Introduction

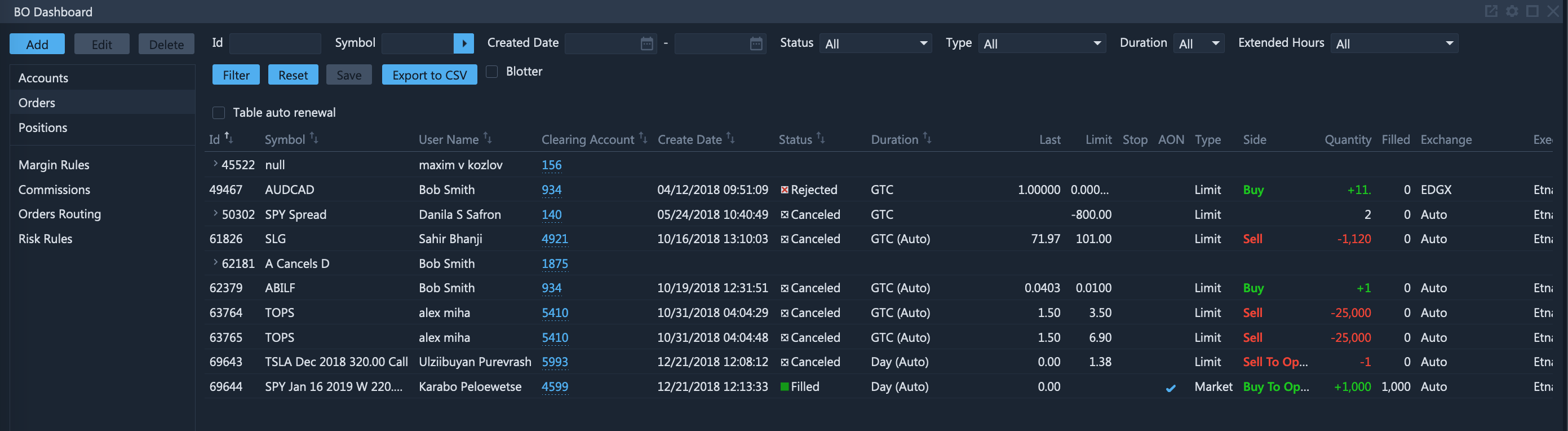

Image: www.etnasoft.com

In the labyrinthine world of financial markets, option trading presents a path to potentially magnify returns and mitigate risks. Among the diverse options strategies, ETNA (Exchange Traded Notes linked to Accrual Notes) emerges as a captivating choice, offering a unique blend of income generation and capital appreciation. This comprehensive guide will delve into the intricacies of ETNA option trading, empowering investors to harness its potential and navigate the complexities of the market.

Understanding ETNA

ETNAs, the foundation of ETNA options, are exchange-traded notes that are linked to an underlying index or benchmark. They provide investors with exposure to a specific asset class without the need to directly invest in the underlying securities. ETNA options, on the other hand, grant holders the right to buy or sell an underlying ETN at a predetermined price and expiration date.

Benefits of ETNA Option Trading

The allure of ETNA option trading lies in its multifaceted advantages:

- Income Generation: Covered calls, a popular ETNA option strategy, involve selling (writing) call options against an underlying ETN held in the portfolio. This strategy generates an immediate premium while retaining the potential for stock appreciation.

- Premium Collection: Selling call options entails collecting a premium from the buyer, which represents the compensation for granting the right to purchase the underlying ETN. This premium can significantly enhance the overall return profile.

- Risk Management: Options can effectively serve as hedges against market volatility. Buying put options, for instance, can mitigate potential losses in the underlying ETN. By managing risk, investors can preserve capital and enhance their overall investment strategy.

- Flexibility: ETNA options provide flexibility in terms of tailoring investment strategies to specific financial goals and risk tolerance. Investors can choose from various options strategies, such as buying or selling calls or puts, to optimize their exposure to the underlying ETNA.

- Volatility Mitigation: ETNA options can cushion investors against market fluctuations. During periods of high volatility, option premiums tend to increase, offering a hedge against potential downside risk.

Implementing ETNA Option Strategies

Effective ETNA option trading involves selecting appropriate strategies aligned with one’s investment objectives:

- Covered Calls: This strategy generates income by selling call options against an underlying ETN owned by the trader. It is suitable for those who are bullish on the underlying ETN and comfortable with limited upside potential.

- Protective Puts: Buying put options serves as an insurance policy against potential losses in the underlying ETN. It is preferred by investors who are concerned about the downside risk of their investments.

- Iron Condor: This advanced strategy combines buying and selling calls and puts at different strike prices and expiration dates. It seeks to generate a net credit while capping both the upside and downside potential.

Factors to Consider in ETNA Option Trading

Informed ETNA option trading requires careful consideration of key factors:

- ETNA Selection: The underlying ETN plays a crucial role in determining the success of the option strategy. Traders should analyze the ETN’s underlying index, historical performance, and market trends.

- Option Pricing: The price of an option is influenced by various factors, including time to expiration, strike price, volatility, and interest rates. Understanding these factors is essential for accurate pricing and strategic decision-making.

- Risk Management: Options can amplify both potential profits and losses. Prudent risk management practices, such as position sizing and setting stop-loss orders, are crucial for protecting capital.

- Market Outlook: Economic conditions, geopolitical events, and market sentiment can significantly impact the performance of ETN options. Traders should monitor the market closely and adjust their strategies accordingly.

Conclusion

ETNA option trading presents investors with an opportunity to enhance returns, mitigate risks, and navigate the complexities of the financial markets. By understanding the concept of ETNA, exploring different option strategies, and considering key factors, investors can unlock the potential of ETNA options and achieve their financial goals. Remember, gaining experience and conducting thorough research are essential to becoming a successful ETNA option trader.

Image: osa.travel

Etna Option Tradeing

Image: acronymsandslang.com