Introduction

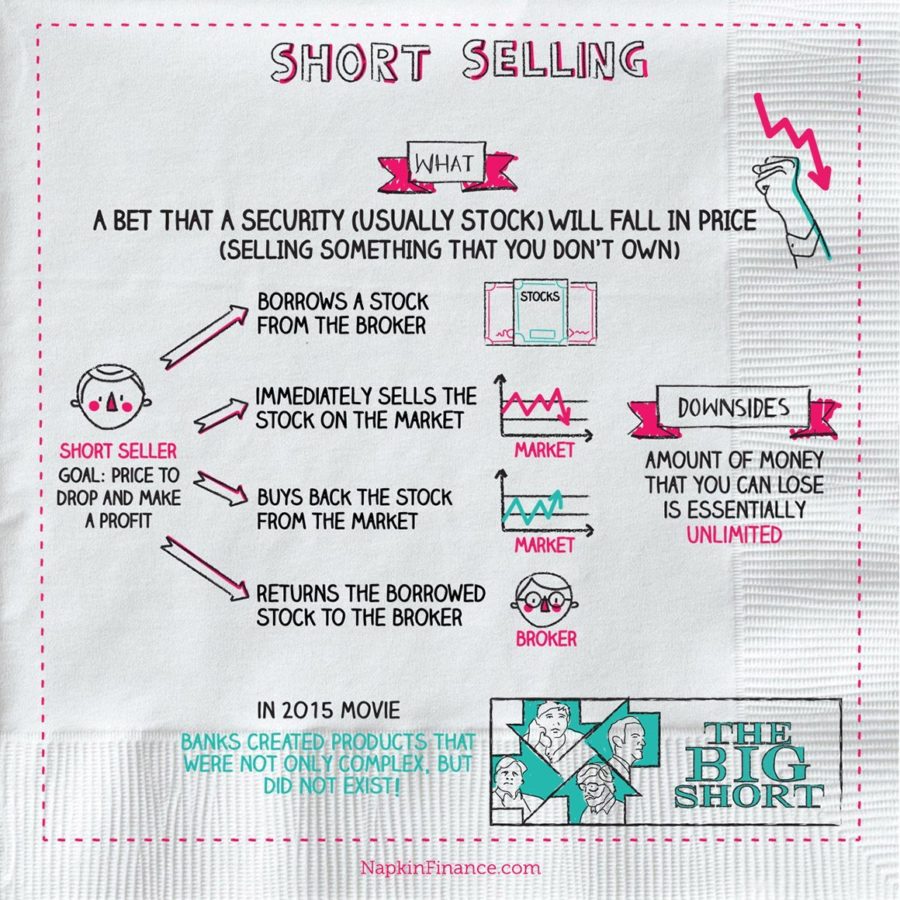

Short selling in option trading is a powerful trading strategy that allows investors to profit from the decline in the value of underlying assets. Unlike conventional shorting of stocks, where you borrow shares to sell them at a higher price and buy them back later at a lower price, short selling in options involves writing (selling) an option contract with the expectation that the value of the contract will decline. In this article, we will delve into the world of short sale in option trading, exploring its basic concepts, advanced techniques, and risk management strategies.

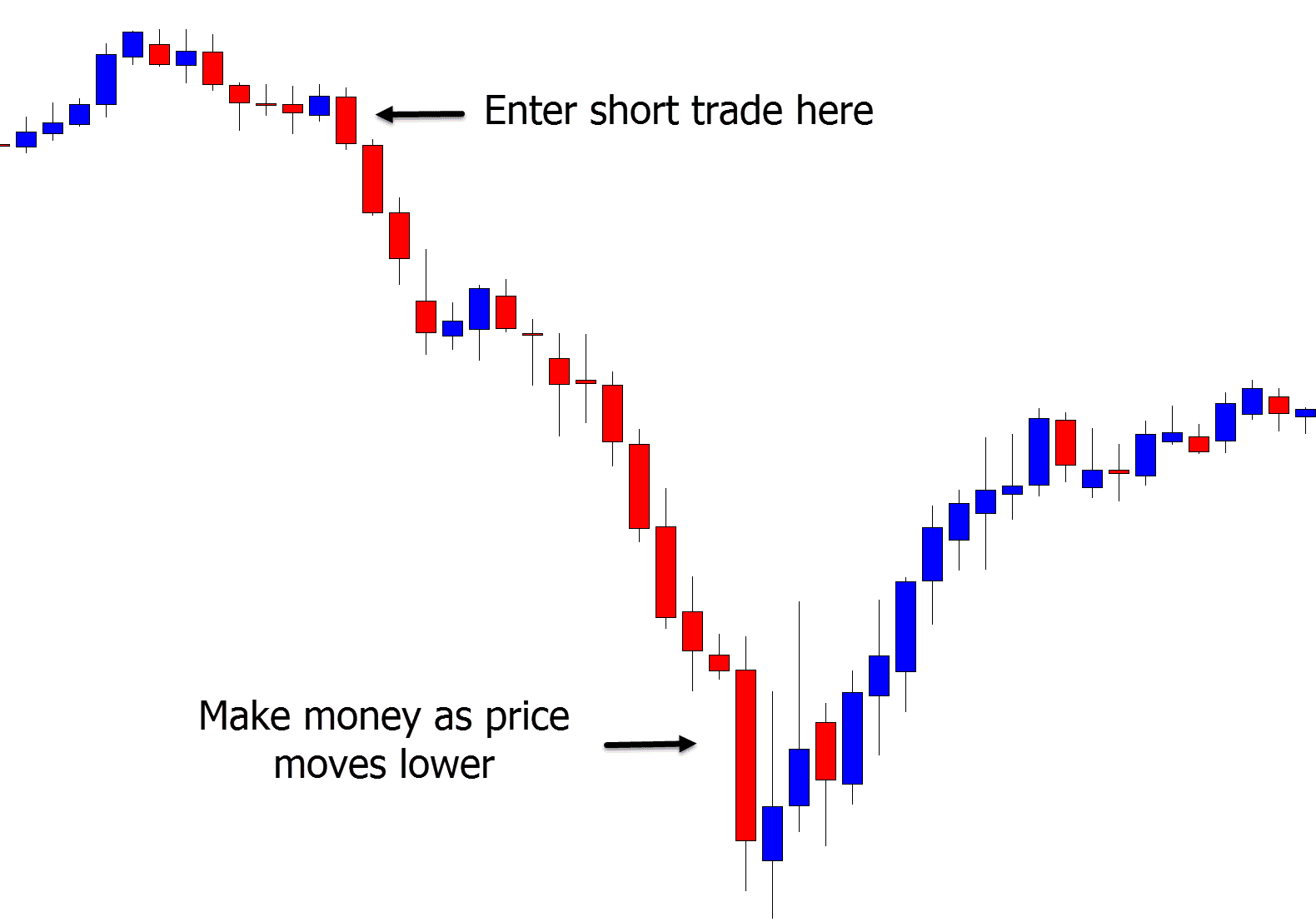

Image: www.forexschoolonline.com

This guide is designed to provide traders, both new and experienced, with a comprehensive understanding of short selling in options. Whether you’re looking to enhance your trading skills or explore alternative strategies to generate profits, this in-depth analysis will equip you with the knowledge and insights you need to navigate the complexities of option trading.

Fundamentals of Short Sale in Options

Shorting options involves writing (selling) an option contract, anticipating that its value will decrease. The seller of a short option is obligated to fulfill the terms of the contract if exercised by the buyer. There are two main types of short option positions: short call and short put.

In a short call, the seller grants the buyer the right but not the obligation to buy an underlying asset at a specified strike price before a specific expiration date. The seller receives a premium for writing the contract.

In a short put, the seller grants the buyer the right but not the obligation to sell an underlying asset at a specified strike price before a specific expiration date. Like short calls, the seller collects a premium for writing the contract.

Understanding the Mechanics of Short Options:

When you sell a short call, you are essentially betting that the price of the underlying asset will decrease or remain below the strike price before the option expires. If the price of the asset stays below the strike price, the option will expire worthless, and you will keep the premium you received for writing it.

Conversely, if you sell a short put option, you are betting that the price of the underlying asset will increase or stay above the strike price before the option expires. If the asset price remains above the strike price, the option will expire worthless, and you will retain the premium.

Profiting from Short Sale in Options

The key to successful short sale in options is identifying underlying assets that may experience downtrends or price declines. By carefully analyzing market conditions and technical indicators, traders can anticipate potential price movements and position their short options to capitalize on these declines. Proper trade selection, timely execution, and ongoing risk management are crucial for maximizing profit potential while mitigating losses.

Image: www.xflowmarkets.com

Risk Management Strategies for Short Sale

Short selling options can be a high-risk strategy, and proper risk management is essential for protecting your capital. Here are some crucial techniques to consider:

- Fixed-risk Position: Only short options if the maximum possible loss is clearly defined and within your risk tolerance.

- Stop-loss Orders: Use stop-loss orders to automatically exit your position if the price of the underlying asset moves against you, minimizing potential losses.

- Hedging: Implement hedging strategies by combining multiple short and long positions to minimize overall risk exposure.

- Closely Monitoring Market Conditions: Continuously monitor market conditions and underlying asset price movements to make timely adjustments to your option positions as needed.

Advanced Techniques for Short Sale in Options

Seasoned traders can employ advanced techniques to enhance their short sale strategies, including:

- Married Puts: Combine a short put option with a long underlying asset to reduce the overall risk of a naked short put.

- Collar Option Strategy: Limit potential losses by purchasing a protective put option while simultaneously selling an at-the-money call option on the same underlying asset.

- Iron Condor: Combine short call and short put options with different strike prices to create a range-bound trading strategy.

- Calendar Spread: Buy a short-term option (with a near-term expiration date) and sell a long-term option (with a later expiration date) on the same underlying asset with different strike prices to benefit from time decay.

Short Sale In Option Trading

Image: napkinfinance.com

Conclusion

Short selling options in option trading presents a powerful strategy for knowledgeable traders to profit from market declines. By understanding the mechanics, identifying opportunities, and implementing effective risk management techniques, traders can harness the potential of short sale in options. Advanced techniques, coupled with ongoing market analysis and a disciplined approach, can further enhance profit potential and minimize risks. Remember, proper research, trading plan, and continuous learning are vital ingredients for successful option trading.