Introduction:

Image: www.stockradar.in

Are you seeking an effective path to enhance your investment returns? Options trading presents a compelling avenue for potential gains. However, successful navigation in this dynamic market demands a well-defined strategy. Through this article, we will delve into an options trading strategy that has proven its ability to yield positive returns consistently.

Options Trading: A Comprehensive Overview:

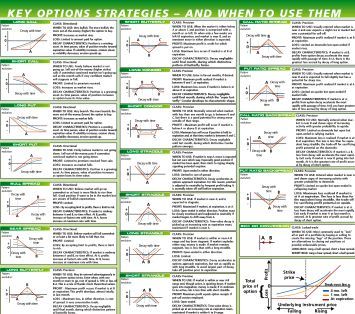

An option represents a contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Options trading strategies harness these contracts to capitalize on market movements while managing risk.

The Power of Covered Call Writing:

Among the various options trading strategies, covered call writing stands out as a prudent approach that seeks to generate income while hedging against downside risk. In this strategy, the trader owns the underlying asset (e.g., stock) and sells (writes) a covered call option against those shares.

Mechanism of Covered Call Writing:

By selling a covered call, the trader receives a payment called a premium. This premium represents the buyer’s obligation to buy the underlying asset from the trader at the strike price. If the market price ends above the strike price on the expiration date, the buyer exercises their option, purchasing the asset from the trader, who then pockets the premium as profit.

Managing Risk with Covered Calls:

In scenarios where the underlying asset’s price remains below the strike price, the option expires unexercised, and the trader retains both the stock and the premium earned at the time of writing the call. This mechanism limits potential losses, considering the trader was already long the stock before writing the option.

Maximizing Potential Return:

The selection of strike price is instrumental in maximizing potential return in covered call writing. By selling a call option with a strike price higher than the current market price, the trader positions themselves to benefit from a moderate increase in the underlying asset’s value. This strategy allows traders to capture price gains while preserving the downside protection offered by owning the stock.

Suitable Market Conditions for Covered Call Writing:

Covered call writing thrives in sideways to modestly bullish market environments. When the underlying asset’s price fluctuates within a narrow range, the premium earned from option sales can provide a steady stream of income, unabhängig of the stock’s price movements. This strategy also exhibits resilience in volatile markets, as the embedded downside protection mitigates the impact of price corrections.

Conclusion:

Covered call writing represents a robust options trading strategy that fuses income generation with risk mitigation. It enables traders to harness market volatility to their advantage while safeguarding their investment capital. By understanding the mechanics of covered call writing, traders can employ this strategy to enhance their investment returns and navigate market dynamics with greater confidence. Remember to conduct thorough research, consult with a financial advisor, and manage your risk appropriately before incorporating any options trading strategy into your portfolio.

Image: www.reddit.com

Options Trading Strategy That Works

Image: kumeyuroj.web.fc2.com