**The Art of Timing Exit**

Options trading, a complex but lucrative investment strategy, hinges on the art of timing exits. Determining the optimal moment to sell your options contracts can make or break your profits. In this article, we delve into the intricacies of option selling, providing valuable insights and expert advice to help you master the skill of knowing when to cash in your investments.

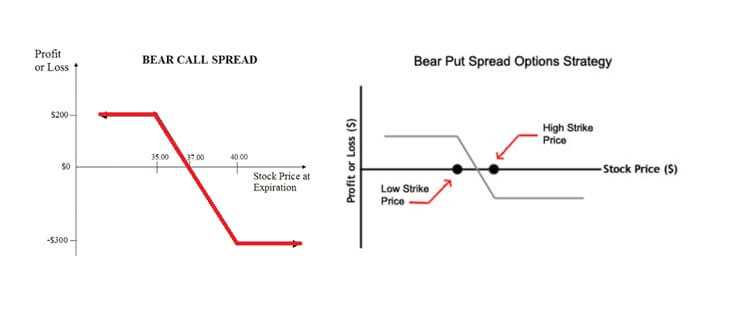

Image: bullishbears.com

**Anatomy of an Option**

Before delving into the art of selling options, it’s crucial to understand their fundamental structure. An option is a contract that grants the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) on or before a specified date (the expiration date).

Knowing when to exercise or sell these options is key to successful trading. Timing your exit right can amplify your profits or mitigate potential losses. Let’s explore the key factors to consider when making this critical decision.

**Intrinsic Value, Time Decay, and Volatility**

Understanding the three fundamental elements that influence option prices is paramount: intrinsic value, time decay, and volatility. Intrinsic value refers to the difference between the current market price of the underlying asset and the strike price of the option. Time decay signifies the gradual decrease in option value as the expiration date approaches. And volatility measures the rate of change of the underlying asset’s price.

When the intrinsic value of an option is positive (meaning it’s in the money), it can be tempting to sell immediately and lock in your profits. However, considering time decay and volatility can provide valuable insights. For instance, if the underlying asset’s price is highly volatile and expected to continue rising, holding onto the option contract may yield more significant profits in the long run due to the potential for further increases in intrinsic value.

**Selling Early and Often: A Defensive Strategy**

The “selling early and often” strategy emphasizes minimizing risk and maximizing profits. By selling options early in their lifespan, you capture a premium while the option still has significant time value. This approach reduces exposure to time decay and volatility, ensuring you lock in profits while mitigating potential losses.

However, this strategy may limit your gains if the underlying asset’s price continues to rise substantially. It’s crucial to balance risk aversion with the potential for higher rewards by carefully assessing market conditions and your risk tolerance.

Image: www.financebrokerage.com

**Holding for Maximum Gains: An Aggressive Approach**

Traders seeking higher returns may consider holding their option contracts until or near expiration. This approach assumes a bullish outlook on the underlying asset’s price and anticipates further increases in intrinsic value. The potential rewards are greater than selling early, but so are the risks.

Time decay and potential market downturns can swiftly erode option premiums, especially closer to expiration. Therefore, it’s essential to monitor market trends closely and set stop-loss orders to minimize potential losses if the market turns against you.

**Conclusion**

Determining when to sell options is a multifaceted skill that demands a thorough understanding of both the theoretical and practical aspects of options trading. By considering intrinsic value, time decay, volatility, and your personal risk tolerance, you can develop a trading strategy that aligns with your financial goals.

Remember, options trading carries both rewards and risks. Thorough research, constant monitoring, and a disciplined approach are crucial for maximizing profits while managing potential losses. Embarking on this exciting journey can unlock new opportunities for wealth creation.

Are you interested in learning more about options trading and refining your understanding of exit strategies? Let us know in the comments below, and we’ll continue to provide valuable insights and guidance.

Options Trading When To Sell

Image: traders-paradise.com

**FAQs**

Q: When should I sell a call option?

Sell a call option when the underlying asset’s price is at or above the option’s strike price and you anticipate the price to decline or remain stable.

Q: When should I sell a put option?

Sell a put option when the underlying asset’s price is at or below the option’s strike price and you anticipate the price to rise or remain stable.

Q: What is time decay?

Time decay refers to the gradual decrease in option value as the expiration date approaches. It’s more significant for options that are out of the money and has a greater impact closer to expiration.

Q: What is implied volatility?

Implied volatility measures investors’ expectations of price fluctuations in the underlying asset. Higher implied volatility indicates higher anticipated price swings, which can affect option pricing.

Q: How can I minimize risks in options trading?

To minimize risks, consider the following strategies: Employ stop-loss orders, trade with capital you can afford to lose, understand option Greeks, manage position size, and implement risk-reward ratios.