Unlocking the Potential of Financial Markets

Share options trading has become an increasingly popular investment strategy in Australia, offering investors the potential for both substantial gains and significant risks. Whether you are a seasoned trader or just starting your journey into the world of options, this guide will provide you with a comprehensive overview of share options trading in Australia. From the basics to advanced strategies, we will delve into the intricacies of this dynamic market, empowering you with the knowledge and understanding necessary to navigate its complexities.

Image: arielle.com.au

Understanding the Fundamentals: What are Share Options?

Share options, also known as stock options, are derivative contracts that grant the holder the right, but not the obligation, to buy or sell an underlying share at a specified price within a specific timeframe. These contracts are traded on regulated exchanges and can be leveraged to capitalize on market fluctuations and enhance investment returns.

There are two primary types of share options: call options and put options. Call options provide the holder with the right to buy a specified number of shares at a predetermined strike price until a specified expiration date. Put options, on the other hand, grant the holder the right to sell a certain number of shares at a predefined strike price within a specific time frame.

Benefits and Risks of Share Options Trading

Share options trading comes with both potential benefits and risks that investors should carefully consider before engaging in this investment strategy.

Benefits

- Leverage: Options offer investors the ability to control a substantial number of shares with a relatively small investment compared to purchasing the shares outright.

- Flexibility: Options contracts provide flexibility in terms of timing and execution, allowing investors to tailor their strategies to market conditions and personal risk tolerance.

- Profit potential: Share options can generate significant profits if market conditions align with the trader’s predictions, offering the potential for substantial returns on investment.

Risks

- Limited time frame: Options contracts have finite lifespans, meaning that investors must carefully manage their positions to avoid losing their investment due to time decay.

- Price fluctuations: The value of share options is highly dependent on the underlying share price, and sudden market movements can result in losses if not properly managed.

- Complex strategies: Certain options trading strategies can be intricate and require a deep understanding of market mechanics, which can pose risks for inexperienced traders.

Getting Started with Share Options Trading in Australia

If you are interested in exploring the opportunities of share options trading in Australia, it is crucial to follow a few key steps:

- Open a brokerage account: Choose a reputable broker that offers share options trading and provides a platform that suits your trading style and needs.

- Educate yourself: Gain a thorough understanding of share options trading concepts, strategies, and market dynamics. Attend seminars, read books, or consult with an experienced financial advisor to enhance your knowledge.

- Start small: Begin with small investments until you become comfortable with the trading process and develop a consistent approach.

- Manage your risk: Implement proper risk management strategies such as stop-loss orders or hedging to mitigate potential losses and protect your capital.

- Be patient: Share options trading requires patience and discipline. Don’t expect to make quick or easy profits overnight; instead, adopt a long-term approach and learn from your experiences.

Image: www.thinkmarkets.com

Advanced Strategies for Experienced Traders

Once you have mastered the basics of share options trading, you can explore more advanced strategies to enhance your profit potential. These strategies include:

- Covered call writing involves selling call options on shares that you own, providing an income stream and potential for additional profits if the share price remains below the strike price.

- Protective put writing entails selling put options against shares you own, offering protection against sudden price declines while also generating premium income.

- Bull call spread involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price, creating a bullish bet on the underlying share’s price appreciation.

- Bear put spread involves buying a put option at a higher strike price and selling a put option at a lower strike price, crafting a bearish bet on the decline in the underlying share’s price.

Share Options Trading Australia

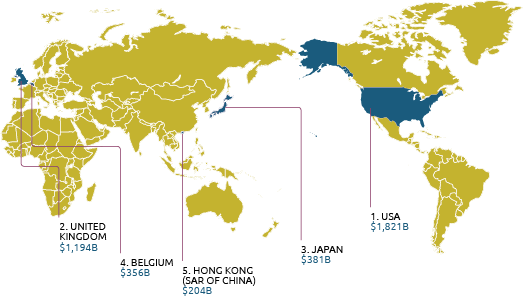

Image: www.dfat.gov.au

Conclusion

Share options trading in Australia provides a range of opportunities for investors to unlock the potential of the financial markets. By understanding the fundamentals, weighing the benefits and risks, following the necessary steps, and embracing continuous learning, you can navigate the complexities of this dynamic investment strategy. Remember that investing in share options requires careful planning, risk management, and the discipline to make informed decisions based on sound market analysis. Embrace the learning process, adapt to changing market conditions, and seize the potential rewards that share options trading offers.