Options trading, a formidable financial instrument, has gained immense popularity in recent times. As traders venture into this dynamic market, understanding the associated costs is paramount to making informed decisions. Among the prominent players in the Indian stockbroking industry, Sharekhan stands out for its comprehensive offerings. In this article, we delve into the details of Sharekhan’s charges for option trading, empowering you with the knowledge you need to navigate this complex landscape.

Image: www.adigitalblogger.com

Sharekhan: A Gateway to Comprehensive and Cost-Effective Option Trading

Sharekhan, renowned for its extensive retail broking services, has carved a niche for itself in the Indian financial markets. With a robust platform and commitment to delivering value, Sharekhan offers tailored solutions for individual investors, enabling them to partake in options trading seamlessly. Their cost structure, meticulously designed to be transparent and competitive, strikes a delicate balance between affordability and service quality.

Unraveling Sharekhan’s Fee Structure

Sharekhan employs a tiered fee structure for option trading, catering to varying trading volumes and requirements. This approach ensures that traders, irrespective of their trading frequency or capital, have access to cost-effective and flexible services. Below is a concise breakdown of Sharekhan’s charges:

-

Transaction Charges:

- Sharekhan levies a transaction charge based on the value of the option contract traded.

- The charges vary across different contract sizes, with smaller contracts attracting lower fees and vice versa.

- Traders are charged a specific rate for both buy and sell transactions.

-

Demat and Custodian Charges:

- For trades involving dematerialized shares, Sharekhan charges a nominal Demat charge per contract.

- The custodian charge is typically levied on the value of shares delivered following an exercise.

-

Clearing and Settlement Charges:

- Sharekhan charges a standard clearing fee for each option contract that is cleared and settled through the clearing corporation.

- These charges are typically fixed and not subject to variation.

Optimizing Your Trading Strategy: Tips for Minimizing Costs

To make the most of Sharekhan’s cost structure and enhance profitability, traders can adopt a few strategic approaches:

- Consider Contract Size: Opting for smaller contract sizes can result in lower transaction charges.

- Utilize Bracket Orders: Bracket orders, which combine entry, target, and stop-loss orders, can help minimize trading costs by limiting market exposure and maximizing potential gains.

- Limit Intraday Trading: While intraday trading may offer certain advantages, excessive trades can lead to higher transaction charges.

- Explore Monthly Trading Plans: Sharekhan offers monthly trading plans that provide bundled pricing for a fixed number of trades. This can be cost-effective for traders with consistent trading volumes.

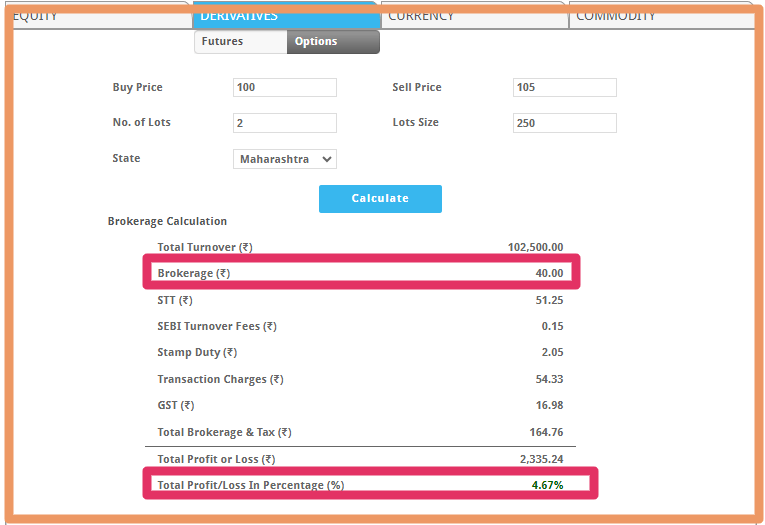

Image: www.adigitalblogger.com

Sharekhan Charges For Option Trading

Image: www.moneycontain.com

Conclusion: Harnessing Sharekhan’s Cost Advantage

Understanding Sharekhan’s charges for option trading is crucial for optimizing your trading strategy and maximizing returns. Their tiered fee structure, coupled with strategic cost-saving techniques, empowers traders of all levels to participate effectively in the options market. By leveraging Sharekhan’s expertise and cost-effective solutions, you can confidently navigate the complexities of option trading, making informed decisions and enhancing your financial success.