP to automate repetitive tasks.

Proper Data Management

Ensure the accuracy and reliability of your data by using trusted sources. Regularly update your spreadsheet with the latest market information to ensure your analysis is based on current conditions.

Regular Maintenance

Periodically review and update your spreadsheets to ensure they remain functional and aligned with your trading needs. Make backups of your spreadsheets to prevent data loss.

Seek Expert Assistance

If you encounter challenges or require specialized guidance, seek assistance from financial professionals, experienced spreadsheet users, or online resources. Consulting with experts can enhance your understanding and unlock the full potential of spreadsheets in your options trading.

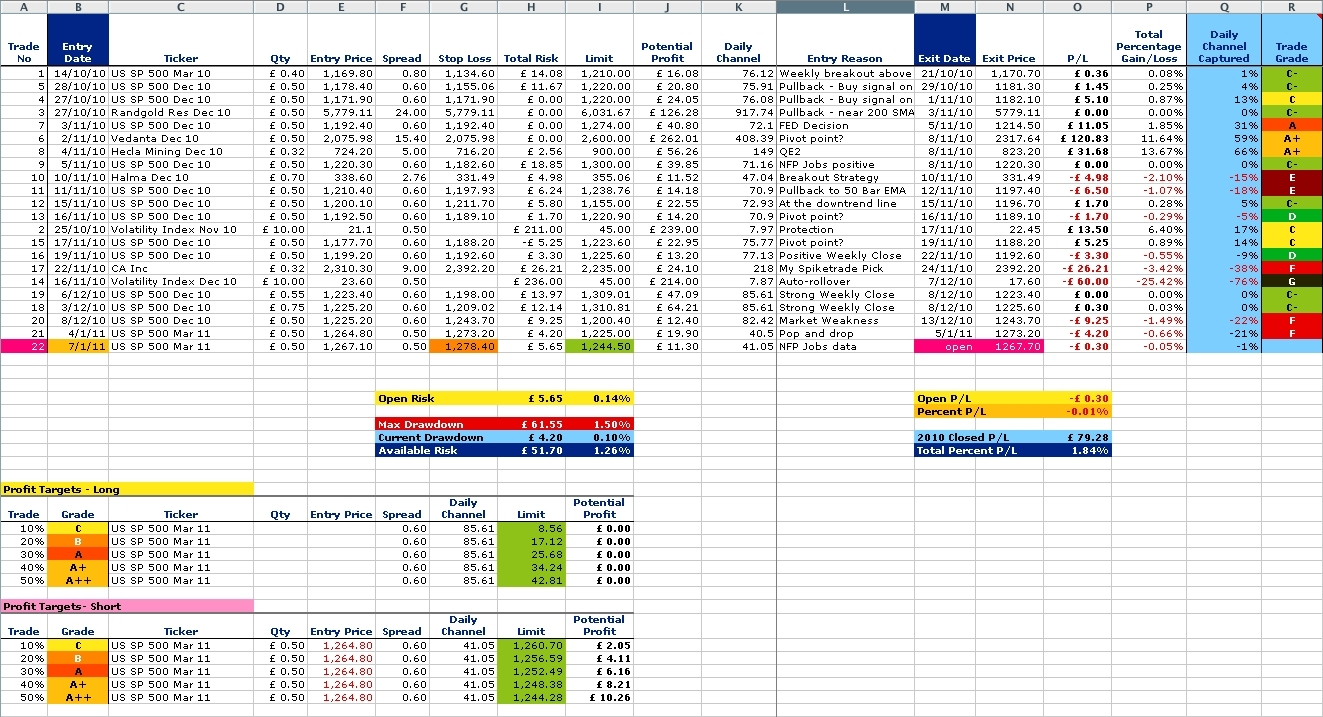

Spreadsheet For Options Trading

Image: www.youtube.com

Conclusion

Spreadsheets are a powerful tool that can elevate your options trading performance. Whether you’re a beginner or an experienced trader, leveraging the capabilities of spreadsheets can provide you with a competitive edge. By incorporating the essential components, understanding practical applications, and observing best practices, you can unlock the full potential of spreadsheets and navigate the complexities of options trading with confidence and precision.

As the financial markets continue to evolve, embracing the use of spreadsheets in options trading will empower you to make informed decisions, maximize your returns, and ultimately achieve your trading objectives.