Delve into the world of pairs options trading, where I share my journey into this realm of financial strategy. This lesser-known technique has empowered me with a profound understanding of risk management and paved the way for consistent returns.

Image: www.cxoadvisory.com

My initial skepticism melted away as I witnessed the power of pairs options trading firsthand. By correlating two offsetting positions, I learned to mitigate risks and optimize profits. It’s a transformative approach that has reshaped my understanding of options.

Expanding the Horizons of Risk Management

Pairs options trading embodies a unique approach to risk management. By carefully selecting two options with opposite positions, I have crafted a safety net that limits potential losses. This strategy ensures that even when one option experiences a decline, the other is likely to offset the impact, safeguarding my capital.

Moreover, the risk-mitigating nature of pairs options trading allows me to pursue higher-risk strategies without the constant fear of financial ruin. This newfound freedom has fueled my exploration of innovative and potentially lucrative trading opportunities.

The Power of Correlation

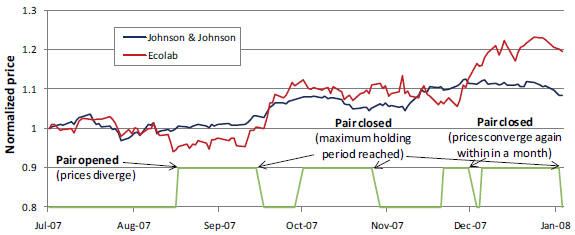

The key to successful pairs options trading lies in understanding correlation. Correlation measures the degree to which two assets move in tandem. By selecting options with a high positive or negative correlation, I can ensure that the performance of one option will closely mirror the inverse performance of the other.

This correlation is crucial for risk management, as it allows me to capitalize on price movements while minimizing potential losses. When one option gains value, the other is likely to decline, creating a natural hedge against downturns.

Enhancing Returns through Pairs Options Trading

Beyond risk mitigation, pairs options trading also presents opportunities to enhance returns. By selecting options with different strike prices, I can create a strategy that benefits from both bullish and bearish market movements. This approach allows me to profit from both upswings and downswings, maximizing my earning potential.

Furthermore, the ability to hold options over extended periods allows me to capture long-term price trends. This buy-and-hold strategy has proven invaluable in capturing the slow but steady appreciation of underlying assets.

![FX Market Pairs Trading Strategy [EPAT PROJECT]](https://d1rwhvwstyk9gu.cloudfront.net/2016/11/pairs-trading-fx-trading-2.png)

Image: blog.quantinsti.com

Current Trends and Developments in Pairs Options Trading

The world of pairs options trading is evolving rapidly. Here are some of the latest trends and developments:

- Growing Popularity: Pairs options trading is gaining popularity among both retail and institutional investors due to its risk-mitigating and profit-enhancing capabilities.

- Increased Availability: Online trading platforms now offer a wide range of pairs options products, making it easier for traders to access this strategy.

- Artificial Intelligence: AI-powered tools are emerging to assist traders in identifying optimal pairs options strategies, further simplifying the trading process.

Tips and Expert Advice for Successful Pairs Options Trading

Based on my experience, here are some tips and expert advice for successful pairs options trading:

- Thoroughly Research: Understand the underlying assets, the correlation between the options, and the potential risks involved.

- Start Small: Begin with small positions until you gain confidence and experience.

- Manage Risk: Monitor your positions closely and adjust your strategy as needed to manage risk and maximize profits.

- Utilize Technology: Leverage trading platforms and AI tools to enhance your decision-making process.

- Seek Professional Guidance: Consult with a financial advisor to ensure that pairs options trading aligns with your investment goals and risk tolerance.

Explanation of Tips and Expert Advice

These tips are essential for successful pairs options trading. By conducting thorough research, you lay the foundation for informed decision-making. Starting small allows you to gain experience without risking excessive capital.

Effective risk management is crucial, which involves monitoring positions and adjusting your strategy as necessary. Technology can enhance your trading by providing valuable insights and automating certain tasks. Finally, professional guidance can help you tailor your pairs options trading strategy to your specific needs and circumstances.

FAQs on Pairs Options Trading

Q: What is pairs options trading?

A: Pairs options trading involves simultaneously buying one option and selling another option with opposite positions and underlying assets.

Q: What is the purpose of pairs options trading?

A: Pairs options trading aims to reduce risk and enhance profits by capitalizing on price movements while minimizing losses.

Q: How does correlation affect pairs options trading?

A: Correlation plays a vital role in pairs options trading, as it determines the degree to which the prices of the two options move in tandem.

Q: Is pairs options trading suitable for all investors?

A: Pairs options trading can be beneficial for experienced investors who understand the risks and rewards involved.

Q: Where can pairs options be traded?

A: Pairs options can be traded through online trading platforms or with the assistance of a broker.

Pairs Options Trading

Image: www.fidelity.ca

Conclusion: Unlocking the Power of Pairs Options Trading

Pairs options trading has revolutionized my approach to financial management. By embracing this strategy, I have gained a profound understanding of risk mitigation and enhanced my earning potential. The tips, advice, and resources provided in this article will empower you to navigate the complexities of pairs options trading and unlock its benefits. Are you ready to explore the transformative power of pairs options trading?