Introduction

Options trading, a strategy that involves speculating on the future price movements of an underlying asset, can be a lucrative endeavor but also carries inherent risks. To ensure the stability of the financial markets, the Financial Industry Regulatory Authority (FINRA) has implemented a set of rules known as pattern day trading rules for options traders. Understanding these regulations is crucial for individuals considering engaging in options trading.

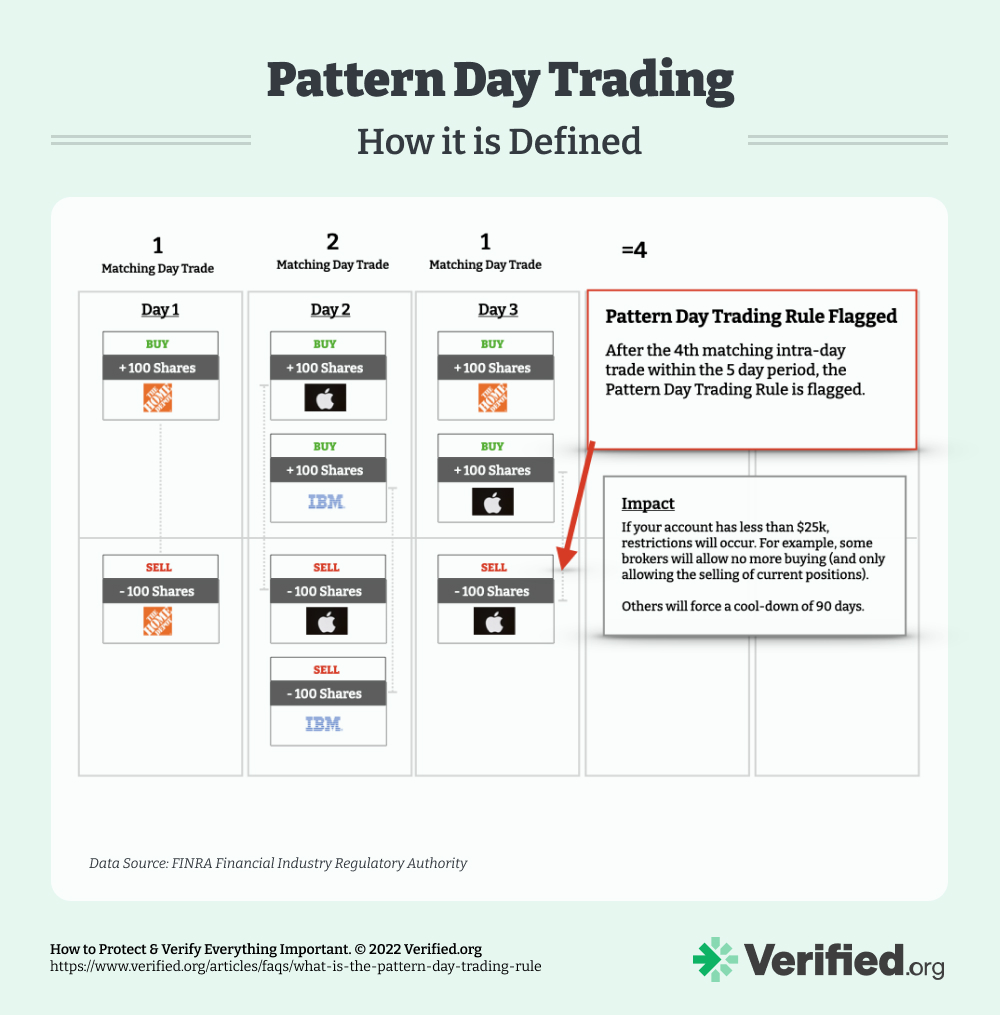

Defining Pattern Day Trading

A pattern day trader is an individual who executes four or more day trades within a five-day period. Day trading involves buying and selling the same security on the same day. Unlike traditional investors who hold positions for extended durations, pattern day traders attempt to capitalize on short-term price fluctuations. Due to the increased risk associated with this strategy, FINRA has established specific requirements for pattern day traders to maintain their trading privileges.

Maintaining Pattern Day Trading Status

To qualify as a pattern day trader, individuals must meet certain criteria:

- A minimum equity balance of $25,000 in their trading account. This balance serves as a buffer against potential losses.

- No history of significant trading violations. FINRA monitors the trading behavior of pattern day traders and can impose restrictions or penalties for violations.

- Completion of a suitability questionnaire, which assesses the trader’s knowledge, experience, and risk tolerance.

Consequences of Violating Margin Requirements

If a pattern day trader fails to maintain the $25,000 equity balance, they will be restricted from trading options for the following 90 days. Any violation of this rule may lead to disciplinary actions by FINRA, including fines or suspension from trading.

Image: www.pinterest.com.mx

Understanding PDT and Good Faith

Pattern day trading rules apply even if the trades are not executed with the intent to profit. The focus is on the frequency of day trades, regardless of the trader’s intentions. However, if a trader can demonstrate that the trades were not part of a pattern of day trading, they may be exempt from the rules and restrictions.

Image: www.verified.org

Pattern Day Trading Rules For Options

Image: optionstradingiq.com

Conclusion

Pattern day trading rules for options are essential regulations designed to protect investors and maintain the integrity of the financial markets. By adhering to these rules, individuals can actively participate in options trading while mitigating the associated risks. It is imperative to thoroughly research and understand these regulations before engaging in pattern day trading activities. For further guidance, traders are encouraged to consult with financial advisors or the official guidelines provided by FINRA. Understanding these rules empowers traders to make informed decisions and navigate the complexities of options trading while ensuring compliance with market regulations.