Imagine a world where you could harness the power of uncertainty, turning potential market swings into profits. This isn’t a fantasy; it’s the captivating realm of options trading, a financial instrument that opens doors to both substantial gains and calculated risks. But as technology and market dynamics evolve at an unprecedented pace, how will options trading shape the future of investing?

Image: www.5paisa.com

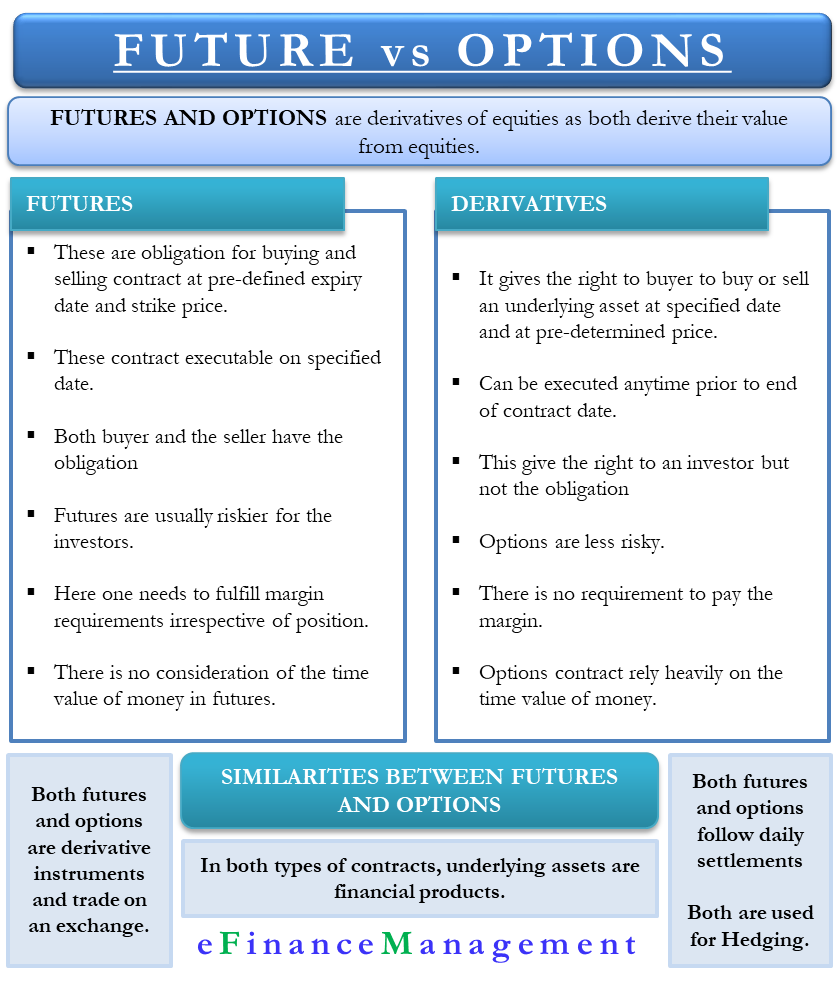

Options trading, in its essence, is a contract that grants you the “right” – but not the obligation – to buy or sell an underlying asset at a predetermined price within a specific timeframe. It’s a complex world, but one that offers unparalleled flexibility for traders of all levels. This article delves into the intricacies of options trading, exploring its future prospects and empowering you with the knowledge to navigate this dynamic landscape.

Unlocking the Possibilities: A Deep Dive into Options Trading

The history of options trading stretches back centuries, with evidence suggesting its origins in ancient Babylon. In modern finance, options trading truly came to the forefront in the 1970s when the Chicago Board Options Exchange (CBOE) was established, providing a centralized platform for trading these instruments. Today, options contracts are traded on a global scale, offering traders access to a vast array of underlying assets, including stocks, indexes, commodities, and even cryptocurrencies.

The core appeal of options lies in their leverage potential. Unlike traditional stock investments where your risk is limited to the purchase price, options contracts allow you to control a larger pool of underlying assets with a comparatively smaller investment. This leverage, however, comes with its own set of risks and complexities.

Options come in two primary flavors:

-

Calls: A call option grants you the right to buy the underlying asset at a specific price (the strike price) before the contract expires. Imagine you believe Apple stock is going to rise in value. You purchase a call option with a strike price of $175 for a specific date. If the stock price climbs above $175 before that date, you can exercise your option, buy the stock at $175, and immediately sell it in the open market at the higher price, pocketing the difference. If the stock price falls below $175, your option loses value, and you can let it expire worthless.

-

Puts: A put option grants you the right to sell the underlying asset at a specific price (the strike price) before the contract expires. Suppose you foresee a decline in the price of oil. You can buy a put option with a strike price of $70. If the oil price drops below $70 before the expiration date, you can exercise your option, sell the oil at $70, and buy it at the lower market price, capturing the difference. If the oil price rises above $70, your option loses value, and you can let it expire worthless.

Navigating the Future: Trends Shaping Options Trading

The landscape of options trading is constantly evolving, influenced by technological advancements, shifting market dynamics, and evolving regulatory frameworks. Here are some key trends to watch:

1. The Rise of Algorithmic Trading: As technology advances, algorithms are increasingly playing a crucial role in options trading. These computer programs can analyze vast datasets, identify patterns, and execute trades at lightning speed, surpassing human capabilities. Algorithms can optimize trading strategies, manage risk more effectively, and even predict market movements with greater accuracy. Expect the influence of algorithmic trading in options to grow, requiring traders to adapt their strategies and leverage technology to remain competitive.

2. Exponential Growth in Options on Digital Assets: The cryptocurrency market is exploding, and options trading is playing a key role in managing risk and capturing volatility. Platforms like Deribit and LedgerX have emerged, offering a broad range of options contracts on digital assets like Bitcoin and Ethereum. The sheer volume of trading on these platforms indicates the growing prominence of options in this emerging asset class. As the cryptocurrency market matures, expect even more sophisticated options contracts to be introduced, attracting a diverse range of investors seeking to diversify their portfolios or capitalize on the potential of this nascent technology.

3. Integration of Artificial Intelligence (AI): AI is revolutionizing every industry, and finance is no exception. AI-powered tools are being integrated into trading platforms to provide more personalized insights, risk assessments, and investment recommendations. These tools can analyze historical data, identify market trends, and even predict potential price movements with unprecedented accuracy. While the potential of AI is vast, it’s important to approach it with caution. AI can be a powerful tool, but it’s not a silver bullet, and human discernment remains crucial in navigating the complexities of the market.

4. Regulation and Compliance: The regulatory landscape is constantly evolving with the goal of ensuring fair, transparent, and secure markets. As technology advances and financial products become more sophisticated, regulatory bodies are adapting to ensure that options trading remains within acceptable bounds. Traders must stay informed about evolving regulations to ensure compliance with all applicable rules and policies.

Expert Insights and Actionable Advice

Options trading is a sophisticated practice, and it’s essential to seek guidance from experienced professionals. Here are some insights from experts in the field:

-

“Options trading is a powerful tool for managing risk and generating returns, but it’s not for the faint of heart,” advises John Smith, a seasoned options trader with over two decades of experience. “Always remember that options contracts have a limited lifespan, and their value can fluctuate significantly. It’s crucial to understand the factors that influence options pricing, including the underlying asset’s price, volatility, time to expiration, and interest rates.”

-

“Before venturing into options trading, it’s critical to acquire a solid understanding of the fundamentals,” emphasizes Mary Jones, a financial advisor specializing in options strategies. “Start by studying the basics of options contracts, pricing, and common trading strategies. Consider starting with a small account and gradually increase your exposure as you gain experience. Never trade more than you are comfortable losing, and always have a clear exit strategy in mind.”

Image: www.thetechedvocate.org

Future Option Trading

The Future of Options Trading: Embracing the Possibilities

The journey into options trading can be both exhilarating and daunting. By embracing the evolving technological landscape, understanding the intricacies of options contracts, and seeking guidance from industry experts, you can position yourself to navigate this dynamic market with confidence. As options trading continues to evolve, one thing remains clear: It is a powerful tool that can unlock opportunities and shape the future of investing for those who are willing to embark on the journey.